“The timely notices and updates are great. The fact that LifeLock maintains 24-hour surveillance on your finances is reassuring and is one less thing to worry about with your financial wellness. Membership is worth every penny!“ - Trustpilot review

Identity Guard, owned by the digital security company Aura, offers a range of identity theft protection and credit monitoring features. The company’s self-proclaimed mission is to “empower every person to take control of their personal information to protect it from fraud, theft or misrepresentation.” But is Identity Guard worth it?

Read on to learn more about Identity Guard's reputation, features, and weaknesses, and explore how it compares to other identity theft protection services available for similar prices. Need answers fast? Get a summary in ChatGPT.

Identity Guard reviews: What users and experts say

With a relatively poor Trustpilot score of 3.6 out of 5 stars, Identity Guard receives mixed user reviews. Some customers have noted the company’s friendly service and quick response times. Other customers, however, report unexpected and expensive auto-renewals, inaccurate or inconsistent alerts, and functionality issues with the mobile app.

Here’s a more detailed look at how user reviews stack up for Identity Guard vs. LifeLock, the #1 customer-rated identity theft protection brand.

Identity Guard |

LifeLock |

|

|---|---|---|

Trustpilot |

3.6 (4K+ reviews) |

4.8 (8K+ reviews) |

Apple App Store |

4.5 (1.2K+ reviews) |

4.8 (153K+ reviews) |

Google Play |

3.8 (228 reviews) |

4.5 (40K+ reviews) |

The mixed sentiment about Identity Guard’s value is echoed in expert reviews, too, with a review for Tom’s Guide giving the service a rating of just 3.5 stars.

In his summary, reviewer Brian Nadel commends the variety of plans, but notes several drawbacks, including that “the entry-level subscriptions don’t include credit monitoring for early detection of fraud” and “the best they do is annual delivery of credit reports.”

Advantages of Identity Guard

Identity Guard offers industry-standard features like identity theft protection, dark web monitoring, and transaction alerts, along with up to $1 million in identity theft insurance.

With three service tiers, it provides flexible options to fit different protection needs and budgets. Users also note the generally friendly customer service.

Drawbacks of Identity Guard

While Identity Guard offers affordable tiers, the lower-priced plans lack key features that other providers offer, like credit monitoring, USPS address change alerts, and stolen wallet protection.

Its entry-level plan in particular falls short of offering anything above basic identity protection, with no alerts for changes to your credit file, a feature that’s standard with other options like LifeLock.

Without these features, users are more at risk of missing early warning signs of identity theft, giving criminals more time to do damage before they even know there’s a problem.

Unlike LifeLock, Identity Guard doesn’t offer a free trial, so there’s no way to test it before committing to a paid plan.

