Several million hopeful borrowers submit mortgage applications every year in the US. And while only 1 in every 134 mortgage applications was estimated to contain fraud in the second quarter of 2023, that amounts to a staggering tens of thousands of potential fraudulent applications every year.

Fraudulent loan applications that slip through the cracks can devastate anyone caught in the middle financially, leading to bankruptcy and low credit scores. Additionally, lenders might tighten their belts after eating the losses associated with loan fraud, making it more difficult for legitimate borrowers to get new lines of credit.

Keep reading to find out more about loan fraud, the different types, how it works, and how to help protect yourself from it.

What is loan fraud?

Loan fraud involves intentionally providing false or misleading information to get financial backing from a lender that wouldn’t otherwise grant an applicant approval. This fraud can range from doctoring paystubs or lying about references to stealing someone’s identity, including their name and address, birth date, Social Security number (SSN), or driver’s license number.

How does loan fraud work?

At its core, loan fraud works in one of two ways: a fraudster steals someone else’s identity, or they lie about their own qualifications like their income, address, or some other information requested on a loan application.

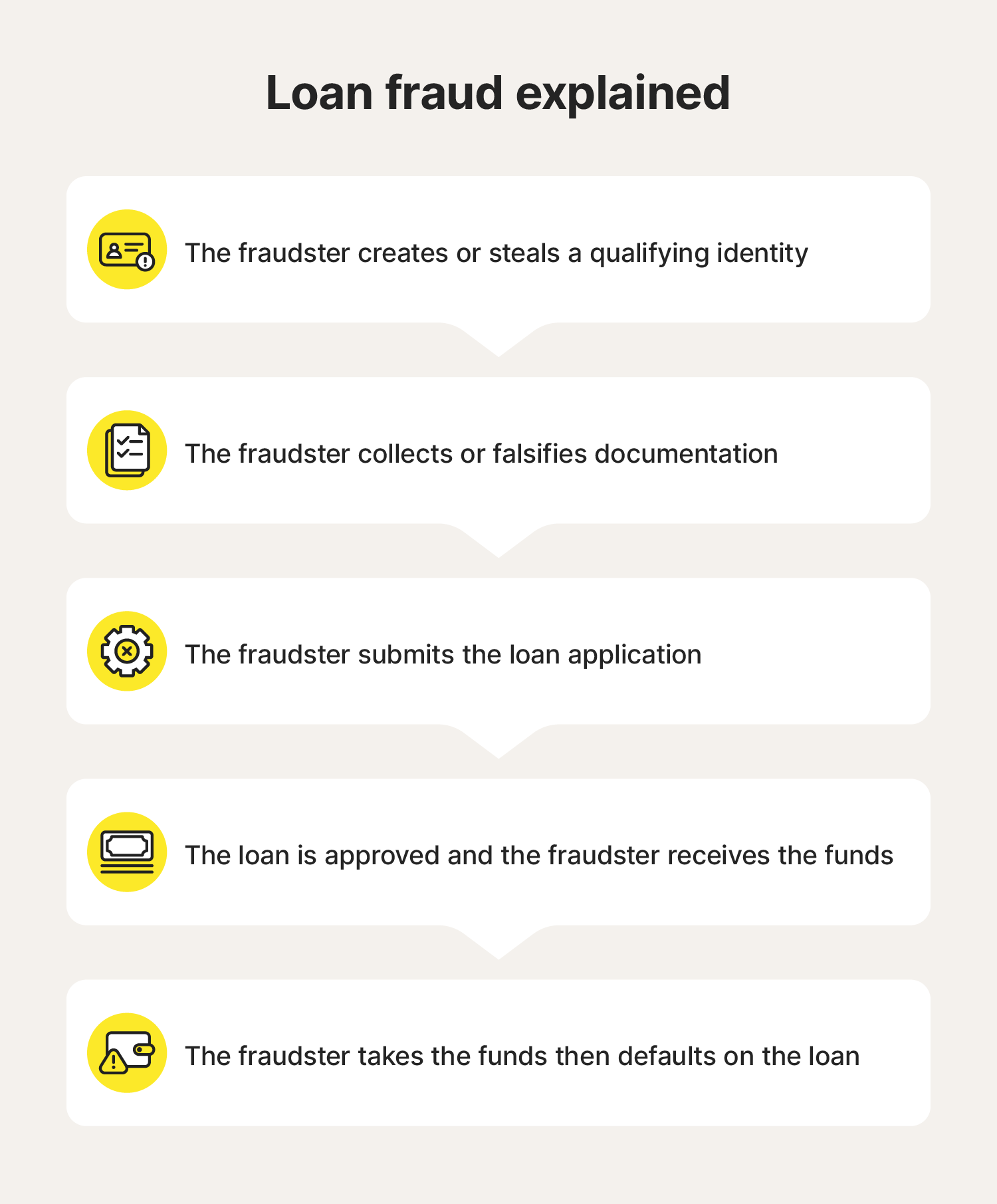

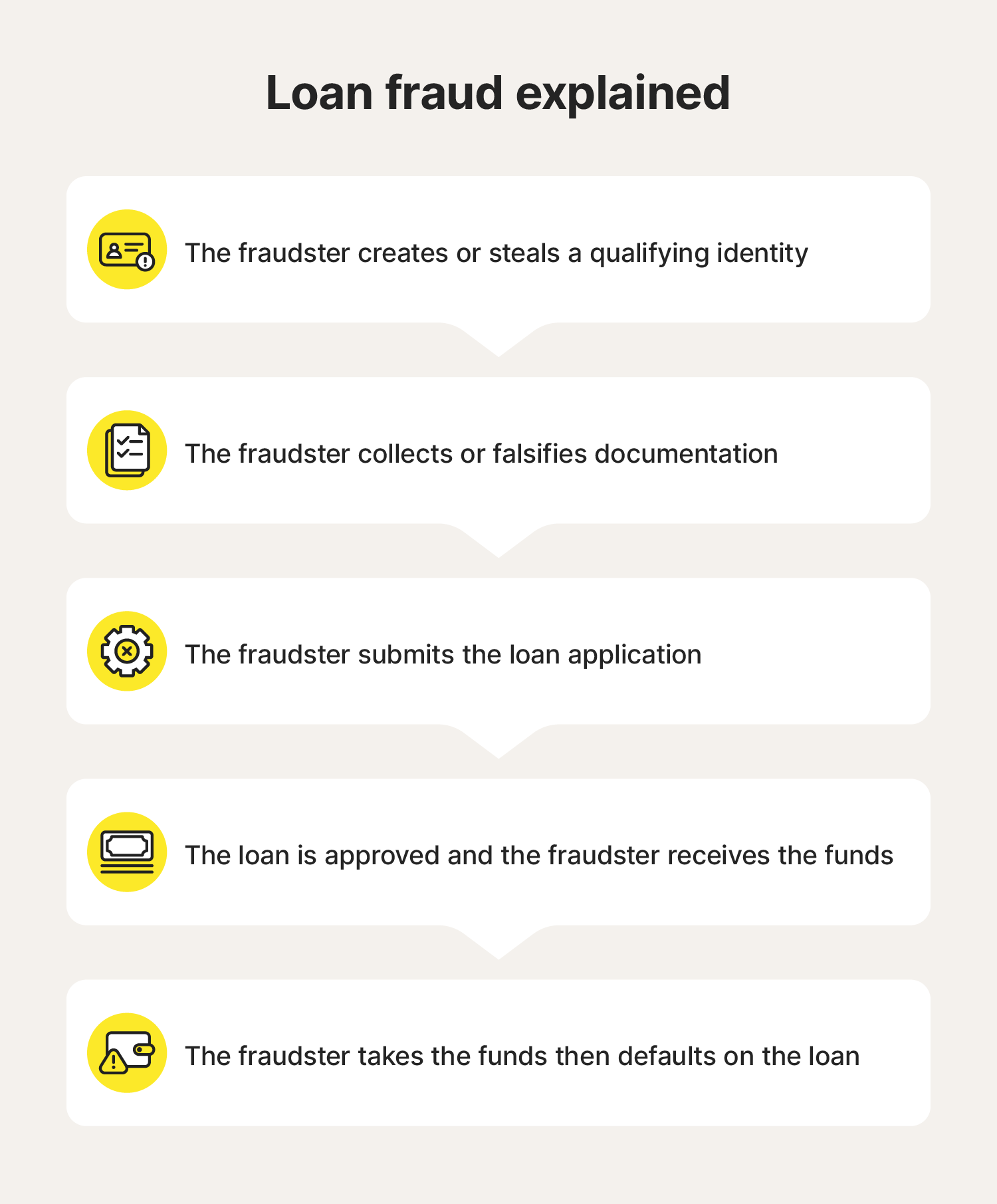

Here’s a breakdown of how loan fraud typically plays out:

- Identity theft or false representation: The fraudster either steals someone else’s identity or partially creates a fake identity (though synthetic identity theft). They may also falsify their own personal information to look like an “ideal” borrower.

