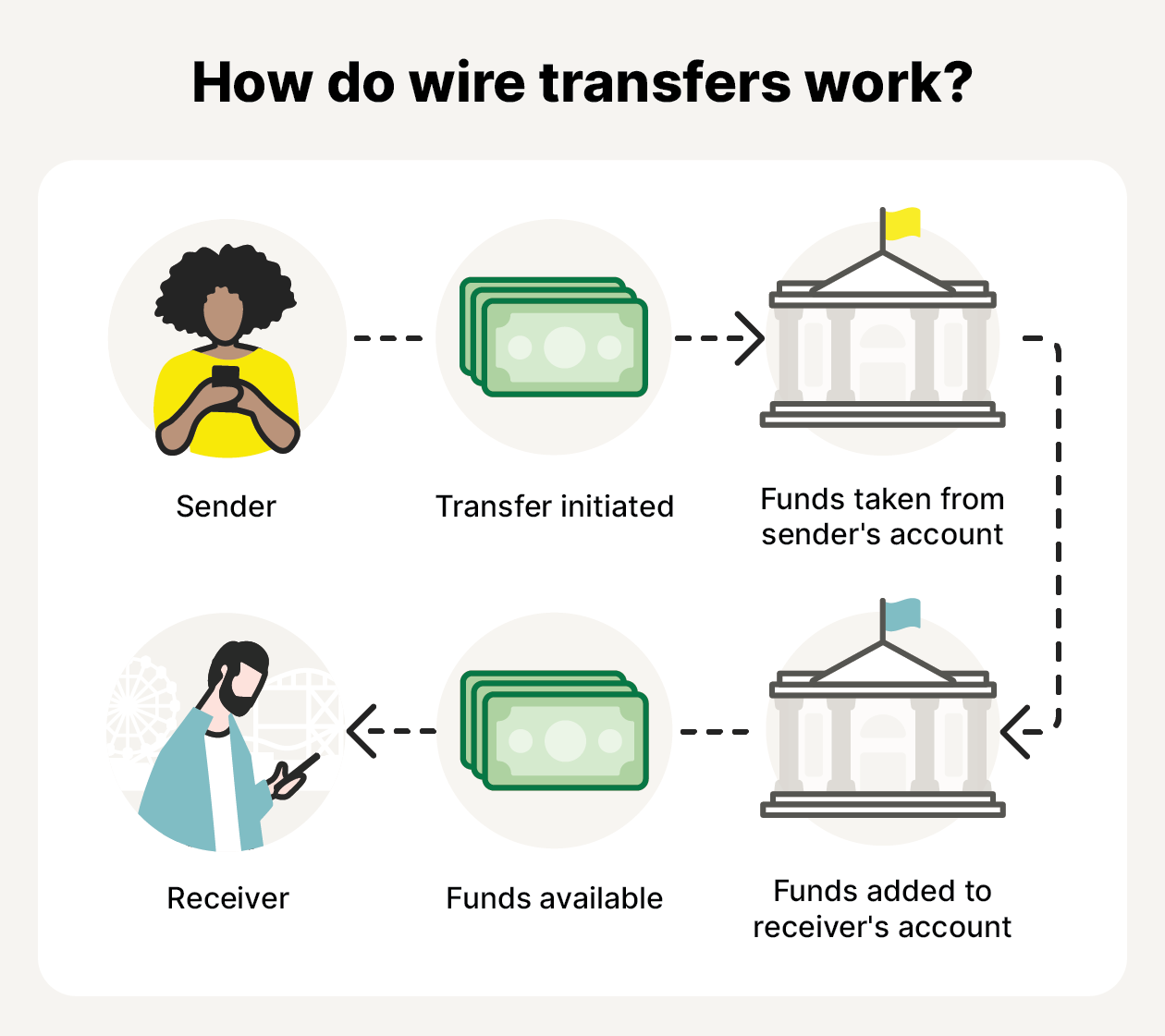

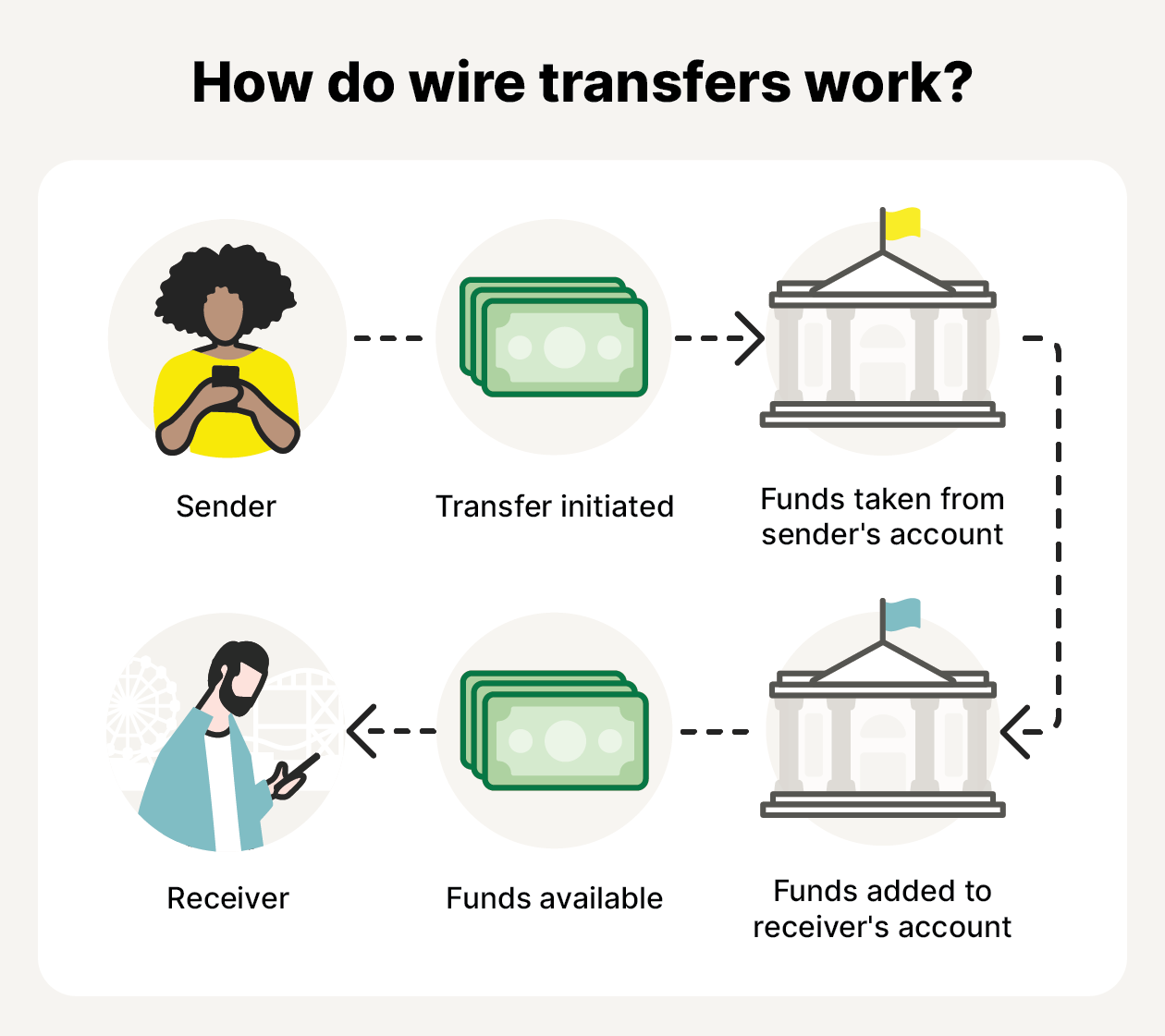

How wire transfers work

Wire transfers work by electronically transferring funds from one bank account to another. They use global payment networks like SWIFT or Fedwire to ensure quick and secure transactions, both domestically and internationally. The sender just has to input the recipient’s bank details and the amount to send, and the funds will be transferred to that account.

Domestic wire transfers (between two bank accounts in the same country) are typically completed the same day, sometimes within hours. International wire transfers (between accounts in two different countries) typically take two business days, depending on the banks and countries involved.

You can send wire transfers from within a bank branch, but most major banks also allow them to be made from an app. To send a wire transfer, you’ll need the following information:

- Your personal and banking details: If you’re making a wire transfer from a bank branch, you’ll need to provide your name, address, ID, bank account number, and your routing number for domestic transfers, or IBAN and SWIFT code for international transfers. If you’re doing it online, this information should be pre-filled.

- The recipient’s personal details: The recipient’s name, address, and contact number.

- The recipient’s banking details: The recipient’s bank account number and routing number for domestic transfers, or IBAN and SWIFT code for international transfers.

- The reason for the transfer: This depends on the bank and is usually more common for international wire transfers.

If the personally identifiable information required for a bank transfer falls into the wrong hands, it could leave you or the recipient vulnerable to fraud or identity theft. To defend against the risks, learn how to help protect your personal information online.

Can a wire transfer be reversed?

