Check washing in the news: In one case, someone lost $310,000 when a criminal stole a check written out to the Internal Revenue Service (IRS).

Imagine mailing someone a check for $43, only to see $14,500 disappear from your account days later. This is exactly what happened to one of the many victims of check washing, a growing scam in which thieves erase and rewrite checks to steal money. This article will teach you how check washing works, how to prevent it, and what to do if you believe you’re a victim.

What is check washing?

Check washing is a form of check fraud in which criminals steal a paper check, use chemicals to erase the ink, and then change the payee and payment amount. These new amounts are often much higher, enabling criminals to drain your account.

The process of obtaining and cashing the checks generally goes like this:

- Criminals pry open residential mailboxes, steal misdelivered mail, or fraudulently sign USPS change of address forms.

- Thieves then replace the payee with their name, a synthetic (made-up) ID, or the name of a money mule (a person criminals use to move stolen money) to hide their identity.

- Criminals or mules may then cash the check at an ATM to avoid face-to-face scrutiny.

Criminals can also make digital copies of your checks in a process known as “cooking.” By cooking your checks instead of washing them, criminals avoid the chemical stains that make a washed check easier to identify. However, cooked checks copy the sequence number from the original, which can be a red flag in a bank’s fraud system.

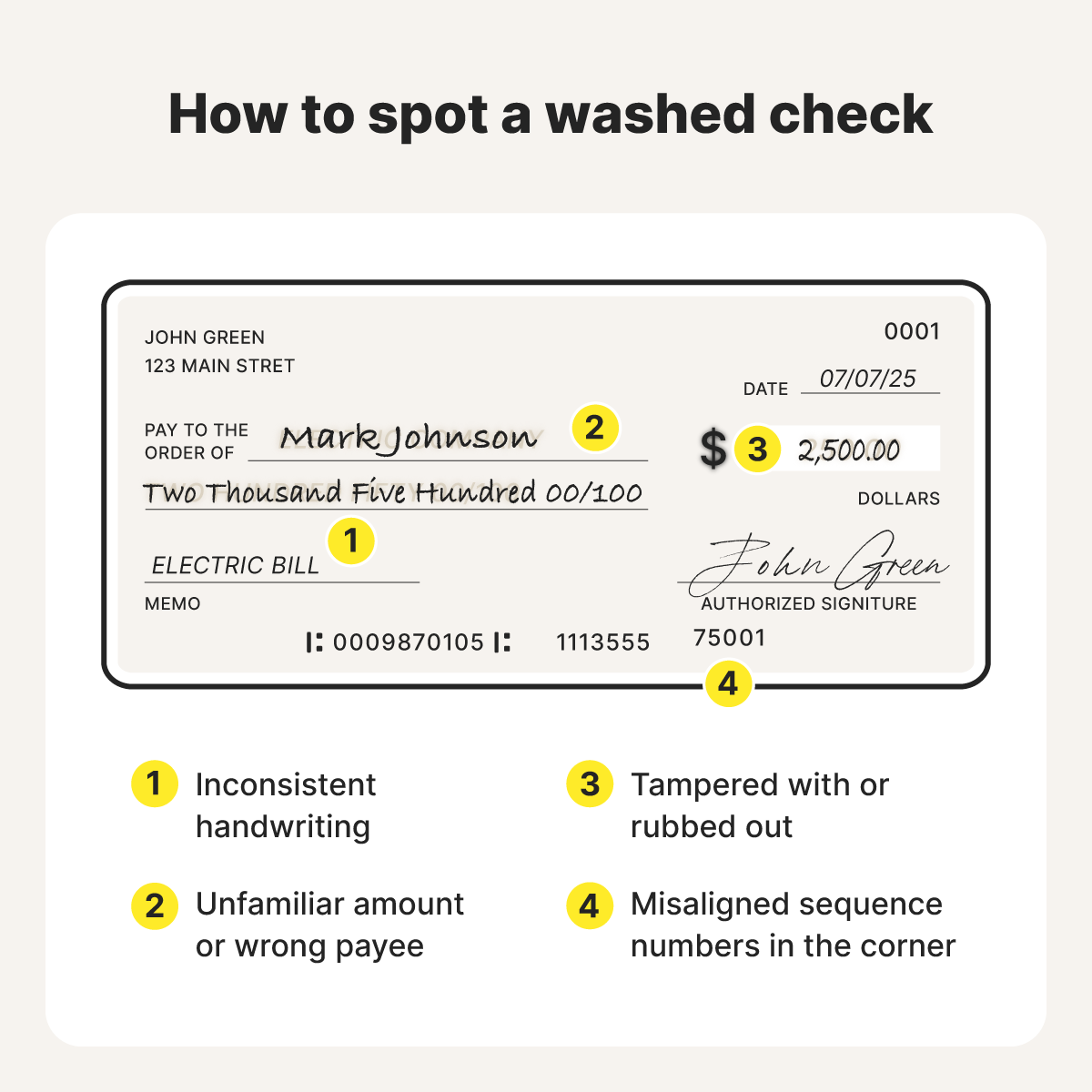

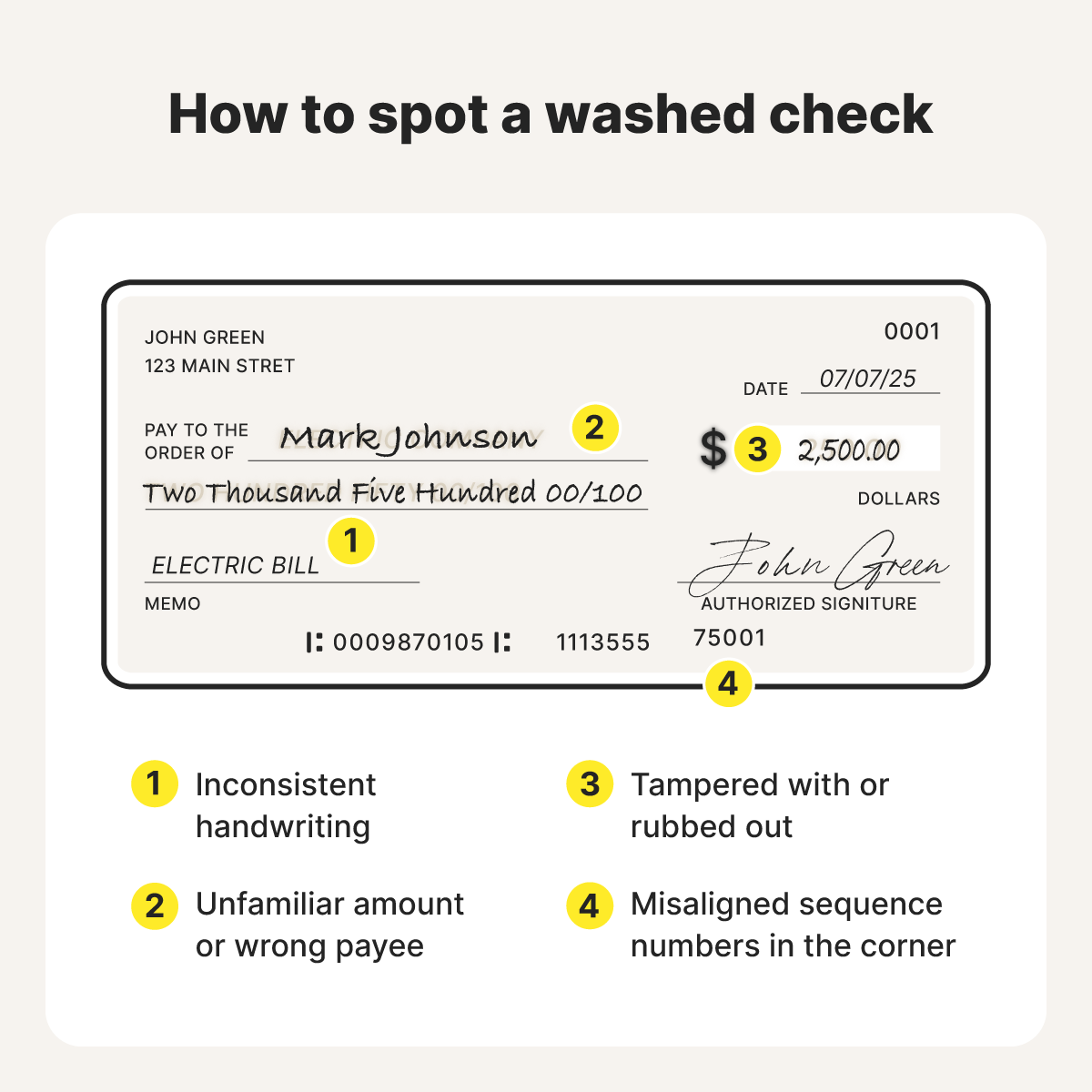

What does a washed check look like?

