How to tell if someone took out a loan under your name

The first step in stopping loan fraud is recognizing the warning signs. Many people don’t realize they’ve been targeted until they start getting collection notices or see a drop in their credit score. Here’s how to spot the red flags:

- Check your credit report: Look for unfamiliar accounts, loan inquiries, or sudden drops in your score.

- Watch for unexpected bills or debt collection calls: If a lender or collection agency contacts you about a loan you never took out, that’s a major warning sign.

- Monitor your mail and email: If you start receiving approval or denial letters for loans you didn’t apply for, someone may be using your identity.

- Keep an eye on your credit score: Unexpected fluctuations can indicate unauthorized activity.

Regular credit monitoring can help you catch fraudulent activity before it spirals out of control.

How to dispute the fraudulent loan

If you’ve confirmed a fraudulent loan in your name, act fast. The sooner you take action, the better your chances of minimizing damage. Be sure to immediately contact the lender and freeze your credit to prevent new bank accounts from being opened in your name. Once you’ve taken immediate steps, it’s time to officially dispute the fraudulent loan. Here’s what to do:

- Dispute the loan with credit bureaus: Contact Experian, Equifax, and TransUnion to challenge the fraudulent loan and request its removal from your credit report.

- Contact the lender: Provide evidence of fraud, including your Federal Trade Commission report and police report, and request the loan be removed from your records.

- Follow up regularly: Credit disputes take time. Keep checking your credit report to ensure the fraudulent loan is removed.

By being persistent and providing proper documentation, you can clear your name and help protect your credit.

How to prevent future identity theft and loan fraud

A fraudulent loan can damage your credit score and financial stability, but taking proactive steps can help prevent it from happening again. Here is how:

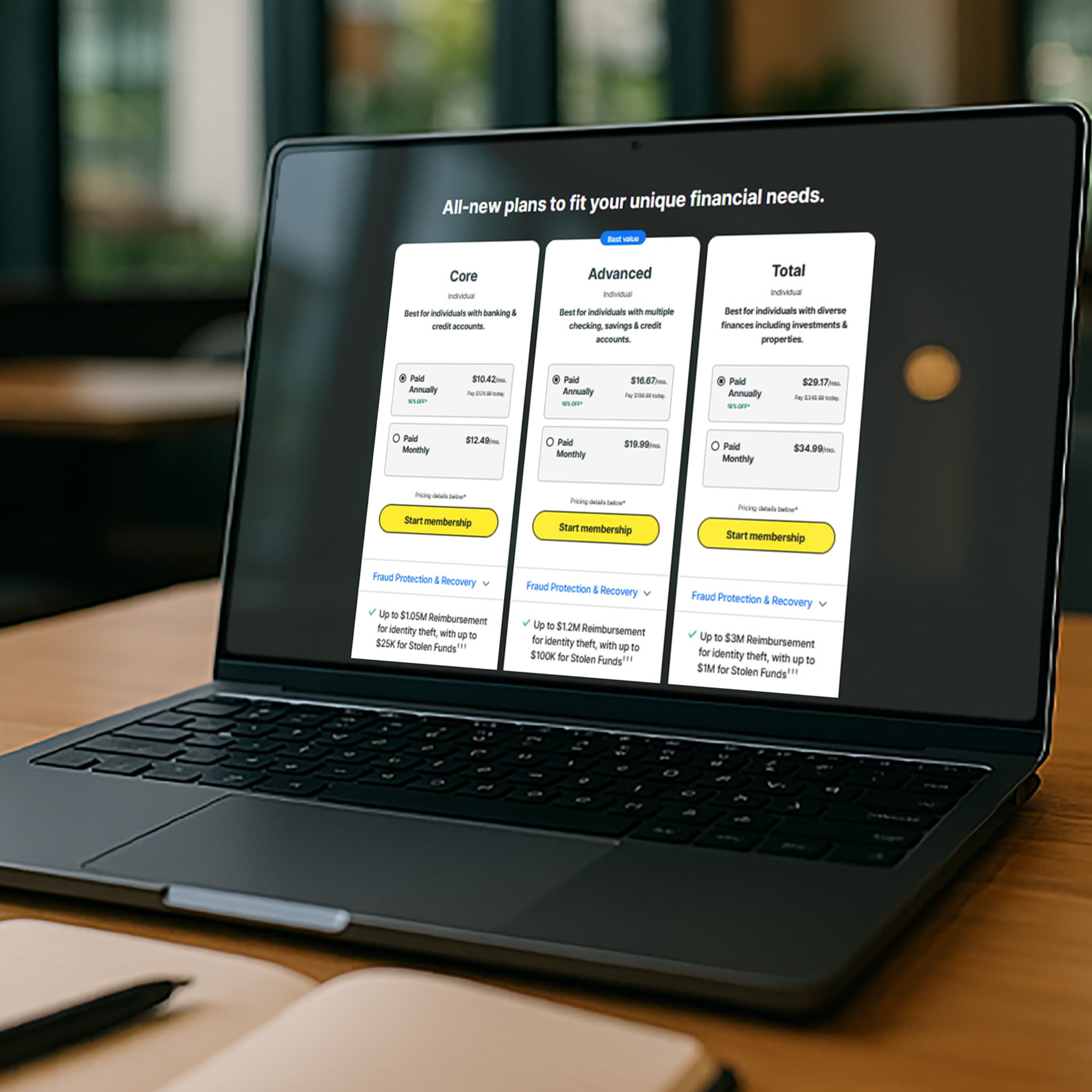

- Set up credit monitoring alerts – LifeLock can alert you to suspicious activity and changes in your credit.

- Check your credit report regularly – You're entitled to a free credit report annually from each major credit bureau at AnnualCreditReport.com.

- Use strong, unique passwords – Avoid using the same password for multiple accounts and consider a password manager for added security.

- Enable two-factor authentication (2FA) – This adds an extra layer of protection to your financial accounts.

- Watch out for phishing scams – Cybercriminals often use fake emails and messages to steal personal information.

Stay alert and monitor your financial activity

Recovering from identity theft isn’t just about fixing the immediate damage—it’s about preventing it from happening again. Regularly monitoring your credit, securing your personal information, and using identity protection services can help you stay ahead of identity thieves.

Identity theft can be overwhelming, but by taking swift action and implementing preventative measures, you can protect yourself from long-term financial harm. Stay informed, stay vigilant, and take control of your financial future. LifeLock provides advanced identity monitoring and fraud alerts to help you detect suspicious activity before it becomes a major problem.

FAQs about someone taking out a loan in your name

How often should I check my credit report?

You should check your credit report at least once a year—but if you suspect fraud, monitor it more frequently. Credit monitoring services can provide alerts for suspicious activity.

Can fraudulent loans impact my credit score?

Yes. A fraudulent loan can lead to missed payments and defaults, which can significantly lower your credit score. Acting quickly to dispute the loan helps minimize damage and rebuild your credit.

Is every type of loan vulnerable to identity theft and fraud?

Most loans—including personal loans, auto loans, mortgages, and even small business loans—can be fraudulently opened with stolen personal information. Monitoring your credit is key to spotting suspicious activity.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.