Identity theft facts

The statistics on identity theft cases and other online fraud can be staggering. If you haven’t done everything to prevent your identity from falling into the hands of cybercriminals—and you aren’t regularly monitoring your credit reports—you might not even know if someone is using your identity.

Look at the statistics below to see how widespread this type of fraud is:

- The FBI reported 27,922 victims of identity theft in 2022.1

- The Federal Trade Commission (FTC) received 231,724 reports of identity theft in Q4 2023 alone.2

- Data breaches involving personally identifiable information had one of the highest victim counts compared to other crimes in 2022, according to the Internet Crime Complaint Center.1

- AI-driven identity theft scams will likely increase in 2024.

- The Bureau of Justice Statistics found that 12% of people over 16 learned that an entity with their personal information experienced a data breach in 2021.3

Most common types of identity theft

Identity theft isn’t as simple as someone taking your credit card or driver’s license. What might start as a social engineering scam could end up with a stranger (or even a family member) using pieces of your identity to commit synthetic identity theft, Medicare scams, or other identity crimes.

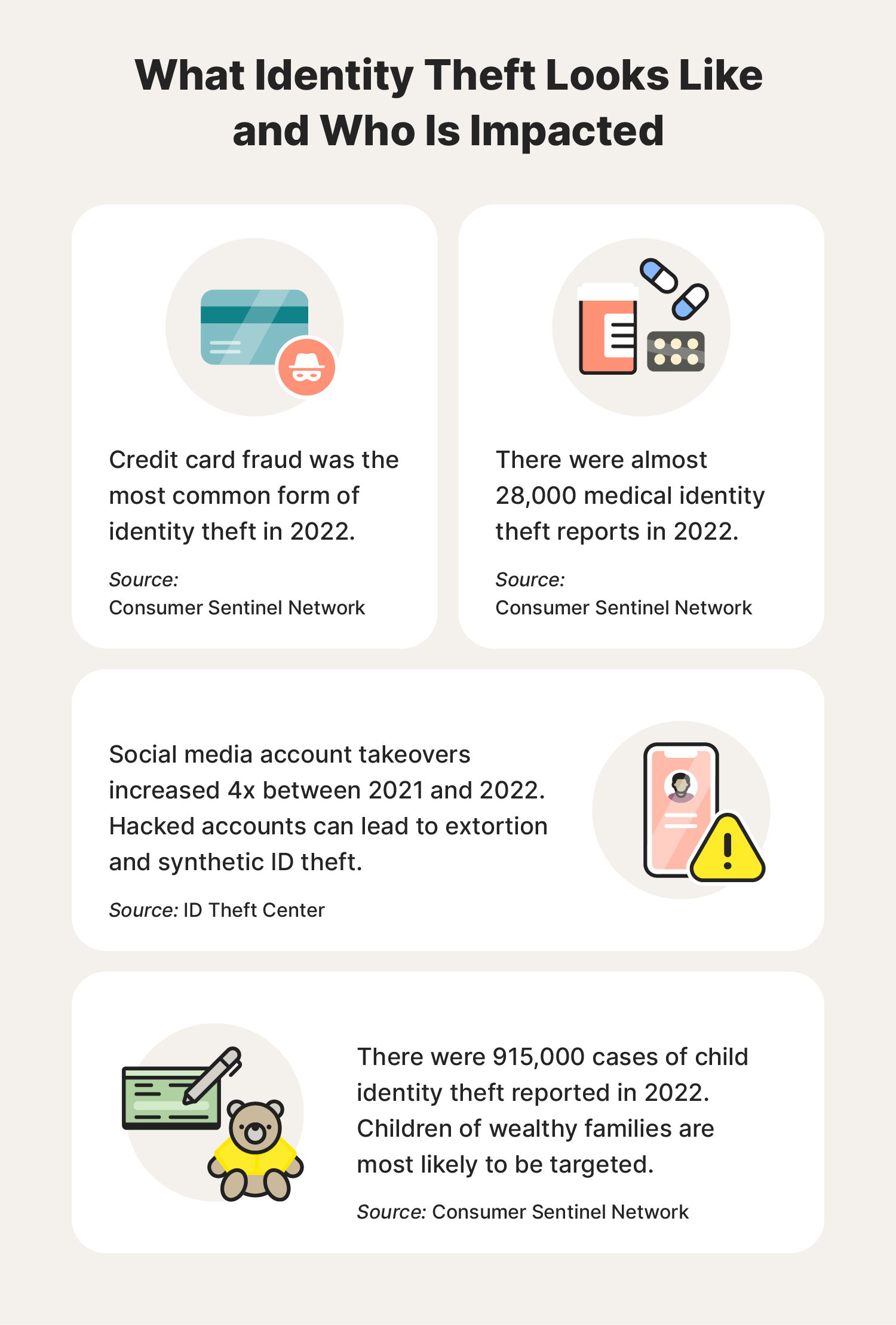

Here are some statistics about common identity theft types:

