“LifeLock is the perfect choice for those looking for the most comprehensive identity theft protection with a wide variety of plans and subscriptions to choose from.” — Tom’s Guide

Aura’s cybersecurity product bundles identity theft protection, credit monitoring, antivirus software, a very basic VPN, and some other features for a starting price of $12 per month when billed annually.

Compared to some competitors, Aura has a lower rating of 4.3 stars on Trustpilot, with reviews calling into question whether the service is worth the price. Customers generally appreciate the platform’s ease of use, but some criticize it for slow customer support, difficulties in canceling subscriptions, and a glitchy VPN.

Here’s a quick overview of Aura's main strengths and weaknesses.

Pros |

Cons |

|---|---|

Affordable first-year plan pricing. |

Mixed customer reviews. |

Standard protection. |

Feature availability varies by device. |

Adequate insurance coverage. |

One rigid plan, offering no choice over features. |

Basic password manager and VPN. |

Limited identity theft alert coverage. |

No social media monitoring. |

|

Reports of device performance issues. |

|

Difficulties canceling subscriptions. |

|

Lackluster device protection tools. |

Interested in exploring other options that may offer better identity theft protection and more bang for your buck? Keep reading to learn about the best Aura alternatives.

1. LifeLock

LifeLock is one of the most reputable brands in identity theft protection for a reason. It offers a broader range of identity theft monitoring features than Aura, alongside an unmatched total reimbursement coverage package of up to $3 million†††.

It’s consistently the highest-rated identity theft protection platform among customers, with a Trustpilot rating of 4.8 out of 5 stars. Industry experts also praise LifeLock, with Tom’s Guide naming it the “Best for all around protection”, PC Mag awarding LifeLock “Best Overall Identity Protection” in 2025, and Security.org placing it top of their list of the best identity theft protection services.