- Document collection or falsification: The fraudster collates the stolen documents or personal information from the identity theft victim or creates fake documents.

- Application submission: They submit a loan application using the stolen or fabricated identity.

- Loan approval and disbursement: The lender approves the loan application and sends the fraudster money.

- Fraud completion: The fraudster receives the ill-gotten funds, and may disappear without repaying the loan, leaving the lender to eat the loss.

Types of loan fraud

There are several types of loans—each designed for a specific purpose, whether to buy your first home, keep your business open through hard times, or fund some other area of life. All of these loans require applications that fraudsters can manipulate.

Here are some common types of loans criminals may try to get fraudulently:

- Auto loan fraud: Lying to secure financing for a vehicle.

- Business loan fraud: Misrepresenting financial information or business operations to secure funding.

- Mortgage loan fraud: Providing false information on a mortgage loan application to obtain financing for a property.

- Payday loan fraud: Providing incorrect or stolen information on a payday loan application to get money for personal expenses or to cover immediate financial needs.

- Personal loan fraud: Falsifying a personal loan application, which scammers can use for personal expenses, such as debt consolidation, home improvements, or medical bills.

- PPP loan fraud: Submitting fraudulent applications in the name of nonexistent businesses to obtain a Paycheck Protection Program (PPP) loan to cover nonexistent payroll costs during COVID-19. Although PPP loans are no longer available, PPP fraud incidents are still being prosecuted.

- SBA loan fraud: Providing misleading information on a Small Business Administration loan application to obtain funds for personal financial gain or to save a failing business.

- Student loan fraud: Manipulating a student loan application to obtain funds for tuition or other educational expenses.

Warning signs of loan fraud [+ how to protect yourself]

To catch loan fraud in your name, keep a close eye on your bank accounts and credit, and look into any suspicious activity like missing mail or unauthorized logins. Here are some tips and tricks to help you know what to look for and how to help protect yourself:

- Credit score changes: If you’re current on your payments but your credit score suddenly drops, that could mean someone took out a loan with your information and failed to make payments. When this happens, let the lender know this is fraud and report the identity theft to authorities.

- Debt collection calls: Calls about loans you never took out or don't remember applying for could be a sign of loan fraud; to protect yourself, ask for proof of debt. If something isn’t adding up, check your credit report and dispute debt that isn’t yours.

- Micro-deposits: If you notice small amounts of money being deposited into your account, contact your bank. This may be a sign a lender is trying to verify your account. You can also freeze your credit to help prevent anyone from taking credit out in your name.

- Missing mail: If someone intercepts your mail, they could steal your personal information and apply for a loan. If this becomes a recurring issue, notify the post office, monitor your credit report, and do your best to bring your mail in as soon as it arrives or swap to online statements.

- New credit report inquiries: If a lender checks your credit to see if you qualify for a loan it will appear as a hard inquiry on your credit report. Monitor your credit independently or with a credit monitoring tool to catch new additions and potentially stop a fraudulent loan from being approved in your name.

- Unsolicited requests for personal data: Never give personal information to anyone if they contact you unexpectedly, even if they say they’re from a trusted organization. Contact the organization via an official channel.

- Get identity theft protection: Subscribe to an identity theft protection service like LifeLock to help monitor your credit and protect against financial fraud. And if you ever become the victim of identity theft, LifeLock will be there with the assistance you need to help restore your identity.

Loan fraud trends and statistics

There are countless examples of loan fraud and statistics to back up the extent of the problem. Here are some important trends and statistics relating to loan fraud in the US:

