Scammers use all sorts of schemes to trick students or their families out of cash, or get access to sensitive personal information they can use in identity theft attacks. From requests to pay fake “student taxes” to listings advertising non-existent college housing, knowing how common back-to-school scams work can help you defend against the risk they pose to your finances and identity.

Here’s a guide to some of the most popular back-to-school scams, how they work, and what you can do to help avoid becoming a victim.

1. Shopping scams

Whatever level of education your children are at, the return to school period can be expensive, with shopping lists containing books, clothes, and tech supplies. Some scammers prey on parents or students looking for bargains with deceptive schemes designed to steal money or financial information.

These scams can take place on popular online marketplaces, with fraudsters running eBay scams or Craigslist scams that specifically target back-to-school buyers, for example. You might come across listings for school supplies or tech products with unbelievable prices, but these listings are likely to be fake.

If you decide to buy, the scammer might request payment via an unusual method, like gift card codes or wire transfer. This makes it harder for you to get a refund when they disappear without fulfilling your order.

Other scammers set up entire fake websites that offer low-cost school supplies, advertised on relevant Facebook groups or message boards. But these fake websites may be a ruse to capture your credit card information as you “check out,” leaving you at imminent risk of credit card fraud.

You might also be targeted with phishing emails claiming that you’ve missed a delivery, requesting that you click a link to reschedule. But, if you click, you may unwittingly install malware on your device or be sent to a fake website that requests sensitive information.

Tips to help avoid shopping scams

- If you’re buying back-to-school supplies online, only use websites that you know or trust.

- Be wary of products available at too-good-to-be-true prices, and check seller reviews on platforms like eBay or Facebook Marketplace before making a purchase.

- Never click links or open attachments in emails you weren’t expecting or don’t recognize. Instead, call the company that supposedly sent the email to ask if it’s legitimate.

2. Competition win scams

You might get an email, text, or message on social media claiming that you've won a competition, entitling you to a package of free school supplies or an all-expenses paid back-to-school shopping spree. All you have to do is click a link in the message and enter some details to redeem your prize.

The problem? Clicking the link and providing your information won’t get you any closer to the prize, which is in fact fake. Instead, the information you submit will be stolen, and you may be left vulnerable to identity theft or subject to a bombardment of spam emails, texts, and robo-calls.

Tips to help avoid competition win scams

- You won’t win a competition that you never entered, so ignore messages claiming you’ve won a prize you’ve never heard about.

- If you’re unsure about whether a prize win is real or not, search for information online about the company claiming you’ve won to verify its legitimacy.

- Don’t give away sensitive information to claim a prize. Most prizes can be awarded with simple details, like your home address or email address.

LifeLock family plans are designed to help protect your family against the risk of identity theft following a scam. Join for features that can help you monitor your family’s risk exposure, including dark web monitoring, SSN notifications, and credit monitoring for two adults and up to five kids. And if a member of your family does become a victim of identity theft, one of our U.S.-based Identity Restoration Specialists will be there to guide you.

3. The student tax

Student tax scams tend to target people who are due to attend college in the fall, or their parents. It starts with an email, text, or phone call from someone claiming to be from the IRS. They may claim that you have an overdue “student tax” payment to make and, if the payment isn’t sent soon, you won’t be able to attend classes during the upcoming semester. Even worse, you might face jail time.

This scam typically aims to convince you to wire money directly to the fraudster, but other scammers might request payment via gift card codes, or that you provide your bank account or credit card information so that the “IRS” can withdraw funds directly.

Of course, there’s no such thing as a student tax. If you send money, you’re doing it under entirely false pretenses, and if you provide financial information, you’re likely to find unauthorized charges on your credit card or bank account statements in the near future.

Tips to help avoid student-tax scams

- Simply knowing that there’s no such thing as a student tax should help you avoid falling prey to this scam.

- Remember that the IRS will never make initial contact with you by phone, email, or text. Instead, they’ll send a letter to your home address informing you that they’ll make further contact.

- If you’re ever worried that you’ve missed or have overdue tax payments, contact the IRS directly for help.

4. Scholarship scams

School can be expensive, especially if you or your children attend private schools or are enrolled in college, so financial aid or grant programs are enticing. Scammers are well aware of this, and build entire scholarship scams specifically to prey on students.

In one type of scholarship scam, fraudsters might copy a common loan scam tactic — advertising lucrative scholarships on social media, requesting an application or processing fee. While the fee might only be $20 or $30, if scammers get enough people to pay it, the profits can add up. The catch is that no scholarships will be awarded, and the scammer will instead run off with the collected fees.

