If someone stole your identity, you’re not alone. More than 1.1 million cases of identity theft were reported to the Federal Trade Commission (FTC) in 2024. And that’s likely just a fraction of the true total, since many incidents go unreported to the authorities.

To help make the identity recovery process easier, we’ve compiled all the steps to take the moment you discover your identity has been stolen.

1. Notify your bank

If an identity thief gets hold of your bank account or credit card information, your first step should be to notify your financial institution. Your bank’s fraud department can put an immediate hold on your account and freeze pending and future transactions. This can help prevent your bank account from being emptied or your credit card balance from being charged up.

To report identity theft, you can contact most financial institutions via phone or online.

Bank |

Phone number |

Online resource |

|---|---|---|

Bank of America |

1-800-432-1000 |

|

Chase |

Checking account: 1-800-935-9935 Debit card: 1-800-978-8664 Credit card: 1-800-955-9060 |

|

Wells Fargo |

1-800-869-3557 |

|

Citibank |

Bank account: 1-800-248-4226 Credit card: 1-800-950-5114 |

|

U.S. Bank |

1-877-595-6256 |

|

Discover |

1-877-737-1931 |

|

Capital One |

1-800-655-2265 |

|

American Express |

1-800-528-4800 |

Here’s what to ask when you contact them:

- Request that your bank accounts, debit cards, and credit cards are frozen to prevent new transactions.

- Ask for copies of records related to any fraudulent transactions or compromised accounts as proof of identity theft.

- Ask the bank to stop reporting inaccurate information to the credit bureaus.

Contact all the financial institutions where you have compromised accounts. If you are uncertain how the thief obtained your personally identifiable information, and suspect they may have information they could use to access other accounts, you can be proactive and freeze unaffected bank accounts and credit cards as well.

2. Report identity theft to the FTC

While you don’t need to report a stolen credit card to the FTC, you should report identity theft right away. The FTC will create a report you can use as proof of identity theft when contacting banks, credit bureaus, and insurance companies.

You’ll also get a personalized recovery plan that will help you navigate the rest of the process, and your report will contribute towards a bank of evidence the FTC uses to fight fraudsters in the future.

Here’s how to report identity theft to the FTC:

- Fill out the identity theft affidavit at IdentityTheft.gov or call 1-877-438-4338.

- View and follow your personalized recovery plan.

- Generate a report to use as proof of identity theft.

3. File a claim with your identity insurance

If you have an identity theft protection plan with reimbursement coverage or another type of identity theft insurance, now’s the time to file a claim. Most services require that you file a claim within 90 days of the incident, so acting quickly is important.

Check with your bank, credit card company, and credit monitoring service to determine if you have insurance. Many financial entities provide their customers with access to some sort of identity theft protection; however, that coverage may be limited. Standalone identity theft protection services typically offer more comprehensive monitoring and recovery support.

How to file a claim:

- Call your identity theft protection service to initiate a claim within 90 days.

- Gather information and proof of your claim.

- Submit all documentation to your case specialist.

Identity theft restoration experts can help you restore your identity, initiate investigations, contact the credit bureaus, and pursue legal action as needed.

4. Secure your online accounts

From social media to online banking, so much of our information is circulating on the internet. That’s why you want to ensure you’re doing everything in your power to secure your accounts, especially when you’ve been targeted by identity theft.

An identity thief with access to your login credentials may be able to steal sensitive data from any account that stores your information, including banking portals, e-commerce sites, and subscription services.

Here’s how to secure your accounts to help prevent follow-up attacks:

- Immediately change any compromised account PINs and passwords, using password security best practices, making sure that every password is unique and contains 15+ characters.

- Enable two-factor authentication on all accounts that offer it.

- Store your passwords securely using a trusted password manager.

These added layers of security can help keep identity thieves out of your online accounts and away from your private information.

5. Place a fraud alert or freeze your credit

The next step is to secure your credit reports and prevent the identity thief from opening new accounts in your name. Each of the three main credit bureaus, Experian®, TransUnion®, and Equifax®, offers you the ability to freeze, lock, or put fraud alerts on your credit.