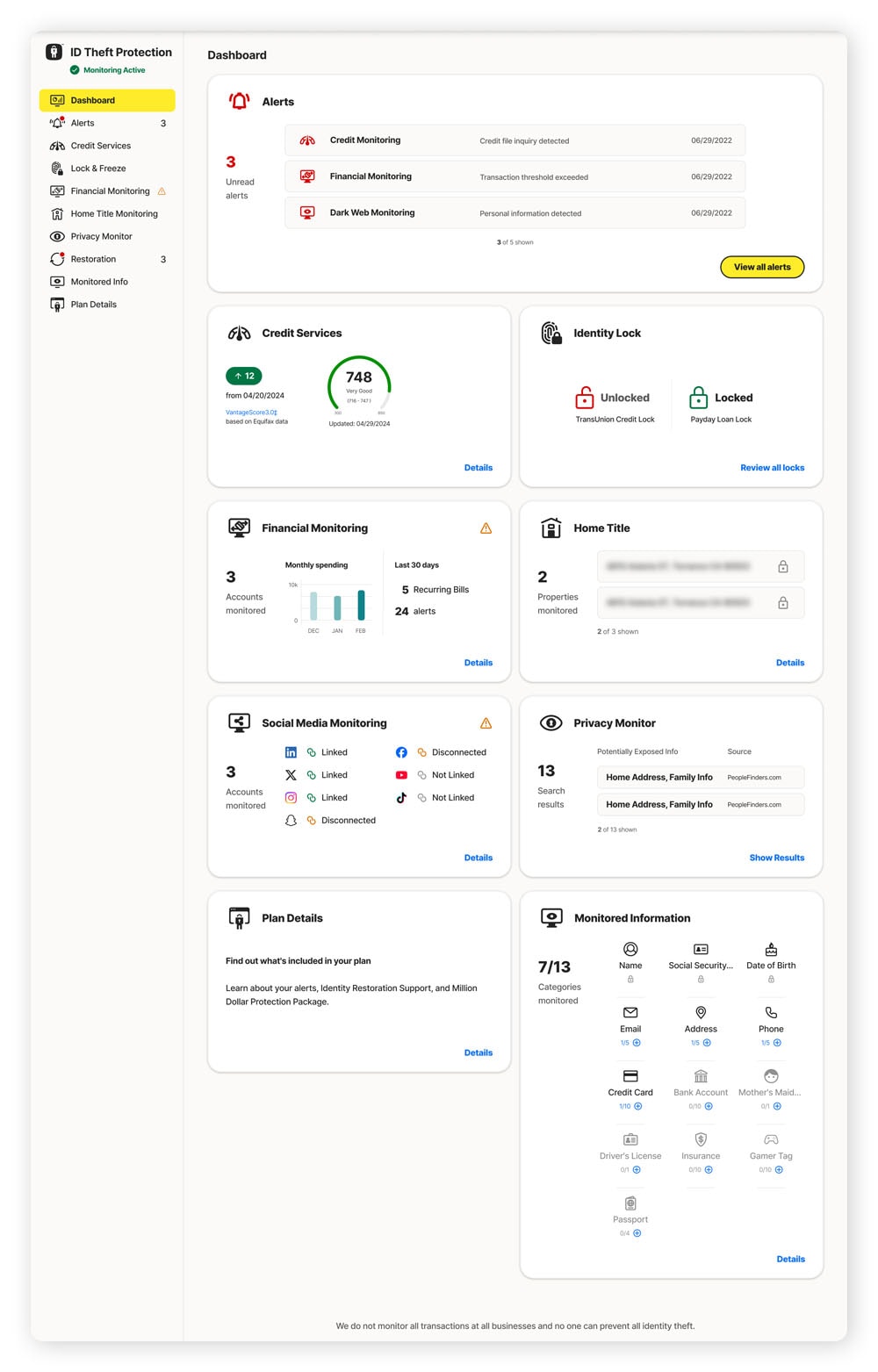

LifeLock goes well beyond Aura’s more limited identity theft protection, providing several key monitoring features that Aura doesn’t have for the broadest volume of alerts all in one place:

- Social media account monitoring: LifeLock scans your connected social media accounts for account takeover threats, risky links, or inappropriate content.

- Phone takeover monitoring: LifeLock alerts you if it detects an attempt to transfer your phone number to another carrier — a key warning sign of SIM swap scams.

- Buy Now, Pay Later account alerts: LifeLock notifies you if your identity is used to open BNPL accounts, which often get overlooked by traditional monitoring services.

- Utility account fraud monitoring: LifeLock looks out for attempts to open electric, water, or internet accounts in your name and sends alerts if it detects suspicious applications.

If your identity is stolen, you’ll get support from a U.S.-based personal restoration specialist who’ll handle your case from start to finish, helping you reclaim your identity and recoup losses. And LifeLock Total offers an industry-leading reimbursement package of up to $3 million to help cover stolen funds, legal fees, and other eligible identity theft-related expenses.

Good to know: We’re so confident in our identity theft restoration service that we offer a 100% guarantee. If we can’t bring your identity back to good standing, we’ll reimburse you for up to 12 months of your subscription.

Unlike Aura, LifeLock’s protection is available in several different plans, so you can choose the level of protection that best suits you. You can also get identity theft protection on its own or easily connect it with Norton’s industry-leading cybersecurity tools.

LifeLock pros |

LifeLock cons |

|---|---|

The #1 customer-rated identity theft protection service. |

The highest tier plan is more expensive than Aura’s basic plan. |

30-day free trial available for new members. |

The free trial requires pre-authorization with a valid payment card. |

Best-in-class monitoring, with the broadest volume of alerts all in one place. |

Monitoring features vary by plan, with fewer additional alerts on the entry-level tier. |

Up to $3 million††† in reimbursement coverage for stolen funds and legal/personal expenses. |

|

Expert U.S.-based restoration specialists to personally handle your identity theft case. |

|

A 100% restoration guarantee — if we can’t restore your identity, you get your money back. |

|

24/7 customer supportΔ available to all members. |

|

A choice of plans that gives you the flexibility to get the features you need and avoid the ones you don’t. |

Plans and pricing

LifeLock offers three identity theft protection plans, available with discounted annual pricing or flexible monthly billing.

