Tip: You should be able to find your state’s unclaimed property website by searching the state followed by “unclaimed property search,” but you can also visit unclaimed.org for a direct link to the right website.

A bank account in your name that you don’t recognize might be harmless — simply a long-forgotten account gathering dust. But it could also be a sign of identity theft, with potentially severe financial fallout.

In 2024, a woman in New York was arrested for opening a fraudulent bank account using forged documents and stealing $50,000 from an unsuspecting victim. While that case made headlines, it’s likely that many other examples of financial identity theft go unnoticed until the damage is already done in the form of drained funds, credit issues, or legal complications.

Looking up what bank accounts are open in your name can help you recover lost money, keep your finances in order, and spot worrying signs of fraud before they spiral into something more serious.

5 ways to find bank accounts in your name

Useful methods to find bank accounts in your name include requesting ChexSystems and Certegy reports, searching your state’s unclaimed property site, and contacting banks directly. Follow these steps to help uncover both active and forgotten accounts, detecting possible identity theft risks along the way.

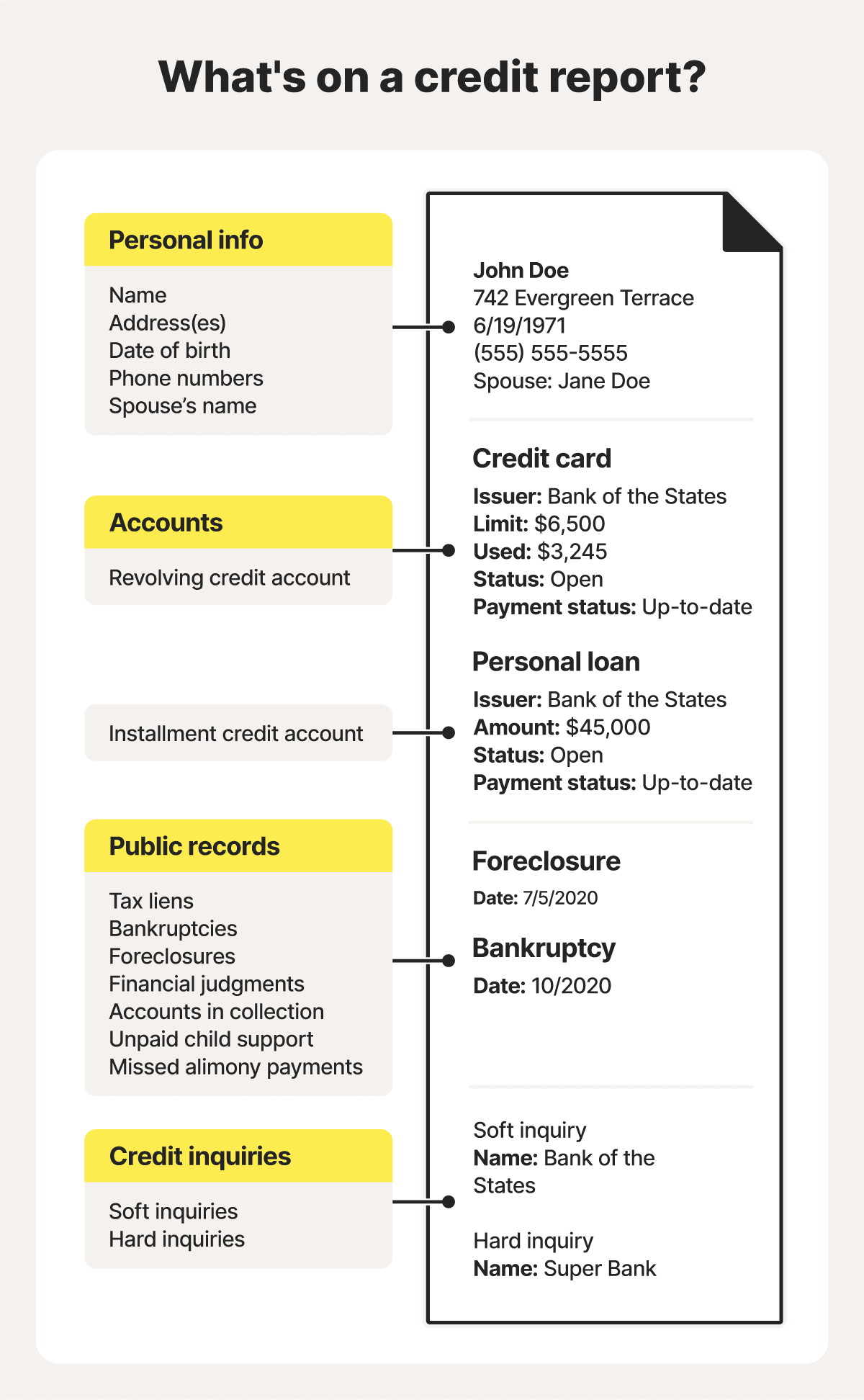

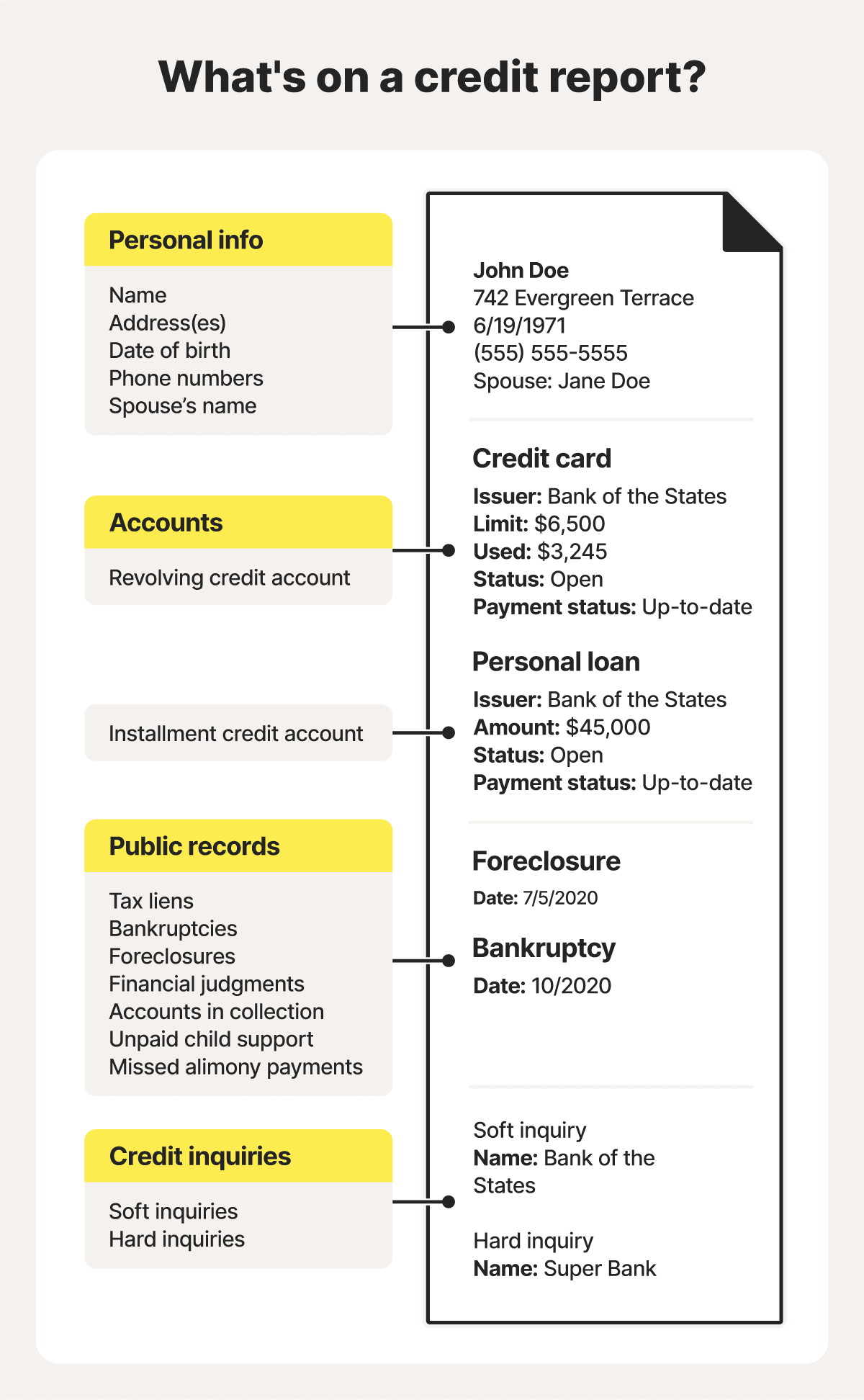

1. Check your credit report

While a credit report won’t show regular checking or savings accounts associated with your identity, it provides a comprehensive overview of your credit history, including information on credit accounts and loans taken out in your name.