A washed check might look normal at first. But there are some red flags to watch for, including:

- Faded, discolored, or blotchy areas: Chemical washing often leaves light smears or washed-out spots as the ink lifts from the paper. Checks placed in solvent may also show signs of a changed texture, like looking worn or thin in areas.

- Inconsistent handwriting: The scammer may use a different ink color or font for the payee or amount than for the signature. Also, look for odd misspellings, unusual alignments, or weird spacing in the payee name.

- Tampered watermark: Chemical erasure can cause the watermark to appear whitened, glossy, or rough. To spot any distortions, hold the check under a bright light and compare it to an unaltered one.

- Misaligned numbers: Criminals sometimes use digital printers to alter the paid amount or sequence number. But these numbers can still occasionally be misaligned if the criminal was rushed when changing them.

- Incorrect amount and wrong payee: A telltale sign of check washing is when somebody you don’t know cashes your check for a much higher amount than you originally wrote it for.

Banks often keep digital copies of cashed checks you can review through your online account. When you do so, inspect individual numbers and letters one at a time to spot discrepancies. Professional check washers work hard to make their checks appear legitimate, so be sure to examine them closely to avoid these bank scams.

Risks of check washing

Check washing risks include unpaid bills, account freezes, and credit damage due to the loss of funds.

Here’s what could happen to you if you’re a check washing victim:

- Financial loss: The most immediate risk is losing money. After the initial loss, any reimbursement you may receive takes time. The same man who wrote a check for $43 that was then cashed for nearly $15,000 waited almost four months for reimbursement.

- Unpaid bills: Other, legitimate checks may reach your landlord or utility company after your account has been drained, only to bounce and leave you with the unpaid bill, additional fees, and a damaged reputation. This is because victims often discover check washing only after their bank alerts them of insufficient funds.

- Account freezes: Law enforcement or regulatory bodies can freeze your account in response to suspicious transactions, believing the account may have ties to illegal activity. The freeze prevents withdrawals and transfers from the account, sometimes until the investigation is complete.

- Credit damage: An unpaid bill can reduce your credit score if a check was intended to pay a credit account. For example, a missed mortgage payment can linger on your credit report for up to seven years.

- Personal information exposure: Checks contain your name, address, bank name, account number, and routing number. Criminals can use this information to conduct social engineering attacks that can help them discover enough private data to eventually steal your identity.

The risks of check washing can be widespread, affecting numerous people. In 2021, four men in Philadelphia stole over $150,000 in a check washing scheme that led to their arrest.

Signs of check washing fraud

Signs of check washing before a check is cashed include letters stolen from mailboxes, bank notifications of suspicious activity, and messages from the intended recipient stating that the check never arrived.

If your check takes too long to post to your account, contact the payee to see if they’ve received it. If not, contact your bank to report the check missing and request a stop payment. This will ensure the bank flags and blocks any attempts to cash it.

You should also contact your shipping company to see if it can find the check. USPS tracks your mail if you pay for First Class Mail®. FedEx and UPS typically provide you with a tracking number when you send a package containing a check.

How to protect yourself from check washing fraud

Prevent check washing fraud by regularly emptying your home mailbox, mailing checks directly from the post office, and using checks with anti-fraud features. You can also replace checks with peer-to-peer (P2P) apps (like Zelle and Venmo) and online banking payment methods.

Here is a list of extra tips to consider when you’re trying to avoid check washing:

- Use an indelible pen: Indelible pens soak into the fibers of your check, making them much harder to wash. Look for gel pens labeled “permanent.”

- Use security checks: Some banks provide secure checks with microprinting, heat-sensitive ink, or chemically reactive paper. For extra security, ask your bank if it provides tamper-proof checks that are verified digitally before being cashed.

- Fill out checks completely: Filling out the entire payee and amount lines forces thieves to use more chemicals to erase the ink. This increases the chances of the thieves leaving behind errors that make the fraudulent check easier to spot.

