What to do: If you spot unauthorized transactions or withdrawals from your bank account, contact your bank’s fraud department to file a report. The Fair Credit Billing Act also gives you the right to dispute fraudulent credit card charges. Contact your issuer’s fraud department and they will investigate the claim, removing the charge if it's found to be fraudulent.

Identity theft occurs when someone steals and unlawfully uses your personal information, like your Social Security number, address, or credit card details, to commit fraud.

According to data from the Federal Trade Commission (FTC), U.S. consumers lost over $12.5 billion to fraud in 2024, a 25% increase from 2023. Understanding how to spot the signs of identity theft can help you catch it early if you’re ever targeted, so you can take steps to protect your finances.

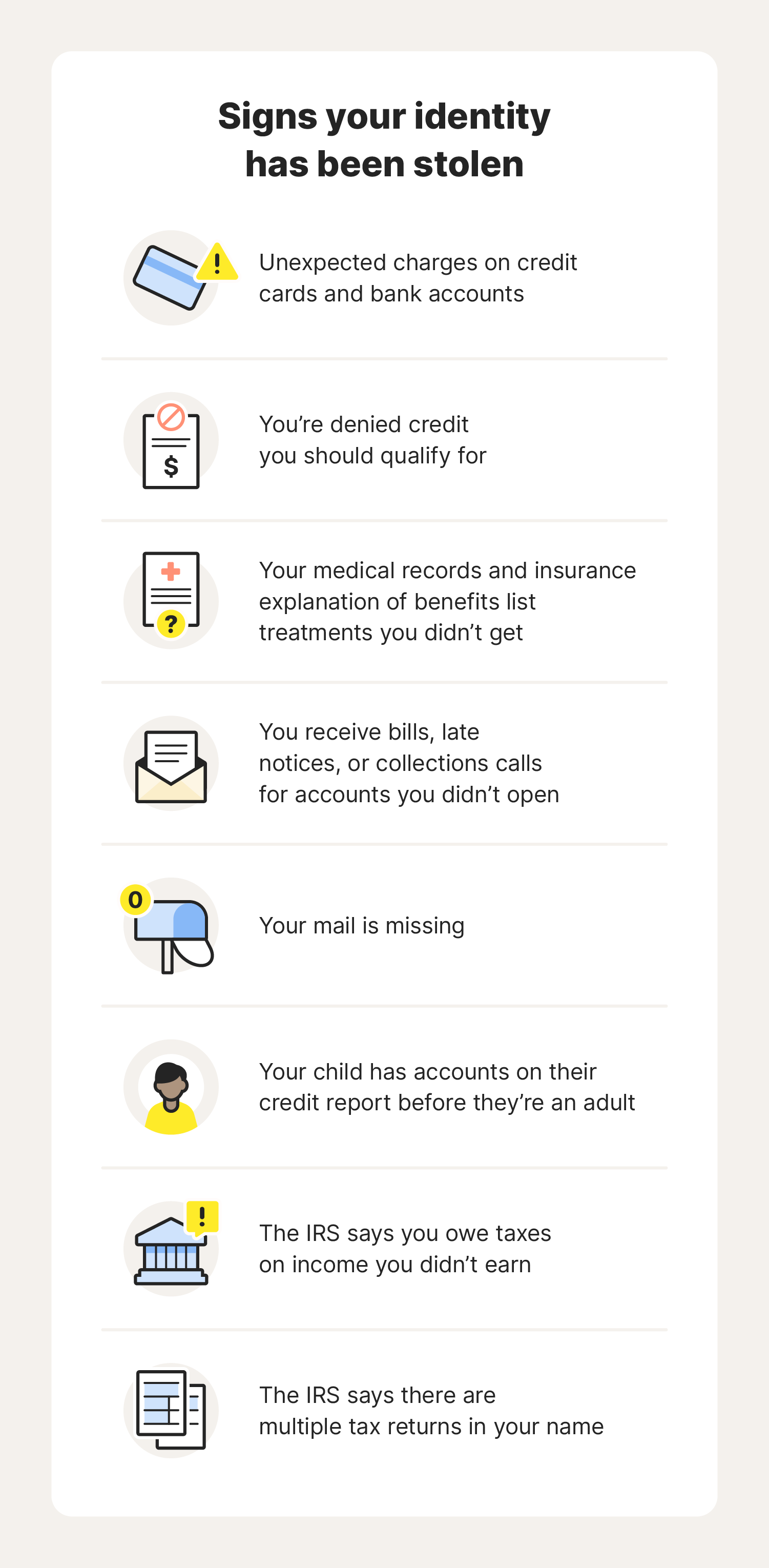

Learn about 20 of the most common warning signs of identity theft and what to do if you spot them, so you’re prepared.