- Credit card fraud was the most common type of identity theft reported in 2022, with 441,882 cases reported to the FTC.4

- Phishing, a tactic commonly used to steal personally identifiable information, was the most common type of cybercrime in 2022.1

- The FTC received 37,924 reports of military ID theft in 2022.4

- In 2022, the Identity Theft Resource Center received four times the number of inquiries related to social media account takeovers than in 2021. Cybercriminals can use hijacked accounts to extort money from the account owner, friends, and family members.5

- There were 27,820 reports of identity theft relating to medical services in 2022, according to data from the Consumer Sentinel Network.4

- In 2023, the FTC received 89,465 reports related to tax-related or employment identity fraud in 2023.6.

Cases of identity theft by age

While it’s easy to think that working-age adults are the only targets of identity thieves, the reality is that anyone of any age can have their identity stolen. Understanding that everyone is at risk can help you recognize the warning signs and take steps to protect your identity, the identity of your children, and the identities of older family members.

Here are a few statistics that show how identity theft impacts different age groups:

- While people aged 30-39 were more likely than other age groups to report identity theft in 2022, elderly victims of identity theft lost more money on average, according to the Federal Trade Commission.4

- Identity thieves also target children—Javelin Strategy & Research, a financial services research company, reported 915,000 cases of child ID theft in 2022.7

- The children of wealthy families (households with $150,000+ in yearly income) are more likely to be the victims of identity theft, according to research from Javelin.8

- The FTC found that the age groups least likely to be the target of ID theft are people under 19, followed by people older than 70.4

Statistics about the consequences of identity theft

The cost of identity theft on an individual can be huge. From potential hits to credit scores to investing time and energy disputing fraudulent accounts and transactions, victims lose much more than money. Add up those costs, and you’ll see that identity theft protection is worth it.

These statistics show just how costly this problem is and why it’s vital that you start protecting yourself against identity theft:

- In 2022, the FTC reported that the median loss for all identity fraud reports was $650.4

- According to the FBI, the total amount lost by victims of identity fraud in 2022 was $189,205,793.1

- It can take around 30 days to dispute fraudulent accounts on your credit report.9

- MyFICO says that every time an identity thief tries to open a new credit card or obtain a loan, it could drop the victim’s credit score by around five points.10