So, if someone has opened a bank account that offers an overdraft or other credit facility using your details, it may show up on your credit report as a new credit inquiry or an unfamiliar active account.

You can get a free weekly copy of your credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion — at AnnualCreditReport.com.

When reviewing your report, look for unfamiliar account names, recent inquiries, or open accounts you haven’t used in years.

Here’s how to check your credit report:

- Go to AnnualCreditReport.com.

- Request your reports from Equifax, Experian, and TransUnion.

- Review each report for unfamiliar bank or financial institution names, recent credit inquiries you didn’t make, and open accounts you don’t recognize.

- Flag anything suspicious and follow up with the bureau or financial institution, filing a credit report dispute if required.

You can also keep tabs on your credit report with LifeLock Total, offering three-bureau credit monitoring that alerts you to key changes which could signal fraud. Alongside automatic monitoring across all three bureaus, you’ll get access to daily credit report and score updates from one bureau, making it easier to catch errors or suspicious activity.

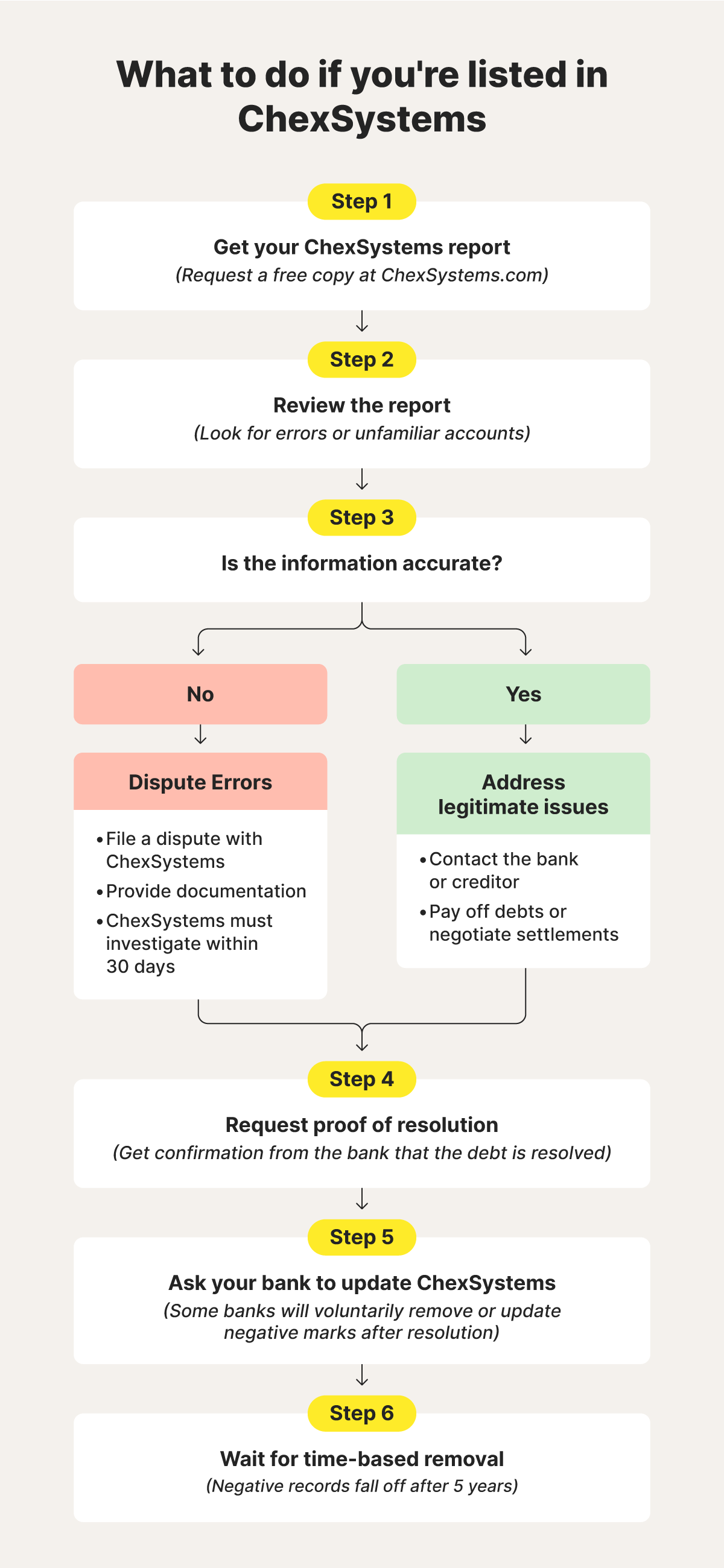

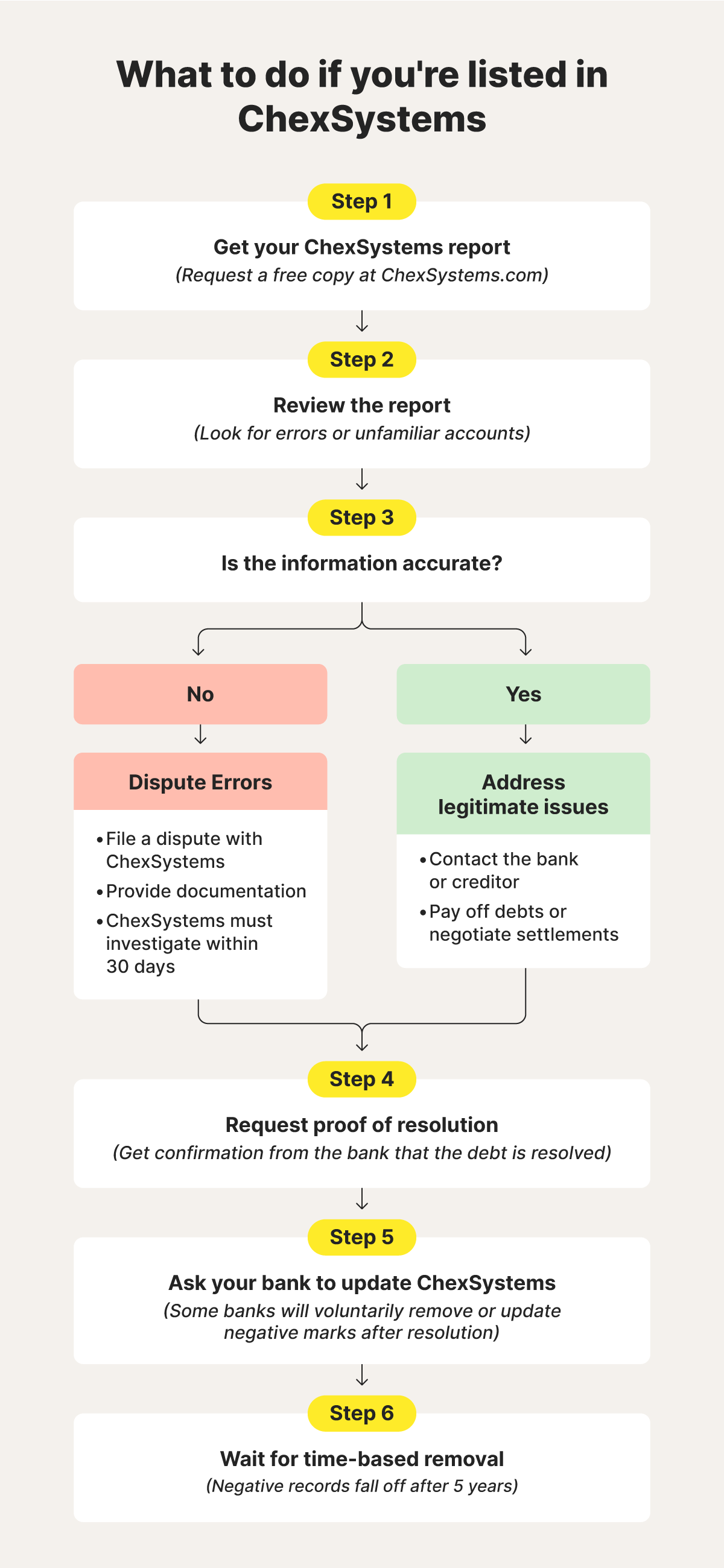

2. Review your ChexSystems report

ChexSystems is a consumer reporting agency that tracks your deposit accounts, such as checking and savings accounts. Banks and credit unions often use ChexSystems to evaluate applicants’ eligibility for new accounts, looking out for a history of unpaid fees, overdrafts, or suspected fraud.

