Understanding military identity theft: a unique threat to our service members

Military identity theft refers to identity theft incidents specifically targeting military personnel and veterans, often exploiting the distinct conditions of military life. From frequent relocations to deployments, service members face vulnerabilities that can make them prime targets for identity thieves. The numbers back this up: military identity theft cases continue to rise, with approximately 43,000 incidents reported in 2023, according to the Federal Trade Commission.

Why are military members more vulnerable to identity theft?

Military personnel face unique identity theft risks, largely due to their lifestyle and the nature of their public service. Frequent relocations and deployments can lead to sensitive documentation exposure, increasing the likelihood of information being intercepted by criminals. Additionally, many military records, especially those related to benefits and healthcare, are stored in public databases or systems that may be compromised. This means that even a stolen military ID, which is a high-value target, can put an entire identity at risk by giving thieves access to personal and financial details.

Common types of military identity theft

Service members are vulnerable to various forms of identity theft, including:

- Fraudulent credit accounts: Thieves may open credit cards or loans using a service member's information.

- Identity theft during relocation: Moving frequently increases the chances of misplacing or having documents intercepted.

- VA or healthcare-related fraud: Criminals sometimes exploit healthcare or veterans’ benefit systems to obtain benefits fraudulently.

- Related reading: Learn about how malware can expose personal information.

Protecting yourself from military identity theft

Service members can take specific steps to safeguard their identities:

- Set up an active-duty alert: Notify credit bureaus of your active-duty status, which places an alert on your file and makes it harder for creditors to open accounts in your name.

- Monitor credit reports regularly: Regular monitoring helps you quickly catch suspicious activity.

- Secure documentation during deployment: Store sensitive documents securely before deployment and use only secure channels when accessing personal files from abroad.

- Check bank accounts regularly: Keep a close eye on all accounts to detect unauthorized transactions early.

- Use military-specific credit monitoring: Many financial services provide free credit monitoring specifically for military personnel.

- Change passwords and enable two-factor authentication: Update passwords frequently and activate two-factor authentication (2FA) for extra protection.

- Be wary of fraudulent emails a nd social media scams: Military personnel are often targeted with phishing scams, so avoid clicking on suspicious links.

- Use encrypted websites and secure devices: Only access websites with SSL certificates and keep your devices secure to prevent data breaches.

- Related tips: Learn how strong passwords and fraud alerts can protect your identity.

What to do if you’ve been a victim of military identity theft

If you or a loved one has experienced military identity theft, acting quickly is essential:

- Report the identity theft to the FTC: The FTC’s online system lets you file an identity theft report and start the recovery process.

- File a police report: Reporting the theft to local law enforcement can help build a case if you need to contest fraudulent charges.

- Contact your base’s legal office: Many military bases offer free legal support for identity theft victims.

- Place fraud alerts and credit freezes: Notify all three credit bureaus to secure your credit profile.

- Leverage the Servicemembers Civil Relief Act (SCRA): This act provides protections, including interest rate reductions, for active-duty personnel impacted by financial fraud.

Put yourself first and secure your future

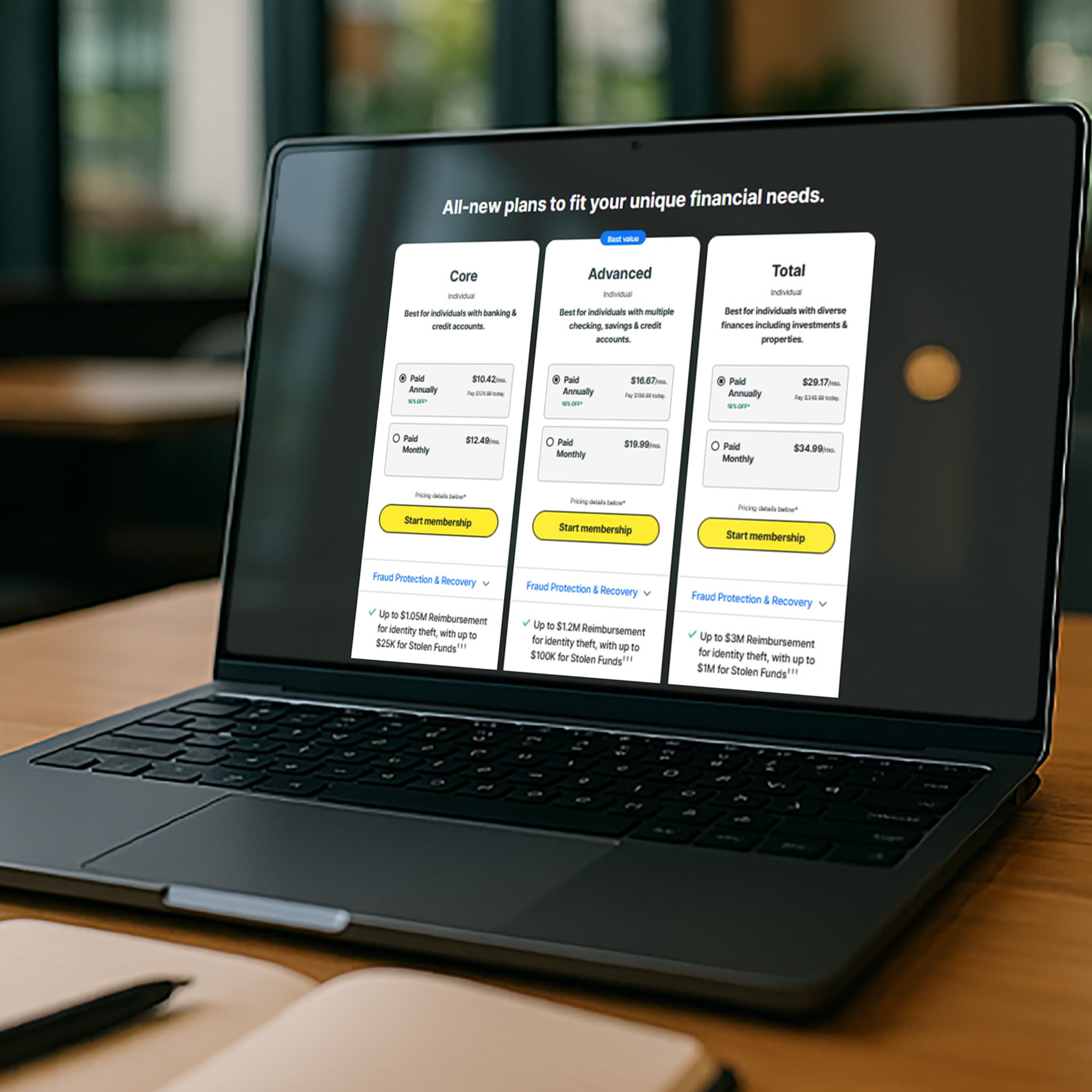

Military life comes with enough challenges—identity theft shouldn’t be one of them. Protect yourself with proactive measures and reach out for help if needed. LifeLock Advantage offers comprehensive protection, helping you monitor your credit, detect unusual activity, and restore your identity if needed.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

Your taxes could be getting filed in your name by someone else.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.