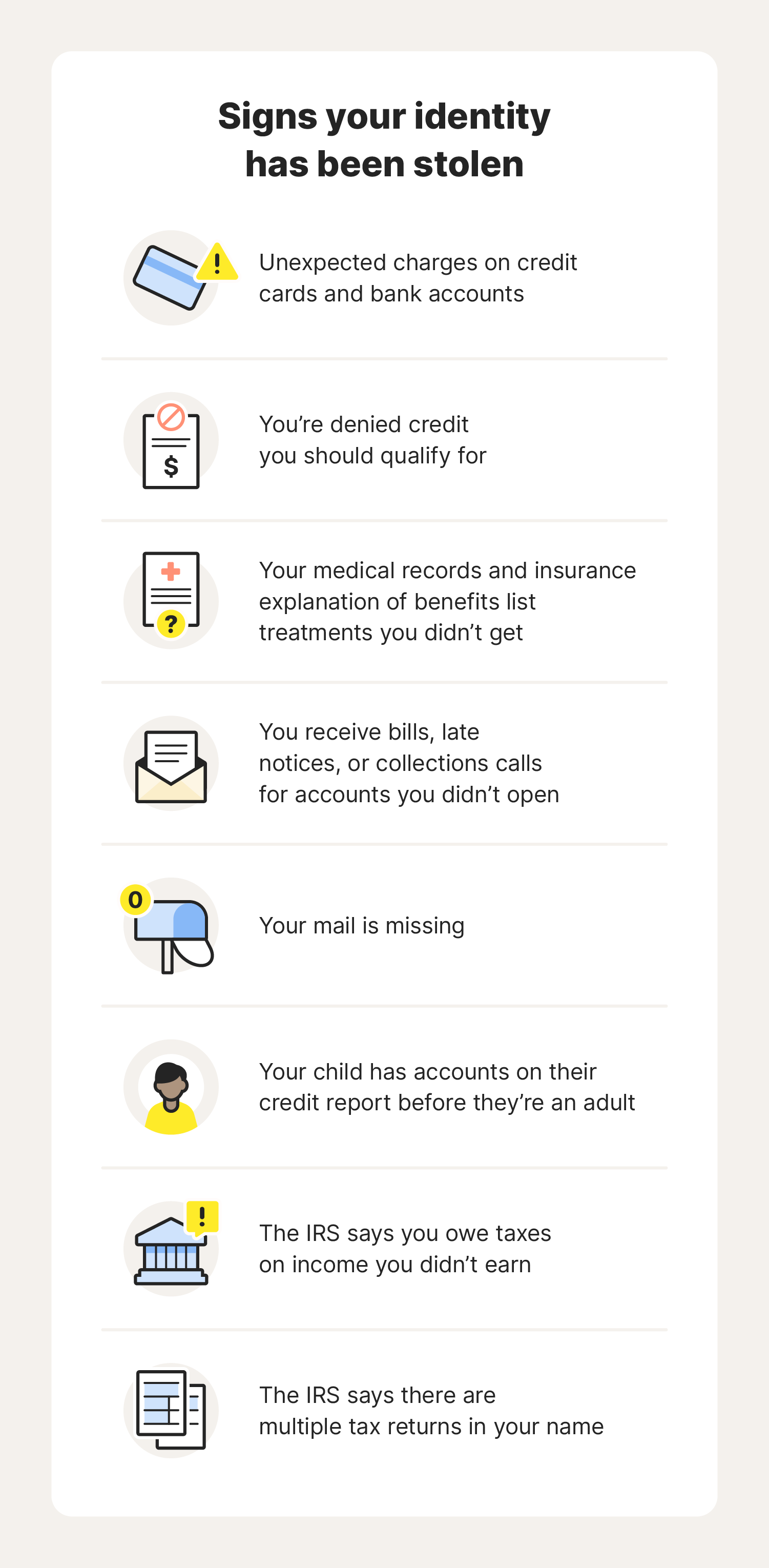

1. Unexplained financial activity

Unauthorized withdrawals from your bank account or charges you don’t remember on your credit card statement could be a warning sign of identity theft, indicating that a fraudster has access to your finances.