Wire transfers typically can’t be reversed once they’re initiated and the transfer has begun processing. There are only a handful of circumstances when you may be able to reverse a wire transfer, including if the bank made a mistake.

Regardless, if you notice a fraudulent wire transfer or make errors when you’re sending one yourself, contact your bank immediately to explore your options.

Wire transfer vs bank transfer vs ACH transfer

Wire transfers, ACH transfers, and bank transfers are all ways to electronically transfer money between accounts. But each option has its own use cases and advantages.

Wondering what the best payment method is for your needs? Here’s a breakdown of the three main types of electronic transfer:

- Wire transfer: They offer a fast and secure way to transfer funds electronically, making them a popular choice for high-value or time-sensitive transactions, despite their higher fees. Wire transfers are processed through secure systems like SWIFT (for international transfers) or Fedwire (for domestic transfers).

- ACH transfer: ACH (Automated Clearing House) transfers are typically used for recurring payments processed in batches. Though not as fast as wire transfers, ACH transfers are more cost-effective, making them ideal for payments made on a fixed, regular basis, like direct deposits and utility bills.

- Bank transfer: An umbrella term for any method of transferring funds between bank accounts, including wire transfers and ACH transfers. Other examples are bank-issued check payments, direct deposits, and online banking transfers. Although generally safe, there are risks associated with any type of bank transfer, such as bank scams where scammers use social engineering techniques to mislead victims.

Types of wire transfers

There are two types of wire transfers: domestic and international. Domestic wire transfers move funds between bank accounts within the same country. International wire transfers move funds across borders. They have different processing times, fees, and security measures — all depending on the banks, financial networks, and countries involved.

Domestic wire transfers

Domestic wire transfers are generally secure, especially when made between established banks using trusted financial networks. Banks protect transactions with encryption and authentication protocols. And many offer real-time monitoring and fraud alerts that notify customers of suspicious activity to help prevent unauthorized transfers.

What happens if your funds are lost during a transfer? Consumer protection measures like the Electronic Fund Transfer Act (EFTA) may cover fraud involving your account. If your funds go missing and your bank made the mistake, they’re typically responsible for fixing it. However, if you entered the wrong recipient details or got scammed, recovering your money depends on your bank’s policies and how quickly you report the issue.

International wire transfers

International wire transfers are also secure but may carry a higher risk than domestic ones. Differences in banking regulations across countries can mean that international transfers offer weaker fraud prevention measures and fewer consumer protections. In turn, this can make reversing fraudulent international wire transfers more challenging.

International wire transfers are also subject to additional fees and fluctuating currency exchange rates, which can impact the final amount the recipient receives. However, some institutions allow you to lock in an exchange rate at the time of transfer.

Risks associated with wire transfers

While mostly secure, wire transfers come with certain risks. For example, transfers are difficult to reverse, and fluctuating exchange rates can affect the amount received by an international recipient.

Here’s a summary of the main risks to keep in mind if you plan to use wire transfers:

- Irreversibility: Once funds are sent via wire transfer, recovering them is difficult. If you make a mistake entering the recipient’s details or transfer funds following a scam, it’s often irreversible.

- Fraud vulnerability: Scammers may try to trick you into sending money via wire transfer or compromise your account to make unauthorized transfers. However, the general lack of transaction protection can make it harder to recover funds lost through a wire transfer than certain other methods.

- Exchange rate risk: For international transfers, which must be converted from one currency to another, exchange rate fluctuations can affect the final amount received. However, you can generally lock in an exchange rate ahead of time to avoid significant discrepancies between the amount sent and received.

Wire transfer pros and cons

Wire transfers offer reliability and the ability to transfer large sums domestically or internationally. However, they can also be expensive and subject to delays that other payment methods, like payment app transfers, don’t have. Understanding the pros and cons can help you decide if a wire transfer is best for your needs.

Wire transfer pros

Widely used, wire transfers offer several advantages:

- Speed: Funds are typically transferred on the same day for domestic transfers and within two business days for international transfers.

- Reliability: Once initiated, wire transfers are generally secure, as they’re processed through verified banking networks.

- Large sums: Allow for transfers of large sums with fewer restrictions than other payment methods, like ACH transfers or payment apps.

- Global reach: Available for both domestic and international transactions, wire transfers are a practical solution for cross-border payments.

- Bank-to-bank security: Transactions are handled directly between financial institutions, reducing the risk of interception.

Wire transfer cons

Despite their benefits, wire transfers also come with drawbacks:

- Expensive: Fees can be high compared to other payment methods, especially for international transfers, with both the sending and receiving banks charging fees.

