Already been scammed? Jump straight to our step-by-step guide covering what to do if you fall for a wire transfer scam and take quick action to try and recover your money and protect against further harm.

Falling victim to wire transfer fraud can leave you with financial losses that your bank won’t help recover. A provision in the Electronic Funds Transfer Act says that banks don’t have to reimburse customers who are tricked into authorizing a wire transfer — resulting in three of the largest U.S. banks only reimbursing 2%, 4%, and 24% of affected customers in 2023.

Because there’s little chance of recovering money you’ve lost to a wire transfer scam, learning how to spot and avoid them altogether is the best defense available to you. That starts with knowing how this type of fraud works and what proactive steps you can take to protect yourself.

What is wire transfer fraud?

Wire transfer fraud is when criminals trick victims into sending money to another bank account under false pretenses. It often involves social engineering tactics, with scammers pretending to be a friend, family member, or trusted organization, and using a convincing story delivered via text or email to fool their targets.

Like cash paid to a fraudulent seller in a Facebook Marketplace scam, money sent via wire transfer is often impossible to recover. From the moment the money hits the scammer’s account, it’s extremely difficult to reverse the transaction, especially if fraudsters move it to another account or withdraw it immediately.

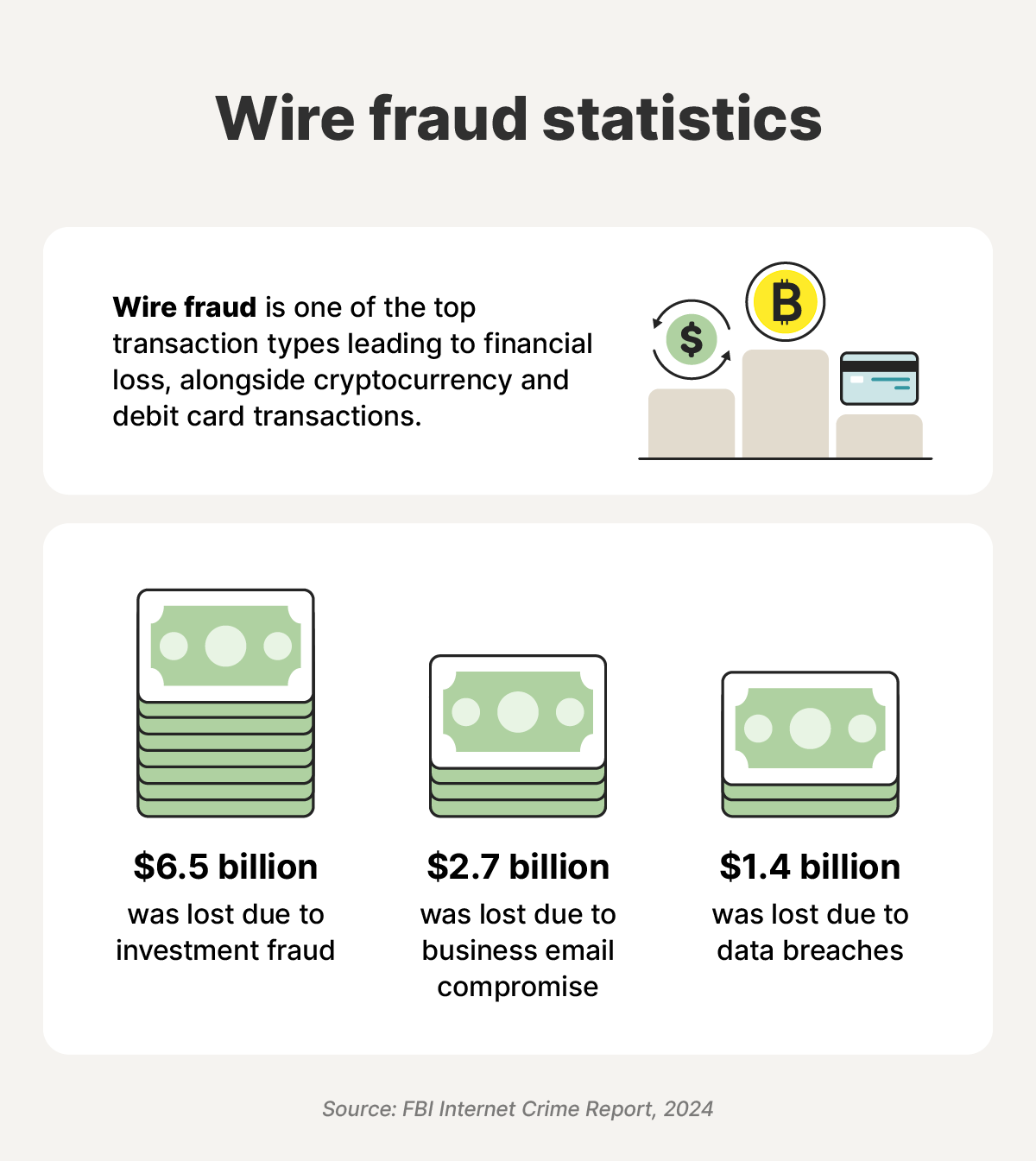

But that’s not the only reason thieves favor wire transfers. They’re also generally faster than ACH withdrawals and can facilitate larger money amounts. Scams involving bank transfer and cryptocurrency payments (another fast and irreversible payment method) caused greater financial losses than all other transaction types combined in 2024.