While your debit or credit card being stolen is one of the most likely ways you’ll become vulnerable to financial fraud, criminals may also try to get access to your financial information through phishing attacks or credit card skimming.

Thieves with access to your accounts may start by making small withdrawals or transactions to avoid detection. To protect your finances, pay close attention to all of your bank and credit accounts on an ongoing basis.

Credit card fraud can take longer to notice because statements are often issued monthly, but make sure to review your statement in full before paying it to catch any suspicious charges.

2. Errors on your credit report

Errors or inaccuracies on your credit report — like new accounts that you didn’t open, late payments that you don’t recognize, or incorrect personal information — could be a sign that your identity has been stolen for use in credit fraud.

Checking your credit reports regularly will help you spot suspicious activity, like new credit card or loan accounts, or changes to your basic details. You’ll also be able to see any recent hard credit inquiries that have been made in your name, which is a sign that fraudsters are attempting to open new accounts in your name.

Since multiple hard inquiries can hurt your credit score, these fraudulent attempts can damage your financial health even if the accounts aren’t successfully opened. You can remove fraudulent hard inquiries by contacting the credit bureaus.

What to do: Get LifeLock to help monitor your credit and receive automatic alerts of key changes that may be a warning sign of fraud If you notice suspicious activity, contact the credit bureaus to dispute credit report errors and consider placing a fraud alert or credit freeze to help protect your credit file from further harm.

3. Drastic credit score drop

A sudden drop in your credit score can be a sign that your identity has been stolen and used in credit fraud, especially if you haven’t recently opened any new credit accounts or experienced a significant change in your financial situation.

Fraudsters often act fast after stealing your identity, opening multiple accounts or racking up charges on stolen credit cards to maximize the damage. These fraudulent activities will typically be reflected in your credit score within 30-45 days, so checking it regularly can help you tackle fraud before it spirals out of control.

What to do: If you notice a drastic drop in your credit score, check your credit report for errors and dispute any inaccuracies with the credit bureaus. You may also want to freeze your credit with the three major bureaus to prevent unauthorized accounts from being opened while you investigate the cause of the drop.

4. Unexpected credit application denial

Being denied credit you should qualify for, like a loan or a new credit card, could be a sign that an identity thief has used your personal information to open new accounts, rack up charges, and leave bills unpaid, damaging your credit score.

Receiving rejection letters or emails for credit cards or loans you never applied for is also a warning sign that should prompt you to investigate whether you’ve been the victim of fraud.

What to do: If you have a credit application denied unexpectedly, start by checking your credit report for errors. If you find any inaccuracies that signify fraud, dispute them with the credit bureaus and consider placing a fraud alert on your credit report to help prevent the thief from opening more credit accounts in your name.

5. Credit limit changes

Your credit limit is the maximum amount you can borrow on a credit card. If it changes without you requesting an increase, it could be a sign of identity theft. Thieves may pose as you and contact your credit card issuer to request a credit limit increase before making large purchases.

If you receive a letter or email informing you of a credit limit increase you didn’t request, contact your creditor. You can also check your credit limit manually by logging into your online banking or credit card account via the website or mobile app and navigating to the account summary or card details section.

What to do: If your credit limit changes unexpectedly, contact your card issuer to ask for an explanation for the limit change, request that your card is frozen temporarily, check your account for unfamiliar charges, and consider placing a fraud alert on your credit report.

6. Returned payments

If you receive a call or letter from your bank saying that a check has bounced or a debit card payment didn’t go through, despite you having sufficient funds, it could be a sign that your identity has been stolen.

Criminals might have accessed your account and used your debit card or written checks in your name for unauthorized purchases, leading to the returned payments.

Review your account transactions carefully and report any purchases you didn’t make to your bank immediately. They may place a temporary hold on your debit card and issue a new card number to prevent further theft.

What to do: To help prevent check fraud, consider switching to electronic banking and payments. By using secure online transactions or mobile payment apps, you reduce the chances of someone accessing and using your physical checks for fraudulent purposes.

