Times are tough, and scammers are taking advantage by offering fake financial hardship loan programs. Scammers have created entities like the Financial Hardship Department to sound legitimate, preying on people looking for debt relief. The reality is that there is not an official agency with that title that can bail you out of debt. With the credit card debt hitting a record $1.13 trillion, identity thieves are on the lookout for those who are vulnerable.

What is the Financial Hardship Department scam?

The Financial Hardship Department scam is a fraudulent scheme where scammers pose as a legitimate entity offering financial relief. They target individuals in financial distress, promising easy solutions that are too good to be true.

How the Financial Hardship Department scam works

Scammers target financially struggling individuals through robocalls, phishing, and smishing. They offer financial relief options, but their true intent is to steal personal information or gain access to your devices through malware. These fraudulent messages ask you to verify information, contain malicious links or downloads, or direct you to a spoofed homepage to capture more personal details. Offers often include pre-approved loans or no credit checks.

Phishing emails from "The Financial Hardship Department" are a red flag—they're not real. Unsolicited offers with too-good-to-be-true conditions and a sense of urgency to act are common traits of these scams. They may also ask for upfront fees to process the loan application, request wire transfers, or demand personal information. Scammers might even text you a link to download an application form.

How to Spot Financial Hardship Loan Scams

- Unsolicited offers: Emails and messages from "The Financial Hardship Department" that you didn't request.

- Too good to be true: Promises of easy money with no credit checks or upfront fees.

- Urgency: Pressure to act quickly on the offer.

- Requests for personal information: Demands for upfront fees, personal details, or wire transfers.

- Malicious links: Links to download application forms or verify information.

Tips to avoid financial hardship loan scams

- Verify the source: If you receive an unsolicited call, email, or text, do not provide any personal information immediately. Research the organization independently. Look up their official website or contact number and verify their legitimacy.

- Guard your information: Never share personal details like your Social Security number, bank account, or credit card information unless you are certain of the recipient's identity. Be cautious of callers who pressure you to make quick decisions or share information urgently.

- Use trusted resources: If you need financial assistance, seek out reputable organizations or government programs. Contact them directly using verified contact information. Utilize financial advisors or non-profit organizations that offer free or low-cost debt counseling.

- Stay informed: Keep abreast of common scams and new fraud tactics. Websites like the Federal Trade Commission (FTC) regularly update information on current scams. Subscribe to identity theft protection services like LifeLock to monitor and safeguard your personal information.

What to do if you fall for a financial hardship loan scam

- Change your passwords: Immediately update your passwords.

- Freeze your credit: Contact credit bureaus to place a freeze on your credit.

- Notify financial institutions: Inform your bank and credit card companies.

- Monitor your accounts: Regularly check for unauthorized transactions.

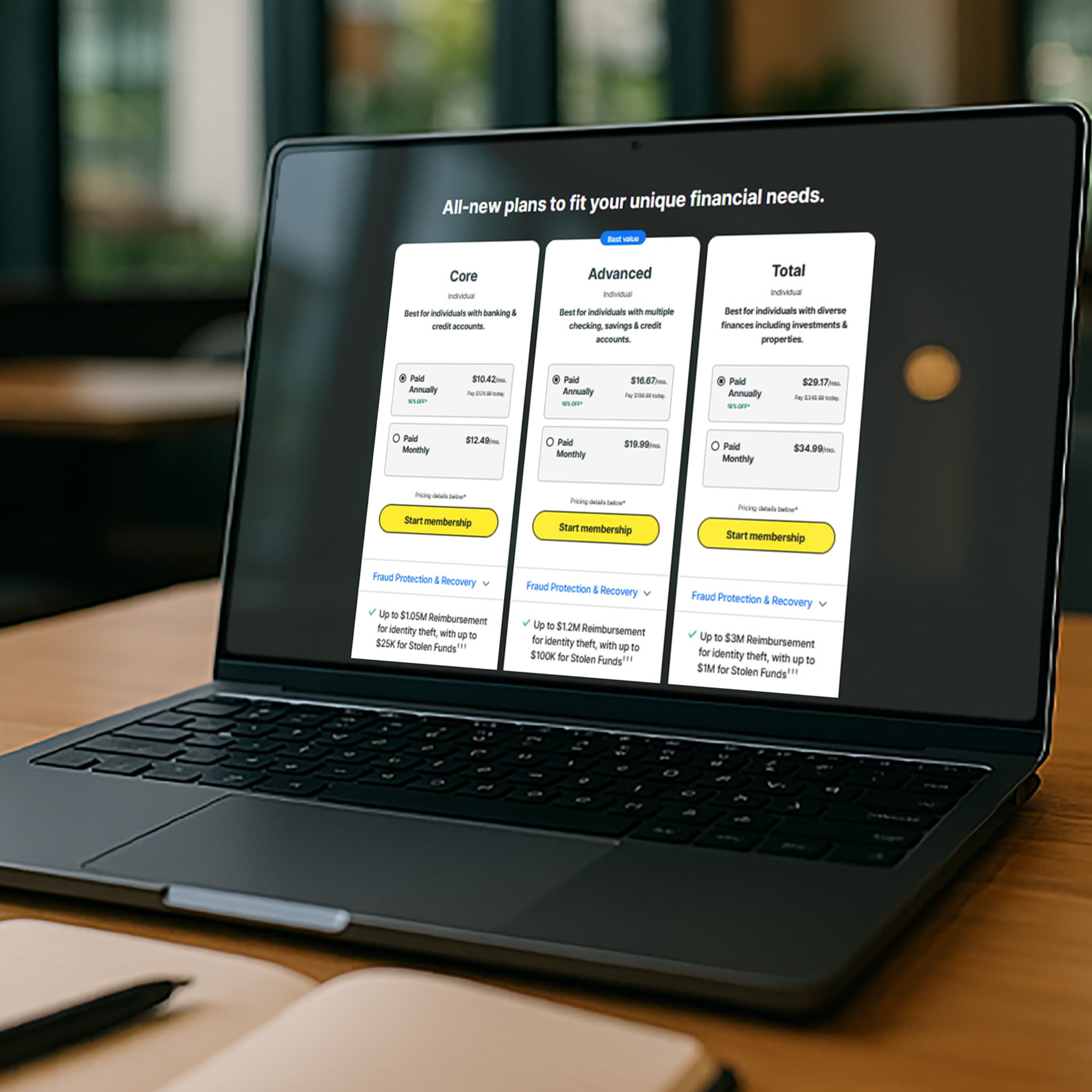

To boost your financial security, consider a comprehensive identity protection service like LifeLock Standard. With advanced monitoring and expert support, LifeLock helps by alerting you of potentially suspicious activity and providing restoration support to resolve identity theft if it happens to you.

FAQs About Financial Hardship Loan Scams

What should I do with a hardship relief program scam email?

Delete it immediately and do not click any links or provide any information.

Is hardship recovery legit?

Generally, no. "Hardship recovery" offers are typically scams.

How do I know if I’m dealing with a scammer?

Look for unsolicited offers, promises that sound too good to be true, and requests for personal information.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.