Identity Guard main features

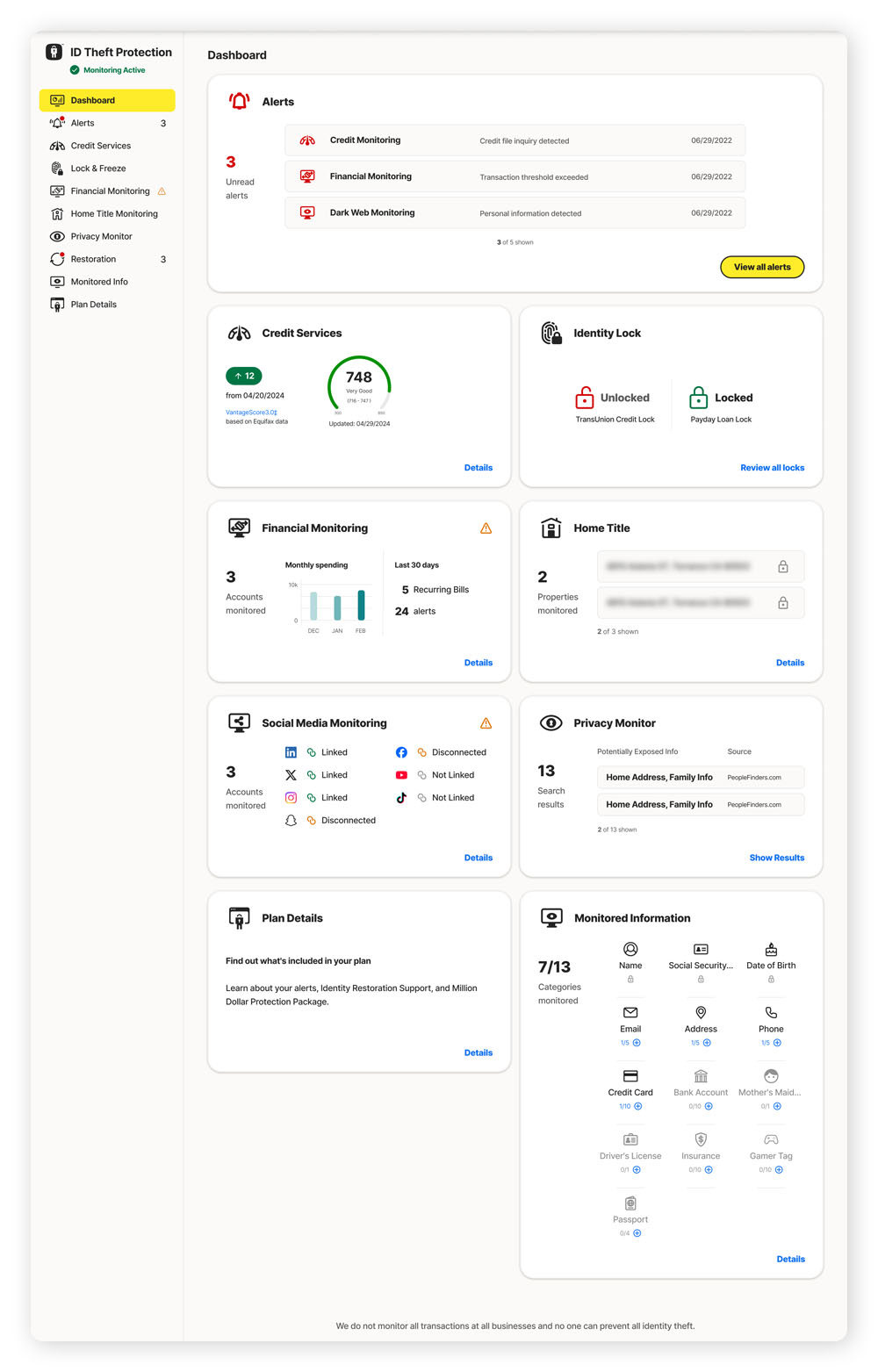

Identity Guard’s basic offering includes a range of tools for personal data and identity theft protection, like data breach notifications, dark web monitoring, up to $1 million in identity theft insurance, and support from a U.S.-based customer care team. Pricier tiers add credit monitoring, social media monitoring, and alerts for suspicious bank account, credit card, or investment account activity.

Here’s a closer look at Identity Guard’s main features:

- Identity monitoring: The platform monitors personal information, like your name, Social Security number (SSN), and driver’s license number, and alerts you to suspicious activity that might signal fraud.

- Identity theft insurance: All plans include up to $1 million in coverage for losses, fees, and other related expenses if your identity is stolen as a member.

- Identity restoration: A customer service hotline based in the U.S. is available to guide you through identity recovery and assist with fraud resolution if you become a victim.

- Dark web monitoring: This feature scans the surface and hidden parts of the internet in real time, alerting you if it finds that your data appears in breaches or on dark web marketplaces.

- Password manager: Identity Guard’s password manager encrypts and stores your login credentials and credit card info for one-click access, although it doesn’t offer as many features as a dedicated password manager.

- Credit monitoring: Premier product tiers offer three‑bureau monitoring, allowing you to keep tabs on your credit reports and get alerts of new inquiries, accounts, or changes.

- Additional monitoring: Identity Guard’s most expensive tier offers a range of additional monitoring features, including alerts for suspicious bank account, credit card, investment account, and social media activity.

Identity Guard plan breakdown

Identity Guard offers three plan tiers, with each one available for individuals or families. Every plan offers a different level of protection, with some valuable features, like credit monitoring, unavailable on the most basic tier.

Value

The Value Plan is Identity Guard’s entry-level offering. It includes core features like dark web monitoring, data breach alerts, high-risk transaction monitoring, a password manager, and $1 million in identity theft insurance.

However, it lacks credit monitoring features, broadly considered one of the foundations of identity theft protection. It also doesn’t offer the financial account alerts and so-called “white glove” fraud resolution services that are available in the premium plan.

This plan is designed for budget-conscious users who want basic identity theft protection, but it may leave them vulnerable to threats like credit or financial fraud.