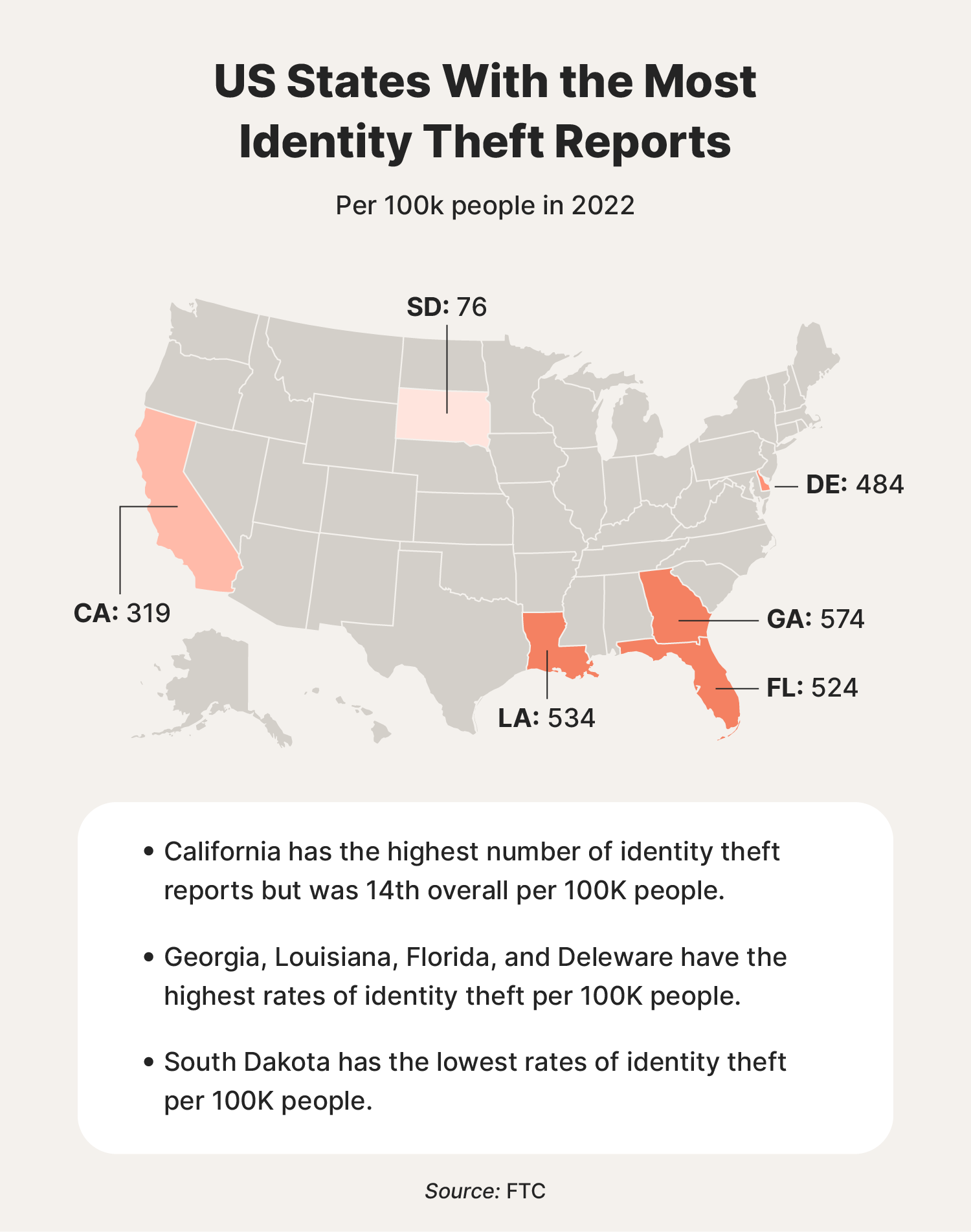

Identity theft stats by area

Though people of all ages and backgrounds can be victims of identity theft, living in certain areas could put you at higher risk.

Check out these statistics about the U.S. states with the highest instances of identity theft:

- The U.S. state with the most reported cases of identity theft in 2022 was California, with 125,597.4

- In 2022, the state with the highest number of identity thefts reports per 100k people was Georgia.4

- Louisiana, Florida, Delaware, and Nevada had the next highest numbers of identity theft reports per 100k people in 2022.4

- The five states with the lowest number of identity theft reports per 100k people in 2022 were Maine, Iowa, Wyoming, Vermont, and South Dakota.4

- Tuscaloosa, Baton Rouge, and Miami-Fort Lauderdale areas had the highest reported rates of identity theft per 100k people in 2022.4

Don’t be a statistic—start protecting your identity now

Keeping your identity completely safe isn’t always possible. But the right identity theft monitoring and protection service can help you limit damage from identity theft.

LifeLock Standard notifies you of data breaches, monitors the dark web for use of your information, and sends alerts when it detects your Social Security number being used for potentially fraudulent credit applications. We’ll also help you remove your personal information from public people search sites to get ahead of potential misuse of your private data.

FAQs about how common identity theft is

Have more questions about identity theft? We have answers.

Does identity theft ever go away?

You can limit the damage done after identity theft by taking appropriate actions: First, freeze or lock your credit and dispute any charges or accounts you didn’t open. Then, monitor your credit report and bank and credit card accounts for fraud. If you don’t dispute accounts or charges, it can take years for those accounts to disappear from your credit report after they’re closed.

How do I clear my name after identity theft?

The best way to clear your name after identity theft is to take steps to prevent it from happening again. Lock your credit unless you’re actively applying for new accounts, place a fraud alert on your reports with the credit bureaus, protect your Social Security number, and dispute all charges and accounts the thief created. You may need to file a police report to prove you didn’t open those accounts and have false criminal records expunged.

What are some warning signs you have had your identity stolen?

There are several warning signs that somebody stole your identity, including:

- Calls from creditors regarding accounts you didn’t open

- Bills in the mail

- Charges on credit cards you didn’t make

- Your name appearing in criminal records searches

- Being denied credit you should qualify for

- Not receiving government benefits you’re entitled to

- “2022 Internet Crime Report,” Federal Bureau of Investigation Internet Crime Complaint Center, Mar. 14, 2023.

- “Sentinel Report Categories,” Federal Trade Commission Sentinel Network, Nov. 1, 2023.

- “Data Breach Notifications and Identity Theft, 2021,” Bureau of Justice Statistics, Jan. 2024.

- “Consumer Sentinel Network Data Book 2022,” Federal Trade Commission, Feb. 1, 2023.

- “The Weekly Breach Breakdown: Hacked and Furious – The Rise in Social Media Account Takeovers,” Identity Theft Resource Center, Mar. 17, 2023.

- “Sentinel Compare Identity Theft Report Types,” Federal Trade Commission Sentinel Network, Nov. 1, 2023.

- “1.7 Million U.S. Children Fell Victim to Data Breaches, According to Javelin’s 2022 Child Identity Fraud Study,” Javelin Strategy, Oct. 26, 2022.

- “Child ID Theft: Social Cyber Risks and the Persistent Threat to Families,” Javelin Strategy, Nov. 28, 2022.

- “Disputes FAQs,” Experian, Jan. 24, 2024.

- “How Can Identity Theft Affect Your FICO Scores?,” MyFICO, Aug. 20, 2019.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2025 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.