With a fraud alert in place, a business must verify your ID before issuing credit to the person requesting it. The initial fraud alert lasts one year, or you can request an extended fraud alert that lasts for seven years.

Both credit locks and credit freezes restrict access to your credit report, making it practically impossible for fraudsters to open new credit accounts (e.g., loans, credit cards, etc.) in your name. The main difference is that credit freezes are free, whereas credit locks, which are typically only available through paid services, are often quicker and easier to manage.

You can apply for a fraud alert or credit freeze using any of the following methods listed below (phone, online, or mail):

1-800-685-1111 |

1-888-397-3742 |

1-888-909-8872 |

Equifax Consumer Fraud Division, |

Experian, |

TransUnion Fraud Victim Assistance Department, |

Fraud alerts, extended fraud alerts, credit freezes, and free credit locks |

Fraud alerts, extended fraud alerts, credit freezes, and paid credit locks |

Fraud alerts, extended fraud alerts, and credit freezes |

Here’s what you need to do to take action with the credit bureaus when your identity is stolen:

- Report identity theft to all the credit bureaus.

- Request an initial fraud alert, which will last one year.

- Provide proof of identity theft if you want an extended fraud alert, which lasts up to seven years.

- If you don’t plan on applying for new credit in the near future, consider putting a freeze or lock on your credit.