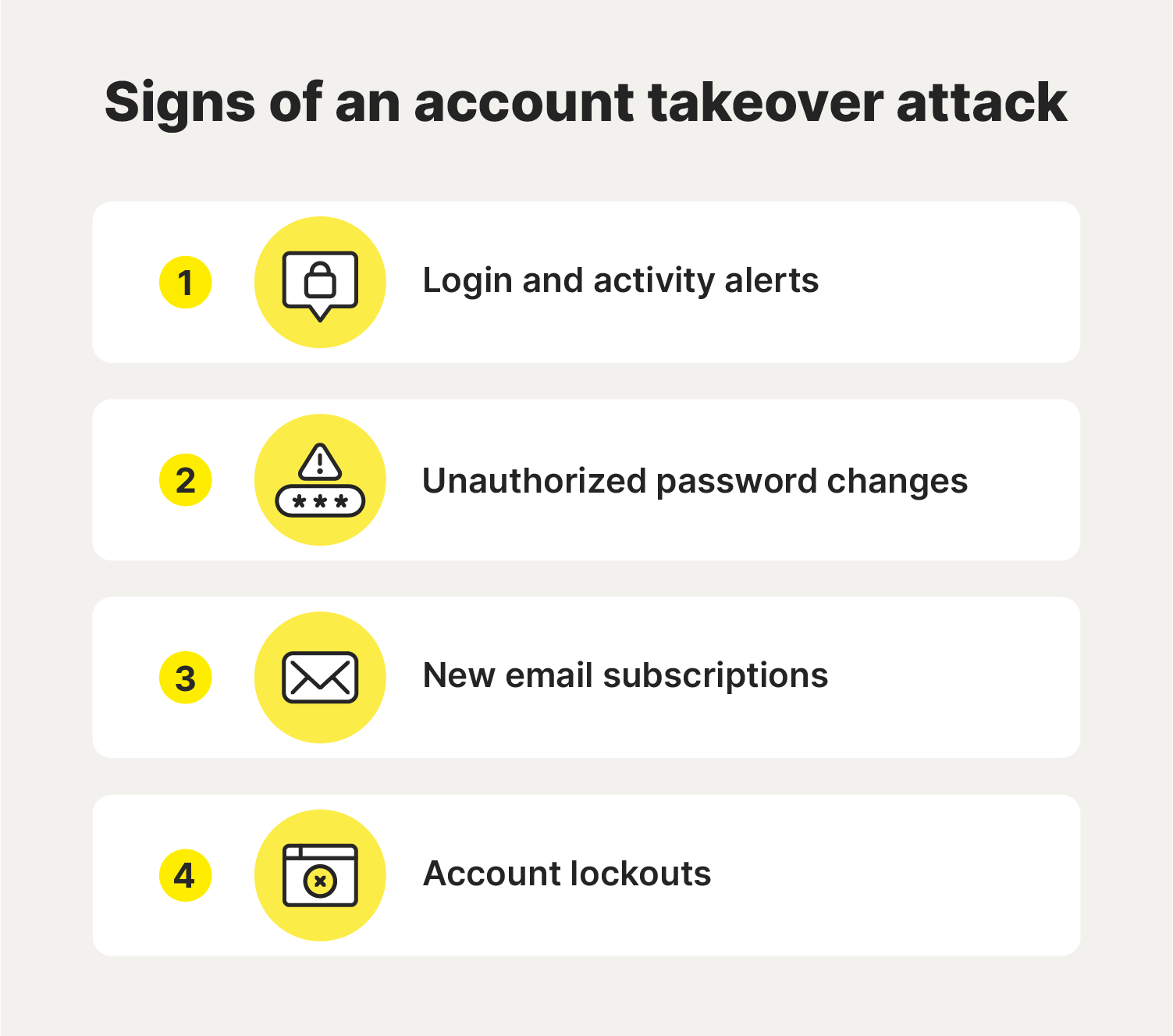

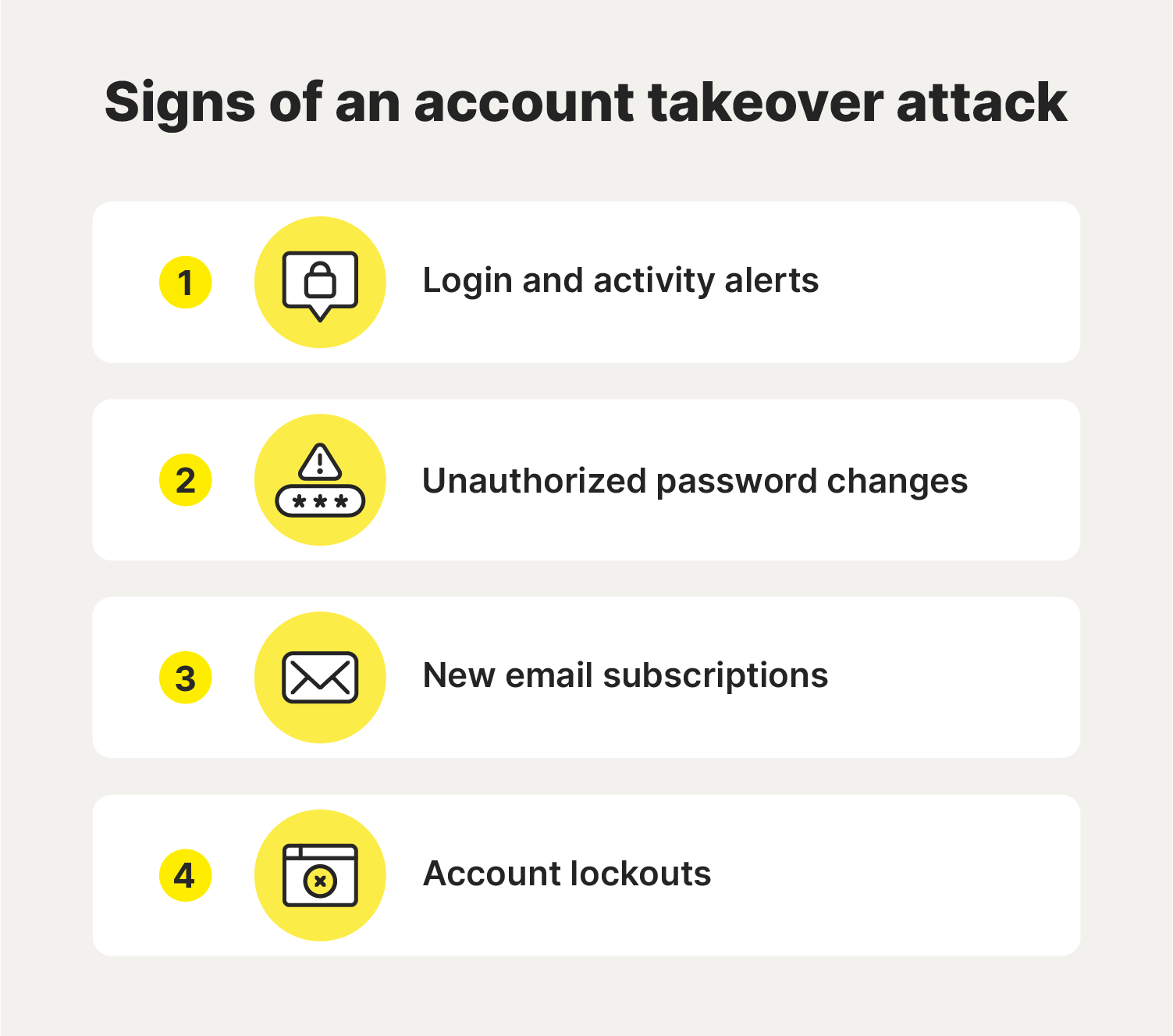

7. Issues accessing online accounts

We all forget or mistype a password once in a while, but if you’re experiencing repeated issues accessing an online account (especially if you know you’re using the right password), it might mean someone has targeted you with an account takeover attack and changed your password to lock you out.

This is particularly dangerous if the compromised account contains sensitive personal or financial details, like your Social Security number, home address, or credit card information. The longer a fraudster has access to your account, the more likely they’ll be able to gather information that helps them steal your identity and commit fraud.

What to do: If you’re locked out of an account, try to recover it immediately using the account’s password reset or recovery options. Contact the website’s customer support team for further assistance if you’re struggling to regain access. Once the account is back in your hands, update your password and enable two-factor authentication (2FA) to help prevent future takeovers.