Plan |

Montly |

Annual |

|---|---|---|

LifeLock Core |

$12.49 |

$124.99 |

LifeLock Advanced |

$19.99 |

$199.99 |

LifeLock Total |

$34.99 |

$349.99 |

LifeLock offers broad protection, high coverage limits, and expert support if identity theft happens. With flexible plans and family options, plus the choice to add Norton security tools, it’s easy to customize your coverage. For strong, reliable identity protection, LifeLock is a top pick.

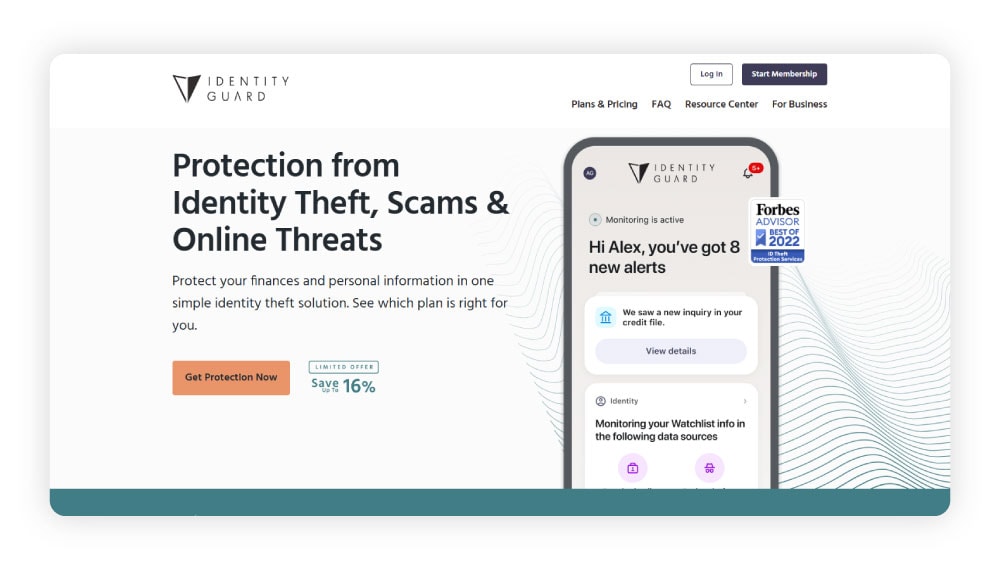

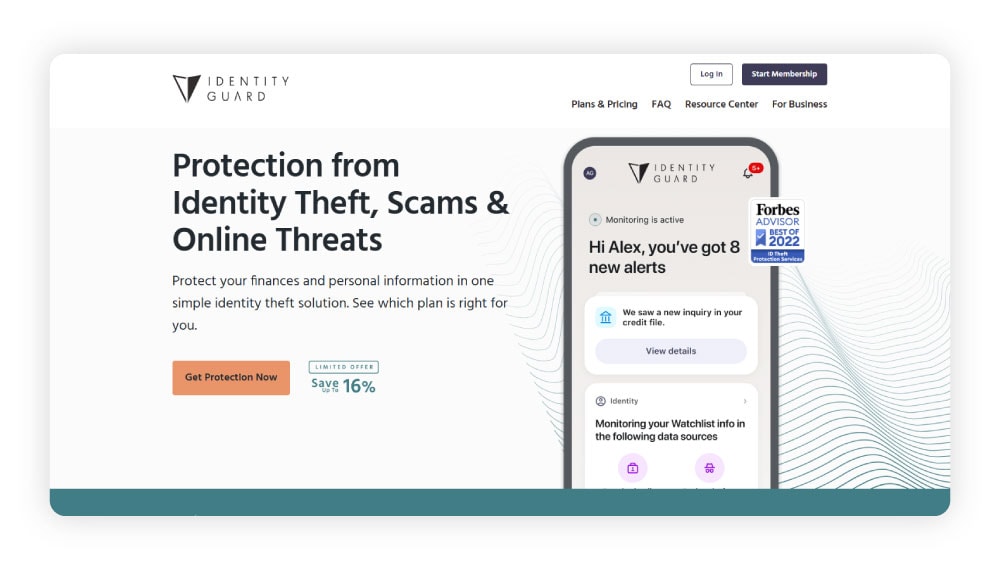

2. Identity Guard

While Identity Guard is owned by Aura, the two services aren’t identical. Both offer similar core features like dark web monitoring, identity theft alerts, and up to $1 million in identity theft insurance, but their availability is different, with Identity Guard offering three product tiers as opposed to Aura’s single plan.