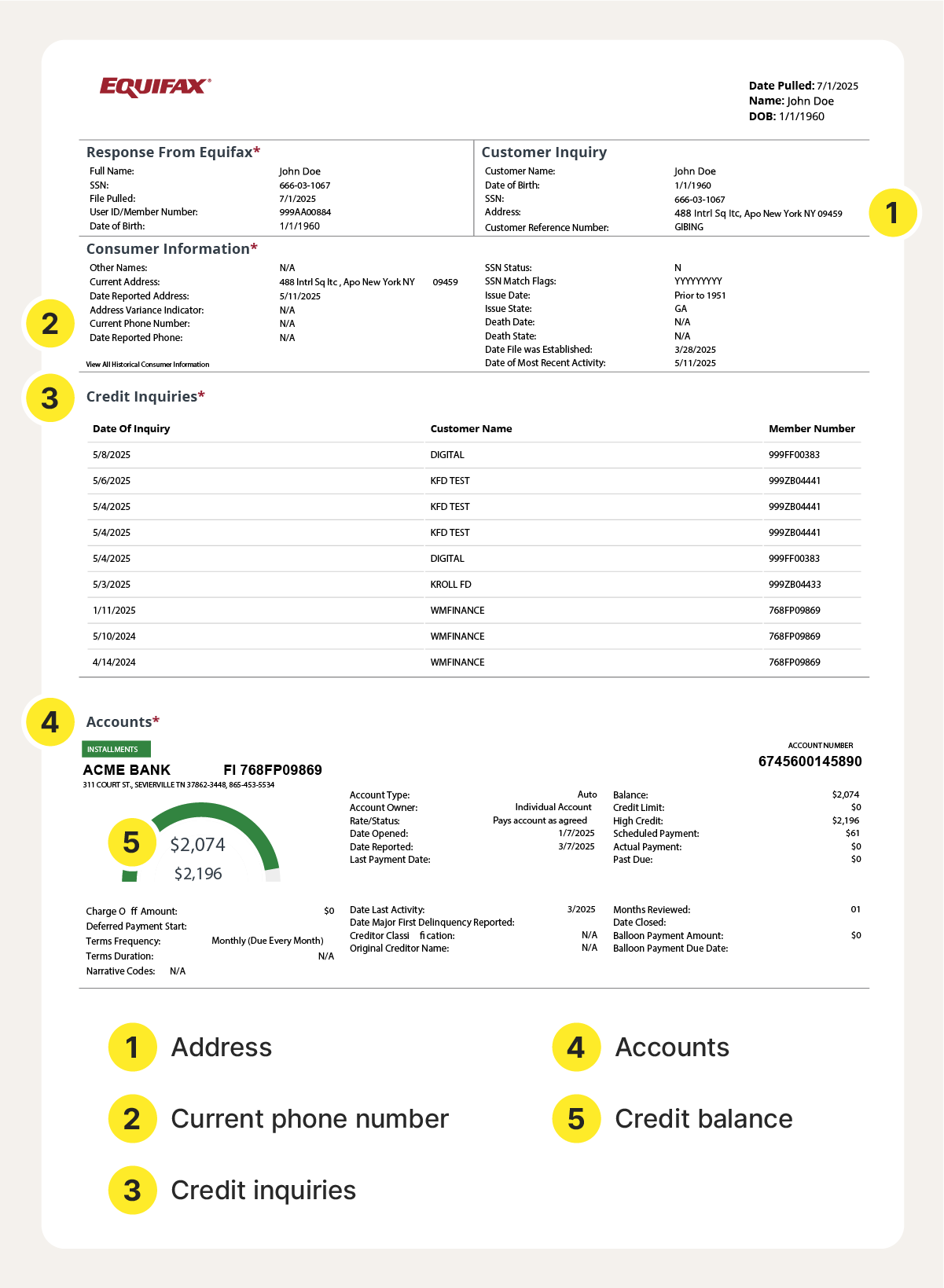

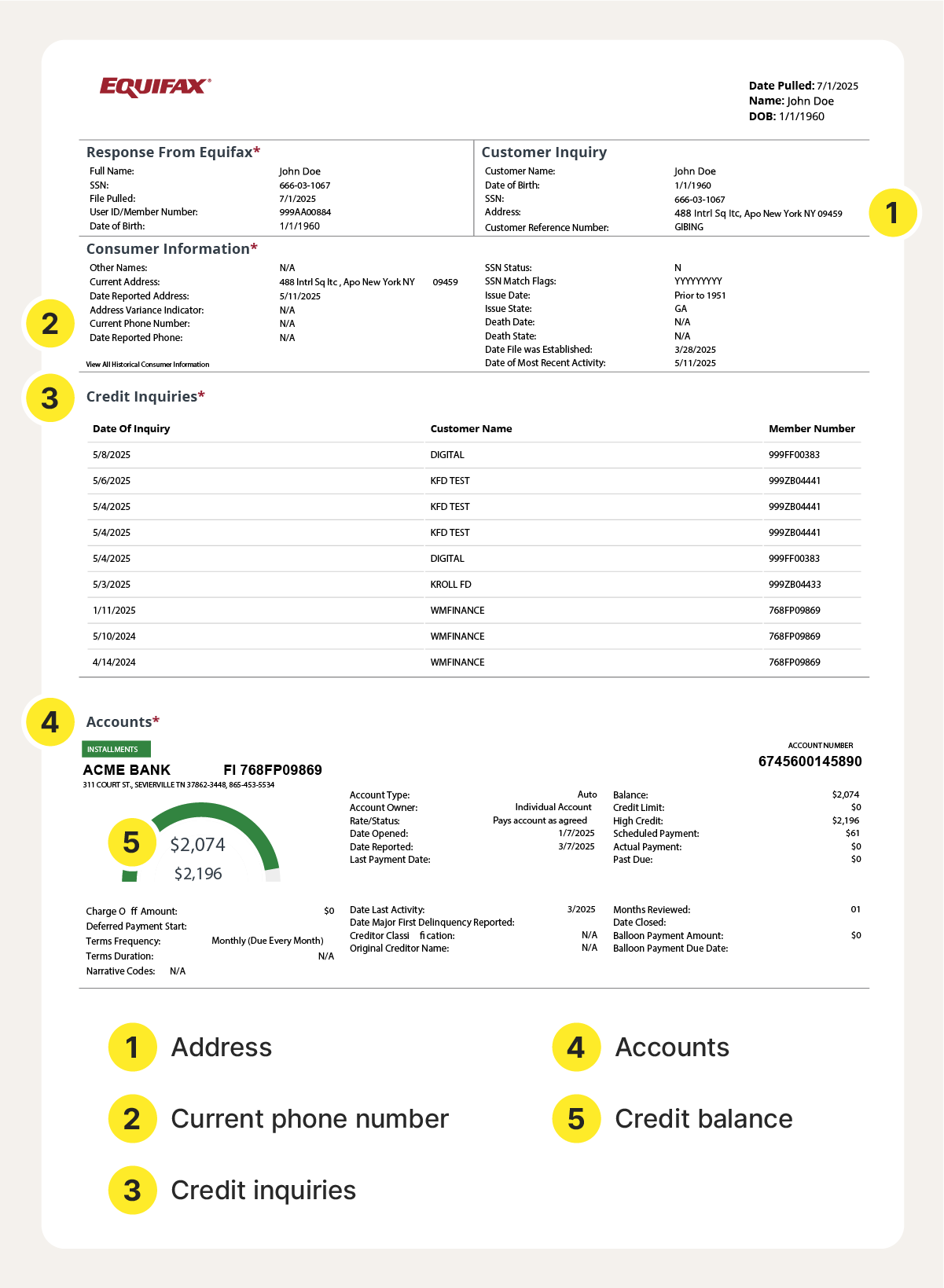

6. Review your credit report for signs of fraud

After freezing your credit or placing fraud alerts, pull your credit reports to check for signs of fraud that may have already occurred. You can get free copies directly from the credit bureaus if you have an account, or through annualcreditreport.com.

Carefully review each report, looking for accounts or activity you don't recognize. Here’s a summary of key things to look for when reviewing your credit report:

- New accounts you didn’t open.

- Unfamiliar credit inquiries.

- Changes to your personal information.

- Addresses or phone numbers that are not yours.

- Incorrect credit balances (may indicate a compromised account).

It’s important to look at your reports from all three credit bureaus to help ensure you’re not missing anything important, because each agency’s report may be different. You’ll need to dispute any inaccuracies you find on your credit reports.

You can also review your reports with ChexSystems, a reporting agency that compiles consumers’ banking history and checking/savings activity.

7. File a report with your local police department

In addition to reporting identity theft to your financial institutions, the FTC, and the credit bureaus, you may also want to alert your local police department to investigate it. This is especially important if you know the identity thief or have information that could help with a police investigation.

Here’s how to report identity theft to the police:

- Contact your local law enforcement agency.

- Provide them with your basic info, proof that your identity has been stolen, and a copy of your FTC report.

- Request a copy of your completed police report.

- Follow any guidance the police offer on how to deal with identity theft.

Your police report can be used as additional proof of identity theft when disputing fraudulent accounts or credit card theft with banks and credit bureaus. It’s also useful if further action is needed, like if you need to pursue a lawsuit or file an online complaint with the FBI’s Internet Crime Complaint Center.