- Protect your mail: Help prevent mail theft by checking your mail often and locking your personal mailboxes. You can also drop off mail close to its pickup time, give checks directly to the post office, and install an outdoor camera.

- Shred documents: Destroy checks and bank statements to prevent fraudsters from stealing them from the trash. Make this a habit with all of your important bank documents to protect your financial information.

- Switch to digital payments: Avoid using checks completely by sticking to digital payment methods. While these methods aren’t risk-free, there are ways you can make online payments more secure.

- Use account alerts: Monitor your account activity closely and immediately report any check transactions you don’t recognize to expedite the dispute process.

- Track with USPS Informed Delivery: Consider signing up for USPS Informed Delivery to track incoming mail. If you expect a check and see it on your Informed Delivery notification, you’ll know to pick it up quickly and can take swift action if somebody steals it.

The USPS has stated that mail theft is more common during the holidays. So, take extra care when sending loved ones checks around this time. You might also consider giving money directly or sending funds through a P2P app. This way, you know your gift will be appreciated and not stolen. Just be careful when using P2P apps. Scams on digital payment tools like Cash App could mean someone is impersonating your friends or family.

What to do if you’re a victim of check washing

If you’re a victim of check washing, notify the police, federal agencies, your bank, and the check’s intended recipient. You should also consider setting up a fraud alert in case someone uses your check information to attempt to open financial accounts in your name.

If you suspect check washing, here are five steps to take right away:

- Contact your bank: Explain that you did not authorize the check with that payee and amount. Some banks advise that you close compromised accounts. So check with your bank to see what it suggests.

- File a police report: Provide as many details as possible when reporting to your local law enforcement. Include when and where you mailed the check, the check number, the amount, and any evidence (such as a copy of the original) you have of fraud.

- Report to federal agencies: Submit fraud reports to the Federal Trade Commission (FTC), the Postal Inspection Service (USPIS), and the Internet Crime Complaint Center (IC3). These three agencies can provide you with identity theft recovery resources and work with local law enforcement.

- Set up a fraud alert: A fraud alert notifies you if someone attempts to open loans or credit cards using information from your checks. While a credit freeze might not be necessary yet, an alert tells financial institutions to stay alert just in case.

- Notify affected parties: Inform intended check recipients about the situation and that they may have to wait to receive payment. If the payees include your mortgage company or another bill you owe, ask if they can waive late fees and penalties while you resolve the issue.

While the information on a check isn’t necessarily enough to commit identity theft, criminals only need to gather a bit more information, like your Social Security number, to impersonate you and commit fraud. If check washing fraud leads to this, take steps to report identity theft to the police, FTC, and IC3, including evidence of the criminal act as part of your report.

Defend yourself from stolen financial information

While check washing starts with good old fashioned financial theft, it could eventually lead to identity theft. LifeLock Standard offers $1 million in identity theft coverage for lawyers and experts to help with recovery, Dark Web Monitoring to check if criminals are selling your information online, and a team of US-based remediation experts.

FAQs

Can check washing affect electronic checks?

No, check washing involves physically altering paper checks by removing ink with chemicals. Using eChecks has other risks, such as fake check fraud, phishing attacks, and data-stealing malware.

Are electronic payments safer than checks?

Electronic payments are generally considered safer than checks because they use encryption and authentication. However, electronic payments aren’t entirely safe. For example, criminals can engage in wire transfer scams to trick people into sending them money.

Will banks always reimburse me for check washing fraud?

Banks are likely to reimburse scammed money due to check washing if their customer isn’t found liable. This falls under Uniform Commercial Code 4-401, which states the item must be “properly payable” if authorized by a customer. In other words, if the bank doesn’t spot the fraud, they’re liable for paying you back unless they can prove you were negligent.

Does homeowners’ insurance cover check washing losses?

Depending on your policy, homeowners’ insurance may cover check washing up to certain limits. Review your policy’s additional coverage section to see if it includes stolen funds.

Are cashier’s checks or money orders safe from check washing?

Cashier’s checks and money orders are both vulnerable to check washing, but are generally more secure because they use typed, not handwritten, words. As such, criminals will need a laser printer to make these check modification efforts more convincing.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.