8. Unexpected login or verification requests

Many websites and apps will send an automatic security alert when someone tries to access your account from a new device or location. They’ll either notify you of the login or request verification in the form of a one-time passcode (OTP) or email confirmation.

If you receive one of these notifications and you’ve not made a recent login attempt yourself, it could mean someone is attempting to access your account using stolen credentials or a brute-force account hijacking method.

What to do: Don’t approve any unexpected verification requests. Instead, change your account password immediately and enable two-factor authentication (2FA) if you haven’t already.

9. Suspicious purchase verification calls

If your credit card issuer notices suspicious transactions on your account, like a large order from a store you haven’t bought anything from before or a high volume of purchases in a very short period of time, they’ll typically call you to verify that it was you making the purchase.

Receiving a call like this when you haven't made any recent purchases could mean an identity thief has gained access to your account, which may leave you exposed to further fraud.

What to do: If you receive a call from your credit card issuer about purchases you didn’t make, and can verify that it’s not a scammer impersonating your issuer, follow their instructions to dispute the charges. Check your account for any other unauthorized transactions, and request a new card if your information has been compromised. Setting up transaction alerts can also help you catch fraud earlier next time.

10. Missing mail or address changes

If you haven’t been receiving mail you normally get, like bills or Social Security statements, it could be a sign that an identity thief is targeting you.

They may have stolen the mail directly from your mailbox to access your personal information or gained access to one of your online accounts and changed your address to redirect your mail.

What to do: If you're missing important mail, request a Missing Mail search through USPS. This service helps track delayed or misdelivered mail and can alert you to possible mail theft.

11. The IRS rejects your tax return as a duplicate filing

Tax scammers aim to steal your personal information so they can file a fraudulent tax return in your name and claim your refund for themselves.

If someone has used your Social Security number to file taxes before you, you’ll likely find out when the IRS rejects your return as a duplicate filing. Not only is that a sign of identity theft, but it means you won’t receive the tax refund you may have been expecting.

In some cases, scammers may change your mailing address or bank account details to intercept your tax refund without your knowledge.

What to do: If you receive a duplicate filing message from the IRS, or notice that a refund you were expecting hasn’t arrived, report the fraud immediately by filing an Identity Theft Affidavit (Form 14039) with the IRS. You should also contact the IRS Identity Protection Specialized Unit for further assistance, and request an Identity Protection PIN (IP PIN) for protection against tax fraud in the future.

12. Unexplained background check results

Identity thieves can use your personally identifiable information (PII), such as your name, Social Security number, or date of birth, to commit criminal identity theft. This often involves the thief creating a fake ID that they can present to law enforcement if they’re caught committing a crime.

Any criminal charges can then end up on your record, potentially causing issues with your background check health and employment opportunities. Thieves can also use employment-related fraud to avoid paying taxes by attaching their earnings to your name and Social Security number.

What to do: If someone has stolen your identity to commit crimes, report it to your local law enforcement agency and the Federal Trade Commission (FTC) immediately. If you’ve become a victim of employment fraud, you may also need to contact the Social Security Administration (SSA) to dispute fraudulent earnings reported under your name.

13. Personal information disclosure

Criminals can use personal information compromised in data breaches and data leaks to steal your identity. The good news is that disclosure laws require organizations to report these breaches, so you should be notified if your information is compromised. However, if you receive such a notification, it might be too late. Your data could have already been used or sold on the dark web.

What to do: Key steps to take after a data breach involving your information include creating new, strong passwords for any compromised accounts and monitoring your financial accounts and credit report for suspicious activity.

14. Unusual medical bills or insurance activity

Medical identity theft happens when someone uses your personal information or health insurance details to receive medical treatment, prescriptions, or other benefits. If you see claims you didn’t submit on the explanation of benefits (EOB) documents you receive from your insurer, or you receive bills from providers you've never used, it could mean your identity has been stolen.

What to do: To find out if someone is using your health insurance fraudulently, review your EOB statements regularly. If you notice any unfamiliar claims or services, contact your insurer immediately to report the issue.

15. Investment changes

If you notice changes to your investments that you or your broker didn’t make, it may be a sign of identity theft. Criminals can target your investment accounts to steal funds, redirect profits, or manipulate your investments for their own benefit.