However, Identity Guard’s entry-level “Value” plan doesn’t offer credit monitoring features — a significant blind-spot. This could leave customers vulnerable to some of the most common types of fraud following identity theft, like new credit accounts being opened in their name.

The “White glove fraud resolution” service is also reserved exclusively for customers paying for the most expensive “Ultra” plan, meaning customers on lower tiers might struggle to get the personalized support they need if they fall victim to identity theft.

Identity Guard has a Trustpilot rating of 3.6 out of 5 stars, placing it lower than Aura and LifeLock in customer satisfaction. Common issues raised in customer reviews include the platform’s expensive pricing, confusion over accounts being switched to Aura, and difficulties receiving support when needed.

Identity Guard pros |

Identity Guard cons |

|---|---|

Tiered plans allow some choice over features. |

No credit monitoring on the entry-level “Value” plan. |

U.S.-based customer care team. |

“White glove” fraud resolution is only available on the most expensive plan. |

Limited alerts compared to more comprehensive services like LifeLock Total. |

|

Mixed customer reviews implying lower customer satisfaction. |

|

No free trial available, meaning you have to pay to try it. |

Plans and pricing

Identity Guard offers three customizable plans with monthly or discounted annual pricing options.

Plan |

1 adult |

5 adults and unlimited children |

|---|---|---|

Identity Guard Value |

$7.50 |

$12.50 |

Identity Guard Total |

$16.67 |

$25 |

Identity Guard Ultra |

$25 |

$33.33 |

First-year per-month prices when billed annually.