It’s worth noting that the police may or may not investigate your case, even if you have the criminal’s information, as one Reddit user experienced. Often, an investigation depends on the resources available to your local department.

8. Contact the Internal Revenue Service (IRS)

When an identity thief obtains a combination of your name, date of birth, and Social Security number, they could file a tax return in your name, hoping to receive a fraudulent refund. Contact the IRS to make sure you aren’t the victim of tax fraud.

Here’s how to notify the IRS that you’re at risk of tax fraud:

- Call the IRS Identity Protection Specialized Unit at 1-800-908-4490, and report the identity theft.

- Fill out Form 14039. If you have not submitted a return for the year, you’ll need to send in a paper copy.

- Provide the IRS with any requested documentation for their investigation.

- An identity theft indicator will be added to your account, and you’ll be assigned a six-digit identity protection PIN each year to file taxes with.

If a fraudulent return is filed before you notice the identity theft, the Taxpayer Protection Program will let you know about the suspicious return. From there, you’ll need to verify whether or not the return is valid. If it’s not, then you will need to proceed through the steps above.

9. Alert your insurance and medical care providers

While identity theft is more often associated with financial fraud, stolen personal information can also be used by fraudsters hoping to claim medical benefits in your name. The National Insurance Crime Bureau estimated that this type of identity theft will have risen 49% by the end of 2025.

If you’ve received bills for services you didn’t get, find fraudulent information in your explanation of benefits, or suddenly get a notice that your benefits are exhausted, it’s time to reach out to your insurance company and care providers.

Here’s how to report medical identity theft:

- Contact your medical care providers and inform them of your situation.

- Obtain copies of your medical records and review them for any suspicious activity or incorrect contact information.

- Request that any inaccurate info be removed or updated.

- Reach out to your insurance company or benefit provider (e.g., Medicare) to report the medical identity theft.