- Slow: Compared to newer electronic payment methods, like payment apps, wire transfers can take longer to process — especially internationally.

- Irreversible: Once sent, wire transfers are difficult or impossible to reverse, making recovering funds lost to fraud or scams challenging.

- Limited tracking: It can be difficult to track funds, particularly for international transfers that pass through multiple banks.

- Potential for errors: The reliance on senders entering the correct recipient details can lead to human error that causes delays, misrouted funds, or financial losses.

- Exchange rate fluctuations: For international transfers, currency exchange rates may fluctuate during the processing period, affecting the final amount received.

How to make wire transfers safely

Wire transfers are typically a safe way to send large sums of money domestically or overseas, but their risks can lead to misrouted payments or financial losses due to fraud or errors. Since recovering lost funds sent via wire transfer is challenging, follow these best practices to help protect your finances when using them:

- Remember that wire transfers are like sending cash: Once money has been sent, it’s very difficult or even impossible to reverse. Use wire transfers only when certain that you know and trust the recipient.

- Know the scam warning signs: Be cautious of urgent requests, unexpected payment demands, or unknown recipients, all of which may be signs of wire transfer scams. This risk also applies to payment apps, with fraudsters running Zelle scams and Cash App scams to try and steal money from victims.

- Don’t be rushed: Fraudsters often pressure victims to act quickly and without thinking — take your time before making any wire transfers, verifying that the recipient is legitimate and the details you enter are correct.

- Always double-check the intended recipient: Confirm the recipient’s name, account details, and banking information before sending funds — misrouted funds may be difficult or impossible to recover.

- Stop and ask for assistance: If something feels off, consult your bank, a financial professional, or someone you trust before proceeding with a wire transfer.

- Use trusted financial institutions: Only send wire transfers through reputable banks or payment services with strong security measures to reduce the risk of falling victim to processing errors.

What to do if you’ve been a victim of wire transfer fraud

If you’ve been a victim of wire transfer fraud, it’s critical to act quickly to increase your chances of recovering lost funds.

- Contact your bank immediately: Report the fraud and provide all relevant details. If the transfer was made through the SWIFT banking network, request a SWIFT payment recall to possibly stop the transfer.

- Contact the receiving bank: If you know where the funds were sent, notify the recipient’s bank to flag the transaction as fraudulent.

- File a police report: Contact your local law enforcement agency and provide full details of the incident. Ask for a copy of the report for future reference — it may help you file a dispute.

- Report it to fraud agencies: File a complaint with the Federal Trade Commission (FTC) and the FBI’s Internet Crime Complaint Center (IC3). These reports may help the authorities build cases against the fraudsters, perhaps preventing them from targeting others with the same scheme in the future.

- Notify the credit bureaus: If the fraud involved identity theft and the perpetrators may have access to sensitive personal information like your banking details or Social Security number (SSN), place a fraud alert or credit freeze to help protect your credit report. Contact one of the three major credit bureaus to place a fraud alert and they’ll inform the others, or contact each bureau separately to place a credit freeze.

- Monitor your accounts: Keep an eye on your bank statements and credit reports for any suspicious activity over the next few months. Set up transaction alerts, if possible, to make this monitoring easier, or get identity theft protection with monitoring services to do this for you.

Remember: the faster you take action, the more likely you’ll be able to recover your funds and mitigate the risk of additional fraud attempts.

Help protect your finances

Wire transfers and other electronic payment methods have protections in place, but fraudsters are experts at getting around them. Join LifeLock Advantage to help keep your finances safer, with bank account activity alerts and credit monitoring making it easier to detect potential fraud. You’ll also benefit from a range of identity theft protection features, including dark web monitoring, that can help you stay one step ahead of fraudsters.

FAQs

Can someone send you a fake wire transfer?

Yes, scammers can attempt fake wire transfers — often to trick you into sending goods, services, or personal information. These scammers might send fraudulent confirmation receipts, use fake bank notifications, or initiate a transfer that later gets canceled due to insufficient funds.

Which is safer: a bank transfer or wire transfer?

Bank transfer is an umbrella term that refers to any electronic money transfer method, including wire transfers. All types of bank transfers are largely safe and secure if used with caution. However, unlike some types, including ACH transfers, wire transfers are typically irreversible, potentially making them more appealing to fraudsters and scammers.

Can money get lost in a wire transfer?

Yes, money can get lost in a wire transfer due to errors in account information, fraud, or technical issues. Once sent, wire transfers are typically irreversible, making it difficult to recover lost funds. Though if a bank makes an error, they are generally responsible for correcting it.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.