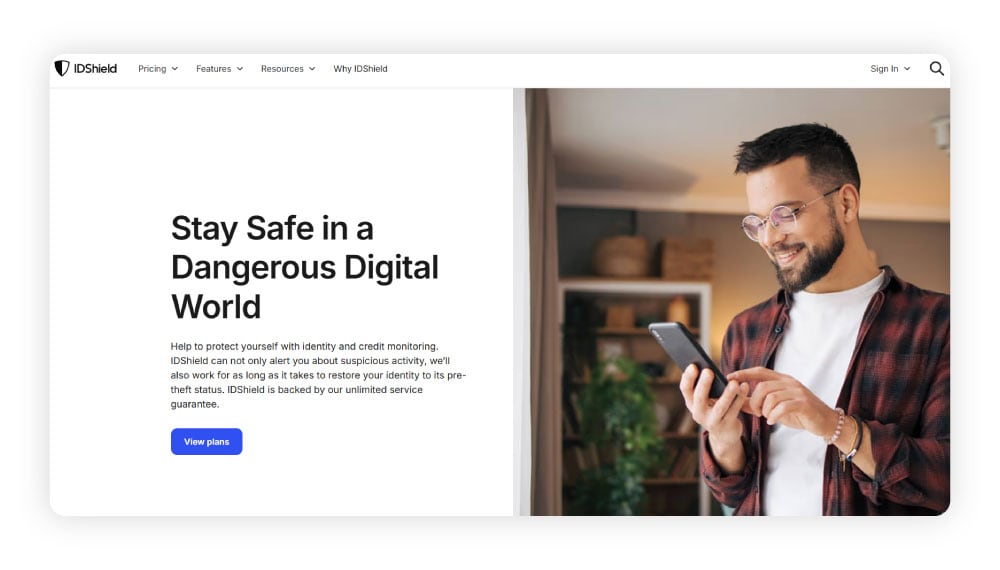

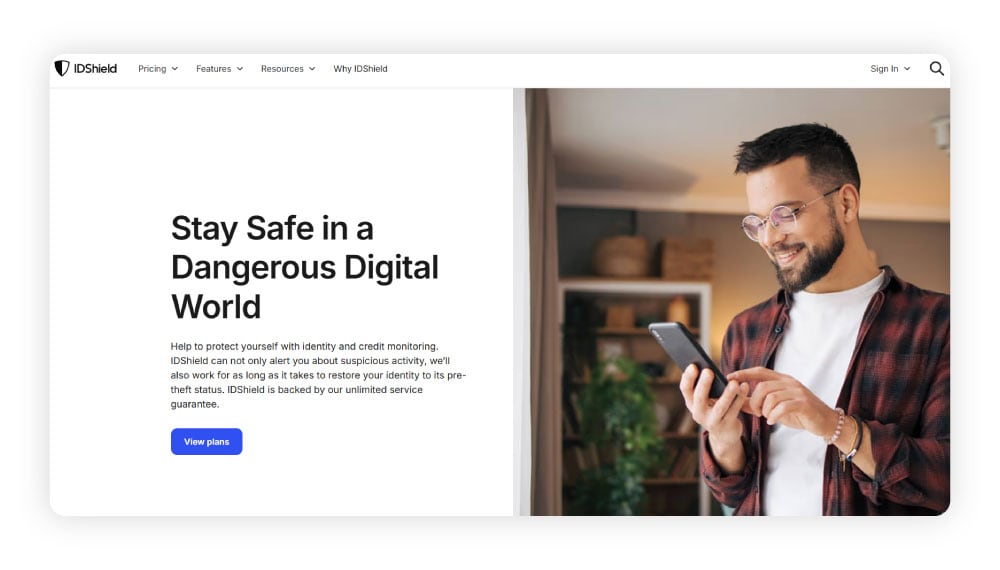

3. IDShield

IDShield, owned by LegalShield, offers a range of standard identity protection features like credit and dark web monitoring, alongside some basic cybersecurity tools like a password manager, malware protection, and a VPN.

It has a score of 4.6 out of 5 stars on Trustpilot. However, it didn’t make Security.org’s list of the best identity theft protection services, in which LifeLock took the coveted top spot, instead included as an “honorable mention.”

The main difference between IDShield and other Aura alternatives is that it offers members the services of licensed private investigators to manage identity theft cases. While this is a compelling benefit, it comes at a cost, and not all customers are happy with the service.

Some reviews, for instance, note that customer support was unhelpful or outright unresponsive, while others complain about the platform being glitchy with links that don’t work.

IDShield pros |

IDShield cons |

|---|---|

Offers up to $3 million in identity theft reimbursement, comparable with LifeLock. |

Isn’t consistently included in expert picks for the best identity theft protection. |

Licensed private investigators offer a unique touch to the restoration service. |

No discount available for annual plans. |

No free trial available for new members. |

|

Digital security tools are light on functionality and only accessible through an extra app. |

|

Mixed reviews regarding the quality of customer support. |

Plans and pricing

LifeLock offers three identity theft protection plans, available with discounted annual pricing or flexible monthly billing.

Plan |

1 adult |

2 adults and up to 10 children |

|---|---|---|

IDShield (1 credit bureau monitoring) |

$14.95 |

$29.95 |

IDShield (3 credit bureau monitoring) |

$19.95 |

$34.95 |

First-year per-month prices, billed monthly.