Reviewing your ChexSystems report can help you spot forgotten or unauthorized accounts linked to your Social Security number, along with closures, bounced checks, or negative balances that could impact your ability to open new accounts.

To check your ChexSystems report:

- Go to chexsystems.com.

- Log in or complete a registration form.

- Select Request Report.

- Submit the online form with your personal information.

- Review the report for bank accounts you don’t recognize, accounts closed for suspected fraud or unpaid balances, and any personal information errors.

- Report any suspicious or incorrect entries directly to ChexSystems or the financial institution that reported them.

3. Review your Certegy report

Certegy is a consumer reporting agency that tracks your history with checking accounts, including account openings, closures, and issues like bounced checks or suspected fraud. Banks and retailers use Certegy to decide whether to approve you for new accounts or allow check payments.

If someone has opened a bank account in your name or you have a forgotten account lying dormant, Certegy may have a record of it.

Here’s how to request and review your Certegy report:

- Visit askcertegy.com.

- Click FACT Act - Obtain Your Free Annual Report.

- Choose your preferred method (online, phone, or mail).

- Provide your full name, address, Social Security number, and a copy of your ID.

- Review the report carefully for accounts or activity you don’t recognize.

- If you spot errors or suspicious entries, follow Certegy’s dispute process on the site.

4. Use your state’s unclaimed property websites

Every U.S. state operates an unclaimed property program that holds financial assets when the rightful owner can't be located. This typically happens due to name changes, outdated contact information, or long periods of account inactivity (between three and five years, depending on state regulations).

Unclaimed property may include dormant bank accounts, uncashed checks, insurance payouts, or safe deposit box contents. If a bank account in your name has been closed and turned over to the state, it may show up here.

To check for unclaimed accounts, visit your state’s unclaimed property website and search using your full legal name. If you've lived in multiple states, search each one. Be sure to check for listings tied to past addresses or alternate versions of your name. If you find a match, you can submit a claim to recover the funds.

5. Make a direct inquiry with financial institutions

Contacting banks and credit unions directly can help uncover checking or savings accounts that may not appear in credit reports or third-party databases.

Start by contacting institutions you currently use or have used in the past. Ask whether there are any open or closed accounts associated with your name or Social Security number. However, this method won’t reveal accounts opened at institutions you’re unaware of, so it’s best used in combination with other checks for a more complete picture.

How to claim forgotten accounts

If you discover a forgotten bank account in your name, whether it’s a childhood savings account or a checking account linked to a past address, start by contacting the bank it’s held with directly.

You’ll need to verify your identity to reclaim the account, so have official documents like a government-issued ID, proof of address, or Social Security number ready. Reclaiming forgotten accounts is usually straightforward once you provide the required documentation.

If contacting the bank doesn’t work, try visiting your state’s unclaimed property website to see if the funds were turned over after the account was closed for inactivity, for example.

Signs someone has opened an account in your name

Warning signs someone has opened a bank account in your name include unfamiliar financial activity, sudden credit score changes, or unexpected mail from banks.

Here's a closer look at the red flags you should watch out for:

- Mail from banks you’ve never used: Banks send welcome letters, statements, or debit cards after opening an account. If you receive mail from a bank you didn’t contact, it could be a sign that someone used your personal information to open a new account.

- Unexpected credit score drops: Fraudsters may miss payments or overdraw balances on new accounts created in your name, negatively impacting your credit score even though you have no knowledge of the account.

- Debt collection notices for unknown accounts: If a fraudster runs up unpaid balances on bank account credit facilities, like an overdraft, the debt may be sent to collections, triggering calls or letters from collectors.

- Credit applications rejected: New account applications made in your name without your knowledge can raise your credit utilization or add negative marks, like failed credit checks, to your file. Credit monitoring services can help you detect these signs.

- Alerts from identity monitoring services: Identity theft protection services like LifeLock track suspicious changes to your credit. If activity linked to your identity is detected, you’ll receive a notification.

What to do if someone has opened an account in your name

If someone opens a bank account in your name, report it to the bank, place a fraud alert on your credit reports, and file an identity theft report with the FTC. Following these steps can help reduce the damage caused by identity theft:

- Contact the bank: Call the bank where the account was opened and explain the situation. Ask them to close the fraudulent account, flag it as identity theft, and provide written confirmation that the account is closed.