Access to these financial accounts may also reveal sensitive details that identity thieves can use to commit further fraud. Check your accounts frequently to spot any irregularities as soon as possible.

What to do: If you notice unauthorized changes to your investment accounts, contact your brokerage immediately to report the fraud. Then, review your account statements for any additional suspicious activity, update your passwords to secure your account, and consider placing a credit freeze. If significant funds have been stolen from your account, file a report with the SEC or FINRA for further assistance.

16. Utilities are shut off

If you receive notices about overdue utility bills that you know you paid, or your utilities are shut off entirely, even though you had money to pay them in your account, it could mean your identity is at risk.

A thief may have intercepted checks you sent in the mail, or gained access to your online accounts, and stolen money or changed your details before the utility company could collect the amount owed. In the process, the criminal might have gained access to information they can use in further fraud.

What to do: If your utilities are shut off unexpectedly, contact your utility provider immediately to verify your payment status. If they confirm the bill has not been paid, check your bank account for unauthorized transactions and report any signs of fraud to your bank.

17. Unexpected debt collection calls

If you don't have any outstanding debt with an organization but receive a call from account services or a debt collector, it could be a sign of identity theft. Fraudsters who use your details to commit credit fraud may have opened accounts in your name and left bills unpaid, resulting in creditors contacting you for settlement.

What to do: Check your credit report for unfamiliar accounts and dispute any fraudulent activity with the credit bureaus. If the debt results from identity theft, report it to the Federal Trade Commission (FTC) at IdentityTheft.gov and contact the creditor to resolve the issue.

18. Packages you didn’t order

Coming home to find packages you didn’t order could mean someone stole your identity and either forgot to change your address in your online account or hoped to scoop up “their” mail from your home before you. These unordered packages could also be part of a brushing scam, which is a way for companies to pump up their review numbers.

What to do next: If you receive packages you didn’t order, check your recent account activity across all shopping platforms and financial accounts for suspicious purchases or changes. If you spot anything unusual, change your passwords immediately and enable two-factor authentication to help secure your accounts.

19. Credit activity in your child’s name

If you have young children, the last thing you expect to see in the mail is a credit card application with their name on it. While it could be an honest mistake, it might also be a sign that someone is trying to steal your child’s identity.

Child identity theft occurs when someone steals a child’s personal information, such as their Social Security number or birthdate, and uses it to commit fraud. This can include opening credit accounts, applying for loans, or claiming government benefits in the child’s name. Because children typically don’t use their credit until adulthood, this type of theft can go undetected for years.

What to do next: To protect your child’s credit, consider placing a credit freeze on their file with the major credit bureaus. You can also invest in a dedicated identity theft protection service for children, like a LifeLock Family plan, for better protection and access to restoration support if their identity is ever stolen.

20. You have issues claiming benefits

If you have trouble claiming government benefits, such as unemployment assistance, Social Security payments, or tax refunds, it could be a sign that someone has stolen your Social Security number and is using it fraudulently. Identity thieves may file for benefits in your name, depleting your entitlement so you’re left without the support you need.

What to do next: If you’re unable to claim benefits that you qualify for, contact the respective government agency immediately to report suspected fraud.

What to do if your identity has been stolen

If your identity has been stolen, taking quick action can help minimize the damage. While steps may vary depending on your specific situation, essential measures to protect yourself from further harm include notifying relevant companies, upgrading your online account security, protecting your credit file, and submitting a report with the FTC.

Here’s a step-by-step guide you can follow if you discover your identity has been stolen:

- Assess the damage: Check your credit report, bank accounts, and other financial statements thoroughly for any unfamiliar activity to understand the full extent of the fraud.

- Notify any companies involved: Contact your bank, credit card issuer, and any other affected companies to report that your identity has been stolen and follow their advice to protect your finances.

- Resecure your accounts: Change your passwords for any potentially compromised online accounts, enable two-factor authentication, and update your security questions to help keep the identity thief from getting access to your accounts again.

- Place a credit freeze or fraud alert: A credit freeze (also known as a security freeze) blocks new credit applications, while a fraud alert warns creditors to take extra steps before opening accounts in your name. Either one can help protect against identity thieves using your information in credit fraud.