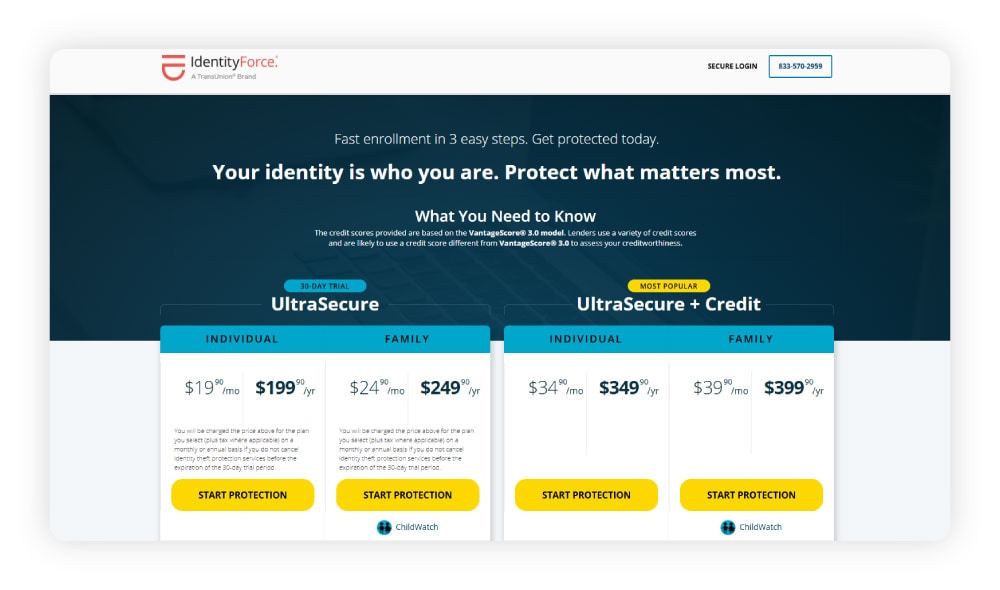

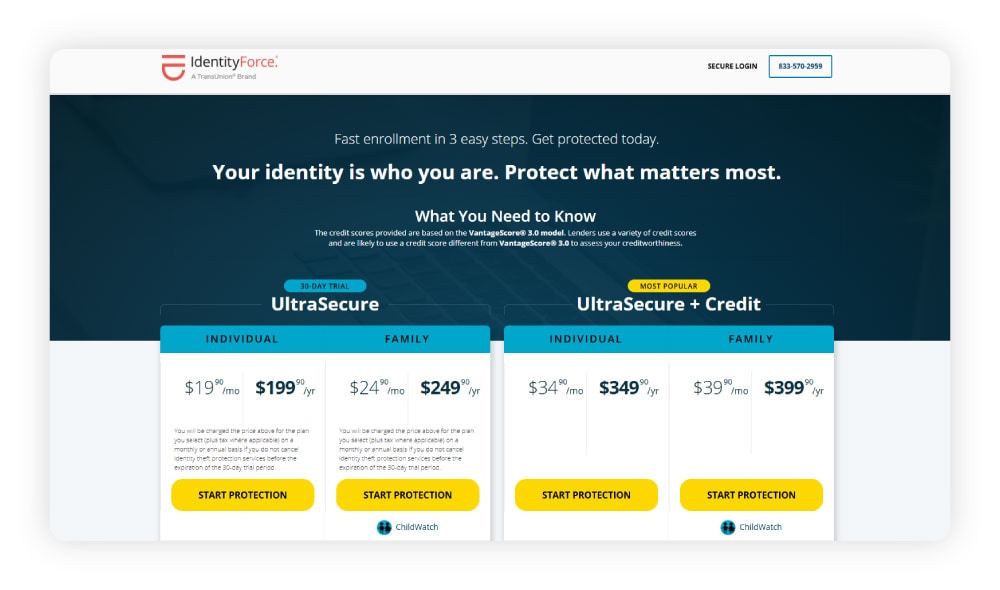

4. IdentityForce

IdentityForce is a TransUnion brand that offers identity theft protection. It includes most of the basic features you’d expect, like dark web monitoring, up to $2 million in identity theft insurance, and the support of a restoration specialist if you fall victim to identity theft. Other more advanced features include payday loan monitoring and court record monitoring.

However, its fully-fledged credit report monitoring feature isn’t included on the basic plan, limiting its usefulness as an identity theft protection tool given the risk of credit fraud.

It has a rating of 3.5 out of 5 stars on Trustpilot, putting it near the bottom of the pack in terms of customer satisfaction. Key customer complaints that call into question IdentityForce’s value for money include excessive spammy emails, slow or unresponsive service during identity theft events, and difficulties canceling the membership.

Identity Force pros |

IdentityForce cons |

|---|---|

A good selection of monitoring features, including dark web, fraud, social media, and financial activity alerts. |

Comparatively low Trustpilot score implying poor customer satisfaction. |

Free trial available for new members. |

Relatively expensive plans compared to other Aura alternatives. |

Limited functionality and bugginess on some iOS devices. |

|

Full credit report monitoring not included with the entry-level plan. |

Plans and pricing

IdentityForce offers four plans, two for individuals and two for families, with monthly or discounted annual billing options.