With access to your medical benefits, a thief could falsely obtain prescriptions or visit an emergency room and leave you to foot the bill. Plus, having inaccurate information on your medical records from these fraudsters could affect your insurance premiums. It could even be dangerous to your health: for instance, imagine the trouble that could be caused by having the wrong blood type listed in your file.

This is why alerting your providers and getting your medical records updated is so important.

10. Report and replace ID cards if needed

Whether you’ve lost your wallet, had it stolen, or your ID numbers were otherwise compromised, an identity thief could have what they need to wreak havoc.

Here’s how identity thieves may use your IDs:

- Use your ID number to pass a fraudulent check.

- Provide your driver’s license during a traffic stop.

- Pass through customs with your passport.

- Claim benefits using your Social Security card.

- Use your birth certificate to impersonate you.

- Sell your ID numbers to other identity theft criminals.

When your IDs have been compromised as part of an identity theft incident, you’ll need to contact the issuing agency to report the situation. Here are some quick references for reporting and replacing your IDs.

ID card |

How to report |

How to replace |

|---|---|---|

Driver’s license |

Contact your local DMV to report the theft. |

Request a new number if possible, or have an alert added to your license. |

Passport |

Request online or by calling 1-877-487-2778. |

Follow the steps for an in-person passport application. |

Social Security card |

File a report with the FTC. |

Request online, by calling 1-800-772-1213, or in-person. |

Birth certificate |

Contact the vital records office in the state where you were born. |

Request a new copy of your birth certificate. |

11. Stay vigilant and set up identity monitoring

One final step to take after your identity has been stolen is to protect yourself from future attacks. To help keep a vigilant watch over your information, consider using an identity theft protection service, such as LifeLock.

Identity theft protection services help you monitor your identity, letting you know when threats or risks are detected while also offering access to expert help in recovering from identity theft if it happens again.

They’ll also typically provide dark web monitoring, which can help you identify risks after a data breach. If your information is exposed, criminals may be able to buy data like your email address and Social Security number off the dark web for as little as $1 and use it to commit identity theft.

With a dark web monitoring service, you’ll receive notifications if your information is found on the dark web, allowing you to take immediate steps to secure your credit and monitor for identity theft.

Don’t face identity theft alone

The stress, financial concerns, and credit fears of identity theft can be a lot to face. But you don’t have to walk the long road of identity recovery alone — LifeLock can help.

With LifeLock, you’ll get around-the-clock identity monitoring and access to identity theft restoration experts who can help you if your identity is compromised. While nobody can completely prevent identity theft, the team at LifeLock will support you every step of the way.

FAQs

How can you tell if your identity has been stolen?

Common warning signs of identity theft include unfamiliar credit applications, calls from collection agencies, lost mail, and unexpected score drops. If you notice any of these signs, your identity may have been compromised.

What should I do if my SSN is stolen?

Notify the Social Security Administration (SSA) immediately. They will launch a Social Security fraud investigation. If the identity theft proves severe enough, the SSA may even issue you a new SSN. To protect yourself from future theft, you’ll want to safeguard your Social Security number.

How long can the effects of identity theft last?

The time it takes to recover from identity theft depends on your unique situation. Things like the number of accounts compromised and the time you can devote to recovering your identity can lengthen the timeline. Because of this, you must respond quickly to identity theft to help prevent the thief from doing any additional damage in your name.

How can I protect my identity going forward?

While nobody can completely prevent identity theft, there are steps you can take to reduce the risk, such as monitoring your credit reports, prioritizing password security, safeguarding your personally identifiable information (including IDs), and using identity theft protection services. By following these steps, you can make it more difficult for a thief to steal your identity.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Notify your bank

- 2. Report identity theft to the FTC

- 3. File a claim with your identity insurance

- 4. Secure your online accounts

- 5. Place a fraud alert or freeze your credit

- 6. Review your credit report for signs of fraud

- 7. File a report with your local police department

- 8. Contact the Internal Revenue Service (IRS)

- 9. Alert your insurance and medical care providers

- 10. Report and replace ID cards if needed

- 11. Stay vigilant and set up identity monitoring

- Don’t face identity theft alone

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.