- File an identity theft report: Report the identity theft to the FTC at IdentityTheft.gov and consider filing a report with the Internet Crime Complaint Center (IC3) if the theft involved an online scam.

Tips to reduce the risk of identity theft

While there’s no way to completely prevent identity theft, key steps to take to reduce the risk of having your identity stolen include constantly monitoring your key financial accounts and credit reports, following cybersecurity best practices, keeping your devices up-to-date, and investing in an identity theft protection service.

Here are more details about some of the best ways to keep your identity, and by extension your finances, safer:

- Monitor your financial accounts: Check your bank and credit card statements regularly for any unauthorized charges. Consider setting up alerts for login attempts or transactions to catch potential fraud more quickly.

- Check your credit reports: Many types of fraud will leave signs on your credit report, like new credit inquiries, changes to your personal details, or bank accounts opened in your name. Keep an eye on your report to catch warning signs — request a free credit report from each of the three main credit bureaus at least once a year, or use a credit monitoring service like the one included in LifeLock for automatic alerts of potential fraud.

- Practice good document security: Collect your mail daily to limit the opportunities thieves have to steal it. Shred any documents containing personal information before throwing them out, and store important documents like Social Security cards and passports securely at all times.

- Share sensitive information with caution: Don’t overshare on social media. Even innocent posts about travel plans or purchasing a new home could give identity thieves the information they need to commit fraud.

- Don’t respond to unsolicited contact: If someone contacts you and asks for personal information unexpectedly, don’t give it to them. Instead, hang up and confirm the request is legitimate by contacting the business or organization the caller claimed to be from.

- Use strong passwords: Use strong and unique passwords for all your accounts to reduce the likelihood of a fraudster guessing them and gaining access to sensitive information. Consider getting a password manager to help store your passwords securely.

- Use 2FA: Two-factor or multifactor authentication adds an extra layer of security to your online accounts, helping prevent hackers and identity thieves from accessing your accounts even if they have your password.

- Look out for data breaches: Data breaches can leave you vulnerable to identity thieves, so pay attention to any alerts you receive claiming your information was compromised. If you ever receive an alert, change your passwords and keep a close eye on your accounts for unauthorized activity.

- Avoid public Wi-Fi: If you need to make a financial transaction in public, avoid using unsecured public Wi-Fi networks or use a VPN to encrypt your connection and protect against cybercriminals who may try to intercept your data.

- Update your software: For maximum protection against cyber threats like hacking or malware, keep the software on your phone, tablet, and computer updated with the latest version at all times.

- Use identity theft protection services: Identity protection services like LifeLock monitor your information online and provide alerts that can help you catch the early signs of fraud. You’ll also benefit from support if your identity is ever stolen.

Help prevent identity theft with LifeLock

Recognizing the signs of identity theft can help you act more quickly if you’re targeted. For added protection, join LifeLock today. You’ll get access to a range of features that can help you safeguard your personal information and identity. And should you still fall victim, you’ll benefit from identity restoration support from a dedicated U.S.-based specialist.

FAQs

How can I report identity theft?

You can report identity theft to the Federal Trade Commission at IdentityTheft.gov. Once you create the report, you’ll receive a personal recovery plan too.

How do identity thieves get my information?

Identity thieves can get your information through a variety of methods, including phishing attacks, data breaches, dark web marketplaces, hacking, and phone scams.

Who is most at risk of identity theft?

The most common identity theft targets are often those who are active on social media and those who earn higher incomes. However, anyone can be targeted by identity thieves.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Unexplained financial activity

- 2. Errors on your credit report

- 3. Drastic credit score drop

- 4. Unexpected credit application denial

- 5. Credit limit changes

- 6. Returned payments

- 7. Issues accessing online accounts

- 8. Unexpected login or verification requests

- 9. Suspicious purchase verification calls

- 10. Missing mail or address changes

- 11. The IRS rejects your tax return as a duplicate filing

- 12. Unexplained background check results

- 13. Personal information disclosure

- 14. Unusual medical bills or insurance activity

- 15. Investment changes

- 16. Utilities are shut off

- 17. Unexpected debt collection calls

- 18. Packages you didn’t order

- 19. Credit activity in your child’s name

- 20. You have issues claiming benefits

- What to do if your identity has been stolen

- Tips to reduce the risk of identity theft

- Help prevent identity theft with LifeLock

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.