Plan |

1 adult |

2 adults and up to 10 children |

|---|---|---|

IdentityForce UltraSecure |

$19.90 |

$24.90 |

IdentityForce UltraSecure+Credit |

$34.90 |

$39.90 |

First-year per-month prices when billed annually.

5. IdentityIQ

IdentityIQ combines identity protection with financial wellness tools. Across its four plans, it offers features including credit monitoring, dark web monitoring, up to $1 million in stolen funds reimbursement, U.S.-based identity restoration support, and various fraud alerts.

Its focus on financial monitoring is represented through features like ScoreCasterIQ, which aims to predict how financial decisions may affect your credit score. However, this focus could be seen to detract from its value as an identity theft protection tool, as IdentityIQ lacks key features like social media and phone takeover monitoring.

It has a rating of 4.1 out of 5 stars on Trustpilot rating, but some customers report extremely poor phone support, unexpected charges, and difficulty canceling memberships. These complaints may cause concern for customers seeking a service that will be there for them when it matters most.

IdentityIQ pros |

IdentityIQ cons |

|---|---|

Financial wellness features may add value for some customers. |

Family plans are only available on the most costly tier. |

Includes most of the basic identity theft protection features you’d expect. |

Some customer reviews call out poor telephone support experiences and unexpected charges. |

A limited selection of alerts compared to frontrunners like LifeLock. |

|

No free trial available meaning you can’t try before you buy. |

|

Your data may be shared to third-parties, including advertisers. |

Plans and pricing

IdentityIQ offers four monthly individual plans with different protection levels, but only the top-tier plan includes coverage for children.

Plan |

1 adult |

1 adult and up to 4 children |

|---|---|---|

Secure |

$7.44 |

N/A |

Secure Plus |

$10 |

N/A |

Secure Pro |

$18.49 |

N/A |

Secure Max |

N/A |

$27 |

First-year per-month prices when billed annually.

6. Experian IdentityWorks

IdentityWorks is Experian’s identity theft protection service. While there’s a free basic plan, it doesn’t include many of the features required for effective identity theft protection. Customers have to invest in the pricey Premium plan for important features like credit monitoring, identity theft alerts, and up to $1 million in identity theft insurance.

Experian IdentityWorks’ key strength lies in its seamless integration with Experian’s broader credit tools, streamlining threat detection and response. For example, users have the option to instantly lock their Experian credit file if suspicious activity is detected.

However, customer complaints commonly focus on poor functionality, unresponsive customer service, and vague alerts that don’t provide much insight into risks or what can be done about them.

IdentityWorks pros |

IdentityWorks cons |

|---|---|

Good integration with Experian’s credit services. |

The free trial is limited to seven days. |

Three-bureau credit monitoring is included in the Premium tier. |

No discount for annual memberships. |

Customer support lines aren’t operational 24/7. |

|

While a free plan is available, it doesn’t provide compelling identity theft protection. |

|

The Premium tier is relatively expensive compared to other alternatives. |

|

IdentityWorks doesn’t have a dedicated mobile app. |

Plans and pricing

Experian offers two identity protection plans, one free and one paid, with only the Premium plan being available for families.

Plan |

1 adult |

2 adults and up to 10 children |

|---|---|---|

Basic |

Free |

N/A |

Premium |

$24.99 |

$34.99 |

First-year per-month prices, billed monthly.

7. ID Watchdog

ID Watchdog is an Equifax service that includes basic identity theft protection features like suspicious activity alerts, dark web monitoring, and credit report tracking. The Premium tier also offers additional features like AI-powered malware alerts, social media monitoring, and some cybersecurity tools.

If somebody steals your identity, ID Watchdog provides dedicated recovery specialists and up to $2 million in identity theft insurance to help cover expenses. However, this platform lacks several important identity theft protection features, including Buy Now, Pay Later loan alerts and phone takeover monitoring.

Most worryingly to customers in the market for effective identity theft protection, it only has a Trustpilot rating of 3.2 out of 5 stars, which puts it at the bottom of the table in terms of customer satisfaction.