- Place a fraud alert: Contact one of the three major credit bureaus (Equifax, Experian, or TransUnion) to request a free one-year fraud alert. This warns lenders to verify your identity before opening any new credit in your name.

- Freeze your credit: A credit freeze stops new lenders from accessing your credit report, making it harder for fraudsters to open more accounts. You’ll need to contact all three credit bureaus to activate the freeze.

- Check your credit reports: Review your credit reports from all three bureaus for unfamiliar accounts or recent hard credit checks. This can help you identify the full scope of the fraud and dispute any other unauthorized activity.

- File a police report: Visit your local police department to file a report for identity theft. An official record can support subsequent claims you have to make with banks or credit bureaus during investigations.

- Report identity theft to the FTC: Go to IdentityTheft.gov to file a report with the Federal Trade Commission. The FTC provides a recovery plan and a personalized affidavit you can use when disputing the fraudulent account.

How to help protect yourself from bank fraud

Following cybersecurity best practices, such as using strong passwords, enabling two-factor authentication, and monitoring your financial accounts regularly, can help protect you from bank fraud.

Here's a closer look at the strategies you should use to safeguard your personal information:

- Bank online: Online banking lets you check your account activity in real time and spot issues faster than waiting for paper statements. You’ll also be less vulnerable to mail theft, which could lead to bank fraud.

- Use strong and unique passwords: Strong passwords are long, unique, and complex — ideally combining uppercase and lowercase letters, numbers, and special characters. Using a different password for each account means that one password being leaked doesn’t compromise your entire online identity.

- Utilize banking security features: Enable features like account alerts, biometric logins (such as fingerprint or facial recognition), and real-time transaction notifications through your bank’s app or website settings. These tools can help you make your account even more secure and notify you of unusual activity in real time.

- Enable two-factor authentication: Two-factor authentication (2FA) adds an extra verification step, like a code sent to your phone, to make unauthorized logins more difficult.

- Check your credit reports regularly: Reviewing your credit reports helps you catch inquiries that could indicate fraud. You can get one free report per week from each bureau at AnnualCreditReport.com.

- Avoid public Wi-Fi: Public Wi-Fi networks are often unsecured, making it easier for hackers to intercept your data. Enable a VPN before connecting or wait to bank online until you're on a secure connection.

- Watch out for phishing scams: Scammers often impersonate banks or trusted companies in emails or texts to steal your login credentials. Never click suspicious links or share personal or banking information unless you’re certain the request is legitimate.

- Use identity theft protection: LifeLock monitors for potential identity theft risks, like new accounts, data breaches, or unauthorized credit activity, and alerts you to threats so you can take action to protect yourself. If your identity is stolen, you’ll also get expert recovery support from a U.S.-based specialist.

Help catch financial identity theft in its tracks

Think someone’s opened an account in your name? Act fast. Use the steps above to investigate — then get extra protection with LifeLock.

LifeLock Total includes three-bureau credit monitoring and real-time alerts to help you detect potential fraud, so you can take action to lock down your finances and your identity. Stay ahead of identity thieves with powerful tools that help secure your financial future.

FAQs

How do I know if a scammer opened a bank account in my name?

Start by checking your ChexSystems and Certegy reports to track deposit account activity and reveal unfamiliar accounts tied to your identity. You should also watch out for red flags like unexpected mail from banks, denied credit applications, or changes to your credit report. For added protection, consider an identity theft protection service like LifeLock, which can alert you if a new account is opened using your personal information.

Can someone open a bank account in your name without you knowing?

Yes, someone can open a bank account in your name without your knowledge using stolen personal details like your Social Security number, birthdate, or address. This kind of identity theft often goes unnoticed until you receive a credit alert, get a bill from a bank you don’t recognize, or hear from a debt collector.

Can I find bank accounts in my name with just my Social Security number?

You can’t directly search for bank accounts using only your Social Security number, but it helps when requesting reports from ChexSystems, Certegy, or unclaimed property sites. These tools use your SSN to locate accounts linked to your identity.

Are bank accounts public records?

No, bank accounts are not public records. Account details are private and protected by federal privacy laws, so somebody shouldn’t be able to access yours without your explicit permission or legal authorization.

What happens if I don’t claim a dormant bank account?

If you don’t claim a dormant bank account, the bank may eventually close it and transfer the funds to your state’s unclaimed property program. You can still claim the money later through your state’s unclaimed property website, but it may take time and require documentation.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.