Signs of wire transfer fraud

Wire transfer fraud often starts with an unexpected request for money, sent in an email or text. This will often be paired with urgent language claiming you need to make a payment quickly to avoid a problem or help a loved one.

Here’s more information about what to look for to help spot a potential wire transfer scam before you fall for it:

- Sudden request for money: Unexpected or suspicious requests for money are the biggest red flag that you’re talking to a scammer. Tax scammers might claim you need to wire them money to settle a tax bill when you know you’ve already paid the IRS, for example.

- Changes to payment instructions: If you have a regular payment usually made through your debit or credit card, a request to suddenly switch to a wire transfer instead could be a scam warning sign. Some scammers might pretend to be your landlord, for example, claiming they need you to wire them rent this month.

- Unknown numbers or emails: Unrecognized contacts claiming to be someone you know should ring alarm bells. Scammers might pretend to be your friend or family member using a new number or email. To make their claim more convincing, they’ll leverage information they found from your social media profile or on the dark web.

- Fake numbers or emails: Scammers might also spoof someone’s contact information with a fake number or email that closely resembles the authentic version. If you’re ever suspicious about a request, closely inspect the phone number or email address the message came from to confirm it’s who you think it is.

- Short payment windows: Someone pressuring you to make a payment you weren’t expecting quickly is trying to get your money before you figure them out. Scammers might create fake past-due notices or threaten you with legal action to create a sense of urgency, hoping it’ll make you act without thinking.

- Refusal of phone calls: Someone who texts you with a request to wire money, but refuses to answer your call, is hiding their true identity. They may create an excuse, like being sick, to make the lie more convincing.

- Grammatical errors: You may be able to identify a scammer by looking for grammar mistakes you wouldn’t expect from a legitimate company or government agency. However, bear in mind that AI tools like ChatGPT make it easier than ever for scammers to create grammatically perfect phishing messages, so don’t rely on this warning sign alone.

- Request for secrecy: Scammers might request that you keep the details of their request hidden from others, claiming it needs to be kept “confidential.” This is a huge red flag that they’re doing something illegitimate.

Common types of wire transfer scams

Wire transfer scams can take many forms, based mainly on who the scammer is impersonating and what pretext they create to try and trick you. If a scammer gets information about you from the internet or social media, they might target you with a message designed to exploit your perceived vulnerabilities.

Here are some of the most common scam types used in a wire transfer fraud attack:

- Romance scams: In romance scams, cybercriminals create fake profiles on dating sites to target people seeking romantic relationships. Tinder, OkCupid, and Hinge scams generally aim to turn fake companionship into financial fraud, with the scammer claiming you need to wire them money for an emergency.

- Real estate scams: Scammers sneak onto popular real estate sites or create fake realtor profiles to entice users to fall for their real estate scams. In many rental scams, they claim you need to wire them money as a deposit to secure a rental property that doesn’t exist.

- Charity scams: Some criminals impersonate charities to fool targets into wiring them money under the guise of charitable collections. In 2024, the IRS notified taxpayers of scammers taking advantage of the aftermath of Hurricanes Milton and Helene to steal money, for example.

- Tech support scams: Scammers often impersonate tech support staff at trusted organizations, using a false claim that the victim’s device is compromised and requesting payment in exchange for fake services. A well-known example is the Geek Squad scam, where impersonators pretend to be from Best Buy’s tech support branch to steal money or personal information.

- Lottery scams: Cybercriminals may impersonate companies known for giving away prizes and claim that the target has won but needs to wire money to receive their reward. Publishers Clearing House (PCH) scams are one example of fraudsters duping targets using a trusted company name.

- Friend-in-trouble scams: Scammers may pretend to be friends in trouble to fool targets into wiring money. They make up fake stories about car troubles or medical bills, manipulating your good nature to “help them out.”

- Overpayment refund scam: In overpayment scams, fraudsters make a purchase from a victim selling products online, but intentionally send too much money and ask them to wire the excess back. It later turns out that the initial payment was made with a fake check or stolen bank account, meaning it bounces from the victim’s account and leaves them out of pocket.

- 419 (Nigerian Prince) scams: A strange email from someone claiming to be an imprisoned prince or king asking you to wire over bail money with the promise of repaying you later is a scam. The number “419” refers to a section of the Nigerian Criminal Code, as many early scammers claimed to be from Nigeria.