A similar scam type involves an email or text claiming you’ve won a scholarship, even if you never applied for one. But before you can collect your thousands of dollars in free money, you must pay a redemption or disbursement fee. Again, this is a clear red flag: legitimate scholarships don't require you to pay any fee to receive your money.

You may also encounter fake scholarship search services that involve scammers claiming they can find scholarship offers for you for a small fee. But if you send them money, the scammer will disappear and leave you out of pocket, and no closer to receiving a scholarship.

Tips to help avoid scholarship scams

- First, remember that no legitimate scholarship provider will require you to pay a fee to apply or collect your funds.

- If you don't remember applying for a scholarship that you've somehow still won, it’s a sure sign of a scam. Scholarship providers don't randomly contact students or parents offering prize money.

- While legitimate scholarship search platforms do exist, they typically allow you to search for yourself. Be wary of “consultants” who offer to search for you for a fee.

5. Student loan forgiveness scams

Scammers aren't above preying on the fears that students and parents have when it comes to the high cost of tuition. That’s why student loan forgiveness scams are so common.

In these scams, fraudsters send emails or texts to students or parents saying that they can reduce or erase the student loan debt that they owe. This, of course, is not true. The scammers will ask for a fee, but if you pay up, they’re likely to disappear and leave you in the exact same debt position.

Others might request your personal or financial information, claiming they need it to start the loan-forgiveness process. Again, providing this information won’t lead to your loan being reduced. The scammers will instead use it to try to steal your identity with a view to take out credit in your name or access your bank accounts.

Tips to help avoid student-loan-forgiveness scams

- Don’t trust private companies that say they can reduce or eliminate your student loan debt for a fee. Legitimate companies don't charge for such a service.

- If you’re struggling with too much student debt, call your loan provider directly. You might be able to work out a new payment plan or terms that make your monthly payment more affordable.

6. College test prep scams

High school students ready to apply for college often spend a good chunk of their junior years studying for and taking the SAT or ACT tests. High scores on these tests can help them land a spot at their dream college.

Scammers can make big money during the college test season. One type of scam involves fraudsters targeting parents of students preparing for the tests. The scammer will email or text them, saying their children ordered materials, but they need credit card details to process the order.

They may use urgency tactics, like claiming that the order will be canceled if payment isn’t made immediately. But the truth is there is no order — and if you give the scammer the information they’re asking for, they may rack up unauthorized charges on your credit card.

Tips to help avoid test-prep scams

- Never give your credit card information to a company that calls, texts, or emails you unsolicited. If you think the request might be legitimate, contact your child, or the company via an official channel, to ask if the referenced order is real.

- Research any company claiming to be a test-prep company before interacting with a message. You can Google the company name followed by the word "scam" or "complaint" to see if there are any reports of fraudulent behavior.

7. Fake student jobs

College students are often on the lookout for part-time or flexible jobs to help cover living expenses and tuition costs. Unfortunately, scammers know this and create fake job offers targeting students. These employment scams can appear on campus job boards, in social media ads, or even in your school email inbox.