ID Watchdog pros |

ID Watchdog cons |

|---|---|

Middle-of-the-pack reimbursement coverage of up to $2 million. |

Some customers may be concerned about their data privacy, given the massive data breach Equifax suffered in 2017. |

A wide range of financial monitoring features. |

No free trial is available for new members to test the service. |

The entry-level Select plan lacks many key identity theft protection features. |

Plans and pricing

ID Watchdog offers two tiers, both available for individuals or families, with monthly or discounted annual billing options.

Plan |

1 adult |

2 adults and up to 4 children |

|---|---|---|

ID Watchdog Select |

$14.95 |

$23.95 |

ID Watchdog Premium |

$21.95 |

$34.95 |

First-year per-month prices, billed monthly.

What to look for in an identity theft protection service

When choosing an identity theft protection service, key features to look out for include broad monitoring and alerts coverage, reliable customer support, and sufficient reimbursement packages. With these attributes, your service should help you catch potential identity theft threats early, respond quickly to urgent risks, and recover losses if you ever fall victim.

Here’s a deeper look at some of the most valuable features in an identity theft prevention platform:

- Comprehensive identity monitoring: Identity threats can surface in many places, from your credit report to your social media account. Your chosen service should include comprehensive coverage, including monitoring of the dark web, public records, and financial accounts, for signs of misuse of your personal information.

- Credit monitoring and alerts: Many types of identity theft result in criminals taking out credit in your name. Choose an identity theft protection service that monitors your credit file across the major bureaus and alerts you to suspicious changes, like new accounts or hard inquiries, for the best protection.

- Large reimbursement packages: Should you ever fall victim to identity theft, the costs can add up quickly. Strong identity theft insurance or reimbursement coverage can help cover the cost of recovering, including legal fees, personal expenses, and stolen funds, so you’re not left out of pocket.

- 24/7 member support: Responsive around-the-clock customer support ensures you can get help when it’s needed, especially during emergencies like identity theft or fraud attempts. Without this, you might be caught defenseless when your identity is targeted.

- Identity restoration services: Look for providers that offer hands-on support from local identity restoration specialists to ensure an expert will be available to guide you through the identity recovery process, help you deal with creditors or agencies, and set up ongoing protection.

- Family and child protection options: If you’re in the market for a service that can protect your whole household, focus on options that have family plans on offer. These often include child identity theft and credit monitoring features that can help keep your kids safe, too.

- Reputation and reliability: A provider’s reputation, evident in reviews and customer ratings, often signals how effective and trustworthy they are in protecting against identity theft and supporting your recovery. Ideally, choose the highest customer-rated option that meets your needs.

Choose LifeLock to protect your identity

LifeLock offers more complete identity protection than Aura, with the broadest range of alerts in one place and an unmatched reimbursement package of up to $3 million. With a choice of plans, expert U.S.-based restoration support, and outstanding customer reviews, LifeLock is a leader in identity theft protection and the most compelling Aura alternative.

FAQs

Does Aura have a VPN?

Yes, Aura includes a basic VPN, but it’s limited compared to full-featured dedicated services like Norton VPN. It lacks advanced features like protocol selection and has limited server options so it may not let you access the content you want. If you need robust online privacy or travel frequently, a more sophisticated standalone VPN solution is likely a better choice.

Is Aura actually worth it?

Aura might be worth it if you want simple identity theft and cybersecurity protection in one package. However, if you’re primarily interested in identity theft protection, LifeLock is the best customer-rated option for a reason. It offers greater monitoring coverage and higher reimbursement limits to help keep you better protected against identity risks.

Is identity theft protection worth the cost?

Yes, identity theft protection is worth the cost. It helps detect threats early, reduces the risk of financial loss, and provides expert support if your identity is stolen. The peace of mind and potential savings on recovery costs make it a smart investment for most people.

††† Up to $1 million for coverage for Lawyers and Experts included on all plans, plus reimbursement and expense compensation up to $25,000 each with Core, $100,000 each with Advanced, and $1 million each with Total. insurance benefits are issued by third parties. See GenDigital.com/legal for policy info.

Δ LifeLock/Norton 24/7 Support is available in English only. See https://www.norton.com/globalsupport.

*Claim that LifeLock is the #1 customer-rated identity theft protection service is based on its TrustPilot rating as of 4/1/2025.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.