How to protect against wire transfer fraud

To help protect against wire transfer fraud, and scams in general, reduce exposure of your information online, ignore messages from unknown contacts, double-check the sender’s details if you’re in doubt, and avoid being rushed into making a payment.

Here’s a more in-depth look at steps you can take to reduce your vulnerability to wire transfer fraud:

- Ignore contact from unknown contacts: If you receive an email, text, or phone call out of the blue and don’t recognize or trust the person getting in touch, don’t interact with them. Instead, confirm that the contact is legitimate by reaching out to the person or company they’re claiming to be via a different channel.

- Check the sender details: Check the email address or phone number of the person who contacted you to review whether it looks legitimate. If they’re claiming to be from a company, their contact details should match what’s on the company’s official website.

- Use other payment methods: If you’re ever in a situation where you need to make a payment to a stranger, like buying something on an online marketplace, consider using a more secure payment method than a wire transfer. PayPal, credit cards, or payment apps with buyer protection can all be good options.

- Don’t post personal information in public: Never post personally identifiable information (PII) like your address, phone number, or full name on your social media accounts or forums. Scammers can use this information to make their fake stories more convincing, pretending to know you personally.

- Don’t be rushed: If you ever suspect you’re being scammed, stop and slow down so you can think the situation over. Don’t get rushed into making a payment, even if the message you received sounds urgent.

- Set up bank alerts: Bank transaction alerts notify you when a transaction is made from your account. This can help give you early warning of a suspicious payment, so you can contact the bank to try to stop it before it’s processed. You can monitor transactions from multiple bank accounts at once using a service that centralizes alerts, like LifeLock Advanced.

- Sign up for ID theft protection: Identity theft protection services like LifeLock include internet and dark web monitoring features that can help you minimize exposure of your personal information online. This reduces the risk that a scammer can get your contact details or personal information, which they could use to sound more convincing when contacting you.

In legal news: A federal district case from 2025 suggested that the Electronic Fund Transfer Act should no longer exclude wire transfers from its coverage, which could place more liability on banks to protect consumers from fraudulent transactions. While the outcome of this case is not currently binding to other situations, it may indicate that the law is moving toward greater anti-fraud protections.

What to do if you fall for a wire transfer scam

If you’ve fallen victim to wire transfer fraud, you should immediately contact the sending bank and the receiving bank to see if there’s anything that can be done to prevent the transaction. Afterward, you can file reports with the Internet Crime Complaint Center (IC3) and the Federal Trade Commission (FTC) to log the scam.

- Request a recall with your bank: Contact your bank as soon as possible after noticing the fraud to ask for the wire transfer to be blocked. If you’re fast enough, you may be able to recall the funds before the transfer is processed.

- Contact the receiving bank: Look up the receiving bank through their routing number to contact them, or the SWIFT code or International Bank Account Number (IBAN) for foreign banks. Contacting the receiving bank will help them investigate the receiving account as potentially fraudulent.

- File a complaint with the IC3: Submit an online complaint to the IC3. Be ready with information on the incident, details on the transactions, and information about the receiver. While this won’t result in you getting your money back, it can help the IC3 build a bank of evidence they can use to fight fraud in the future.

- File a complaint with the FTC: Filing a report with the FTC at reportfraud.ftc.gov can also help support the authorities’ scam-busting efforts.

- Contact local law enforcement: With the FTC and IC3 reports in hand, contact local law enforcement. Depending on the severity of the fraud, they may open an investigation on your behalf.

- Monitor accounts: Set up bank account transaction alerts and credit monitoring to be ready if you’re targeted again. Criminals may return if they know you’ve been successfully targeted by one scam. And next time, they might target your identity along with your finances.

Defend yourself against wire transfer fraud

Scammers will use all sorts of tricks to try and get you to transfer money to their accounts. But you don’t have to be defenseless. LifeLock Advanced offers a range of features that you can use to reduce exposure of your contact information online, helping limit your vulnerability to scams.

You’ll also get access to a powerful financial monitoring dashboard that provides easy access to alerts of potential fraud involving your bank or credit accounts. That makes it easier for you to spot scams as they happen, giving you the best chance of mitigating serious financial losses.

FAQs

What are some alternatives to wiring money?

Instead of wiring money to make payments, consider using ACH transfers, your credit or debit card, or a secure online payment app like PayPal. These payment methods often provide more security than wire transfers, in that they’re easier to reverse so you have a better chance of getting scammed money refunded.

What are the differences between legitimate and scam wire transfers?

A request to make a wire transfer may be legitimate if it comes from a friend or family member, or if it’s an approved payment method for a company you know and trust. Red flags of a scam wire transfer request include receiving it unexpectedly, often from a contact you don’t know, and the message having a sense of urgency.

How can I recover lost funds due to wire transfer scams?

You can increase your chances of recovering bank account funds lost to a scam by contacting your banking provider immediately after you notice you’ve been scammed. Even so, recovering funds sent via wire transfer may not be possible, given the speed of the transaction and its irreversible nature.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.