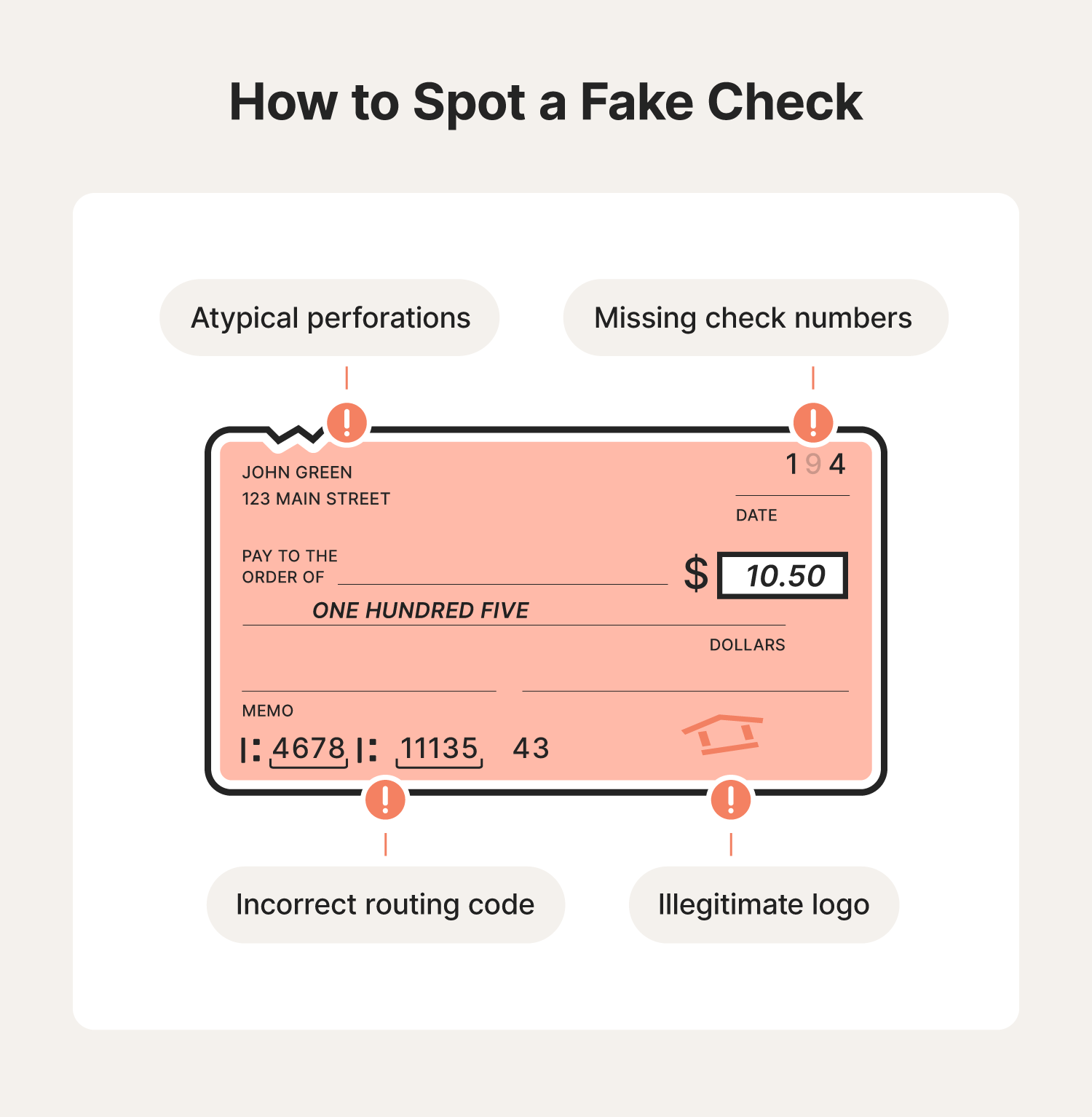

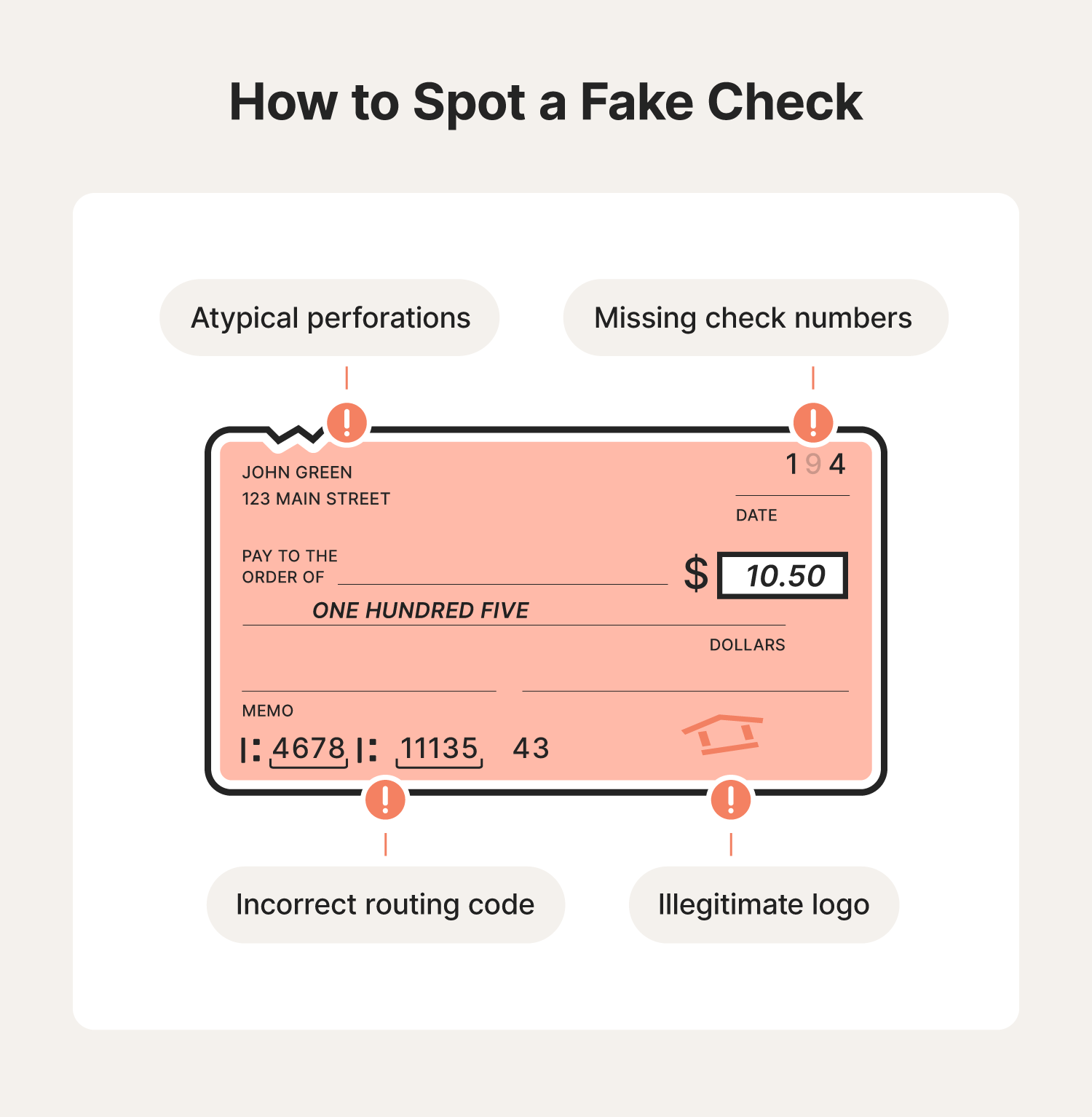

One common approach is the “overpayment” scam. A fraudster posing as an employer will offer you a job like data entry, tutoring, or helping with administrative work. If you accept, they’ll send a check for your first wages up-front. However, the check will be written out for too much money, and the scammer will ask you to send back the difference via a payment app or wire transfer. The catch? The check is fake, and once it bounces, you’re left without the money you returned.

Another approach involves scammers advertising fake jobs and asking applicants for personal details, like their Social Security number (SSN) or bank account information, under the guise of setting up payroll. Instead of paying you, they’ll use that information to steal your identity or drain your bank account.

Sometimes the scam is as simple as asking you to pay for training materials, uniforms, or background checks for a job that doesn’t exist. Once you pay, the “employer” vanishes, and you’re left out of pocket.

Tips to help avoid fake student job scams

- Be wary of jobs that pay unusually high wages for very little work — if it sounds too good to be true, it probably is.

- Never send money or accept a check from an employer you haven’t met in person and verified.

- Research the company online, and if you can’t find a legitimate website, reviews, or contact information, walk away.

- Use official campus career services or reputable job boards when looking for part-time work.

8. Student housing scams

Finding housing near campus can be stressful, especially for first-year college students eager to secure a place before the semester starts. Scammers take advantage of this urgency by posting fake apartment or student housing listings that appear legitimate and appealing — often with prices that seem like a rare bargain.

In one common student rental scam, fraudsters copy photos and descriptions from real property listings and repost them under their own fake ads. They’ll claim to be the landlord or property manager and might say they can’t meet in person because they’re “out of town” or “traveling abroad.” They’ll then pressure you to send a security deposit or first month’s rent to “reserve” the unit. But, once you send the money, the scammer vanishes and you’ll discover the property was never available in the first place.

Other scammers might ask for sensitive personal information like your SSN, driver’s license, or a copy of your passport under the guise of a rental application or identity verification check. They may then use this information to commit identity theft, potentially attempting to apply for credit in your name.

How to help avoid student housing scams

- Prioritize using trusted campus housing portals or reputable rental websites with secure payment systems.

- Never send money or provide personal ID documents before you’ve toured the property in person and verified the landlord’s identity.

- Be wary of listings with prices far below market rates or landlords who create a sense of urgency to pay quickly.

- Search the property address online to check if it’s already listed elsewhere by a legitimate agent or landlord.

Protect your family this academic year

Scammers operate all year round, but if there’s a school or college student in your family, you may be more at risk as the back-to-school period rolls around. Join LifeLock Standard for features that can help you monitor exposure of your family’s information, detect potential fraud, and get support if you fall for a scam that leads to identity theft.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.