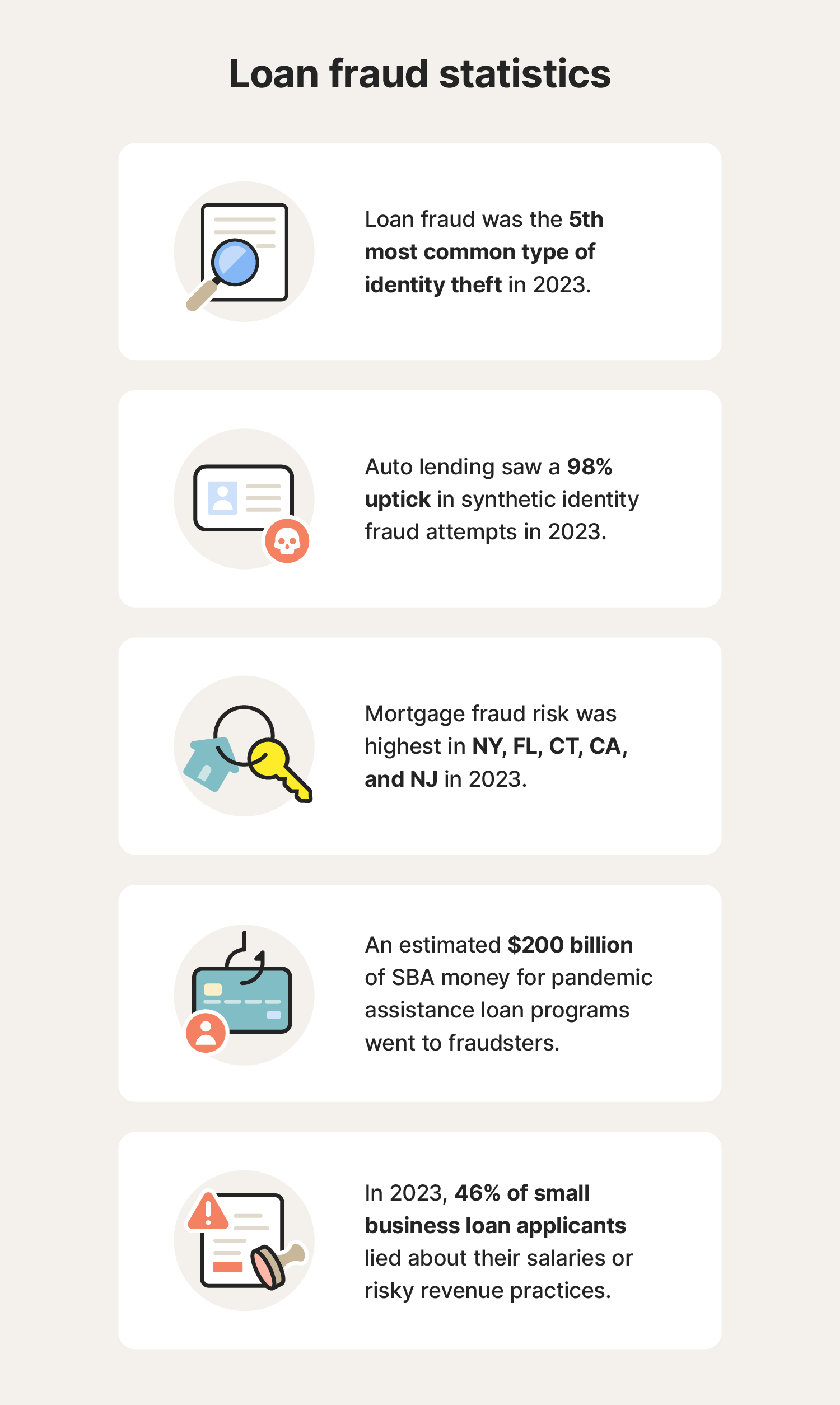

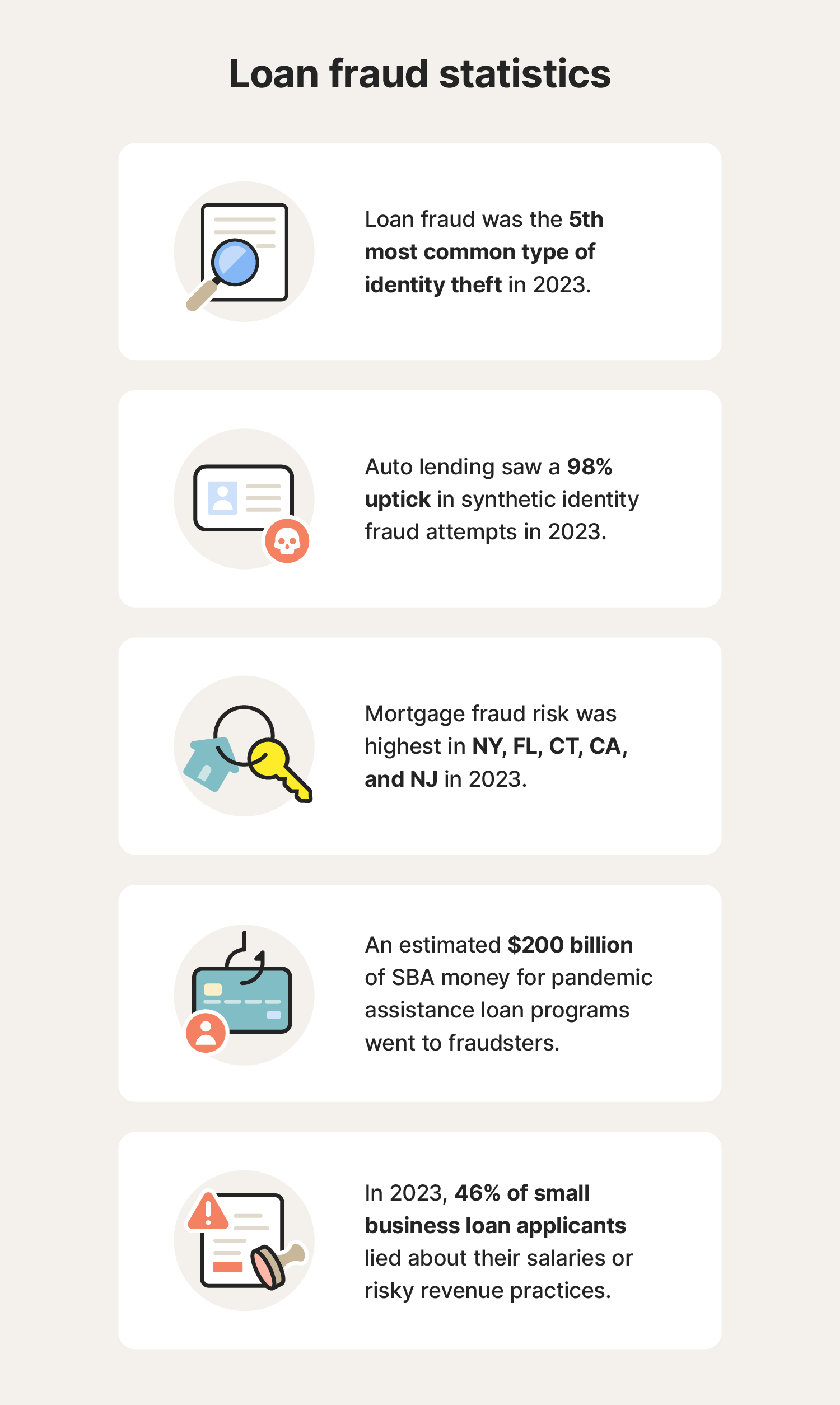

- Loan fraud (business/personal) was the 5th most common type of identity theft in 2023.

- In 2023, mortgage fraud risk was highest in NY, FL, CT, CA, and NJ.

- The auto industry experienced a 98% increase in synthetic identity fraud attempts in 2023.

- Over $200 billion of funding from the Small Business Administration’s (SBA) pandemic assistance loan programs is estimated to have gone to fraudsters.

- In 2023, 46% of small business loan applicants artificially inflated their salaries or hid evidence of risky revenue practices, which presents a greater risk of delinquency.

Monitor your finances with LifeLock

With loan fraud and other forms of identity theft being a persistent problem, you should help protect yourself by keeping on top of your credit report and finances.

Subscribe to LifeLock to help detect† unauthorized transactions in your linked bank, credit, and investment accounts so you can stop fraudsters from stealing your hard-earned money and savings.

FAQs about loan fraud

Still have questions? Here’s what you need to know.

How do you identify a loan scam?

While some criminals may want to steal your information to apply for a loan, others may roll you with a loan scam. Some signs of this include unsolicited offers, unsolicited requests for personal information and upfront fees, and excessive pressure to act quickly.

What happens if someone commits loan fraud?

If someone is caught committing loan fraud, they’ll likely have to pay fines and restitution, and could face prison time. The severity of the consequences will depend on the fraud committed.

How many years do you get for loan fraud?

The length of imprisonment for loan fraud varies depending on the severity of the crime, the type of loan fraud, and the jurisdiction. Other mitigating factors may also influence the sentence like prior criminal history.

†LifeLock does not monitor all transactions at all businesses.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.