Individual |

Family |

|

|---|---|---|

Monthly cost |

$8.99 |

$14.99 |

People covered |

1 adult |

5 adults, unlimited kids |

Total

The Total plan is Identity Guard’s mid-tier option, offering everything in the Value plan plus credit monitoring, monthly credit score updates, and bank account monitoring. However, it doesn’t include credit reports, credit lock features, or advanced monitoring covering social media, investment accounts, credit cards, or home titles.

This plan is built for users seeking more comprehensive protection than the Value plan, but who are hesitant to pay the high price of Ultra. The addition of credit monitoring makes it a more compelling option, but the lack of more advanced financial monitoring features may leave users with fraud blind spots.

Individual |

Family |

|

|---|---|---|

Monthly cost |

$19.99 |

$29.99 |

People covered |

1 adult |

5 adults, unlimited kids |

Ultra

The Ultra plan is Identity Guard’s most comprehensive option. It includes everything from the Total plan plus additional monitoring features that provide coverage of credit cards, 401(k) and investment accounts, home titles, social media accounts, USPS address changes, and criminal registries. It also includes credit lock functionality and annual three-bureau credit reports.

This plan is best for individuals or families with financial assets, like investments, property, or high-limit credit cards, who want more comprehensive protection and recovery support.

However, the higher cost puts it in the same category as LifeLock Total, which offers the broadest volume of alerts all in one place, up to $3 million in reimbursement coverage3, and greater access to credit reports††.

Individual |

Family |

|

|---|---|---|

Monthly cost |

$29.99 |

$39.99 |

People covered |

1 adult |

5 adults, unlimited kids |

Are there better identity theft services?

While Identity Guard offers many of the features you’d expect from an identity theft protection service, there are more comprehensive options available that include additional features like stolen wallet protection, credit monitoring as standard, and higher-value reimbursement packages. Some of these alternatives, like LifeLock, also have significantly higher average user reviews.

Is Identity Guard better than LifeLock?

No, LifeLock is one of the most reputable identity theft protection brands for a reason. The entry-level product tier, LifeLock Core, offers better protection than Identity Guard’s equivalent, with credit monitoring built in.

And, with a Trustpilot score of 4.8 out of 5 stars, users seem to have a better experience with LifeLock than Identity Guard, which earns just 3.6 out of 5 stars.

Experts echo users’ feelings about LifeLock, too, with a Tom’s Guide review of the best identity theft protection services naming it “Best for features” and saying:

“LifeLock is the perfect choice for those looking for the most comprehensive identity theft protection with a wide variety of plans and subscriptions to choose from.” - Tom’s Guide

Here’s a closer look at a few of the perks LifeLock Total users receive that Identity Guard customers don’t.

- Up to $3 million in reimbursement: LifeLock Total offers a total of up to $3 million in reimbursement following identity theft, covering stolen funds, legal support, and personal expenses.

- Daily credit reports and scores: While Identity Guard offers monthly credit score updates, LifeLock Total provides daily credit scores and reports from one bureau, so you’re always in the know about your financial well-being.

- Stolen wallet protection: If your wallet is lost or stolen, LifeLock assists with canceling/replacing credit cards, SSNs, driver’s licenses, and other IDs.

- Phone takeover monitoring: LifeLock provides alerts if it detects someone trying to steal your phone number and move it to another device without your permission, helping you prevent criminals from getting your texts or calls and breaking into your accounts.

- Buy Now Pay Later alerts: LifeLock looks out for fraudsters using your identity to open a Buy Now Pay Later (BNPL) account, providing alerts that can help you catch unauthorized activity fast.

- Utility account creation monitoring: LifeLock monitors for attempts to open utility accounts in your name, flagging potential fraud.

Is Identity Guard worth the price?

Identity Guard may not be worth the price, since competing services offer more comprehensive protection. It lacks useful features like credit monitoring across all plans or stolen wallet protection, and, despite praise for its generally friendly customer service, is rated worse by real users than LifeLock.

Choose LifeLock for leading identity theft protection

There’s a victim of identity theft every five seconds, so it’s critical that you choose the right protection. LifeLock, the #1 customer-rated identity theft protection brand, offers a combination of advanced monitoring, timely alerts, and comprehensive reimbursement to help restore your peace of mind. And if your identity is ever stolen, our U.S.-based restoration specialists are available 24/7 to help you get back on your feet.

3 $3 million coverage in our Total plan consists of up to $1 million each for Reimbursement, Expense Compensation, and Lawyers and Experts. Total coverage and category limits vary depending on plan chosen. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.

†† Credit reports, scores and credit monitoring may require an additional verification process and credit services will be withheld until such process is complete.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.