[I]f bad debt exceeds 10 percent of the open position’s salary, it may be considered a risk regardless of when the debt occurred.

- SHRM President and Chief Executive Officer, Johnny C. Taylor Jr.

Employment credit checks could determine whether you get the job you’ve been looking for. About half of U.S. employers use credit checks, so understanding how your credit might affect your employability is critical if you’re looking for a new role. Read on to find out what credit checks for employment include, what employers look for, and how to prepare.

An employment credit check examines your credit history to assess your financial responsibility, which could impact an employer’s perception of your trustworthiness and reliability. Similar to a standard credit check, employment credit checks reveal your credit card balances, debts, record of on-time payments, and any derogatory marks on your credit report.

Employers won’t be able to check your credit score during an employment screening — they can only see your credit history. A good credit history makes you seem like a responsible potential employee, increasing your chances of getting the job. Conversely, a bad credit history might decrease your chances of getting a job for which you might otherwise be qualified.

Employers review your credit history as part of their hiring process to assess your trustworthiness. They may see applicants with a bad credit history, evidenced by excessive debt or past financial mismanagement, as more likely to cause financial or reputational issues.

Here are some insights employers get when checking your credit report:

The CEO of the Society for Human Resource Management (SHRM) had this to say on when employers become concerned about an applicant’s credit:

[I]f bad debt exceeds 10 percent of the open position’s salary, it may be considered a risk regardless of when the debt occurred.

- SHRM President and Chief Executive Officer, Johnny C. Taylor Jr.

Employment credit checks arguably have more weight for certain jobs, including roles that directly involve financial responsibility, like personal banking or investment management. They may be less common for positions like grocery store clerks, delivery drivers, and laborers.

Typically, employers initiate a credit check as the final step in the application process because it costs money. Understanding what employers look for in your credit report is crucial to minimize the risk of your application failing at the last hurdle.

Just like creditors, employers seek applicants with a strong credit history, a consistent payment record, low credit utilization, and manageable debt. Essentially, any factor that lowers your credit score could also impact your job prospects.

Here’s what an employer looks for when reviewing your credit history:

Proactively working on improving your credit before a job search could boost your employment prospects. Paying off past-due accounts or decreasing your credit utilization, for example, might make a positive difference in your chances of passing the check.

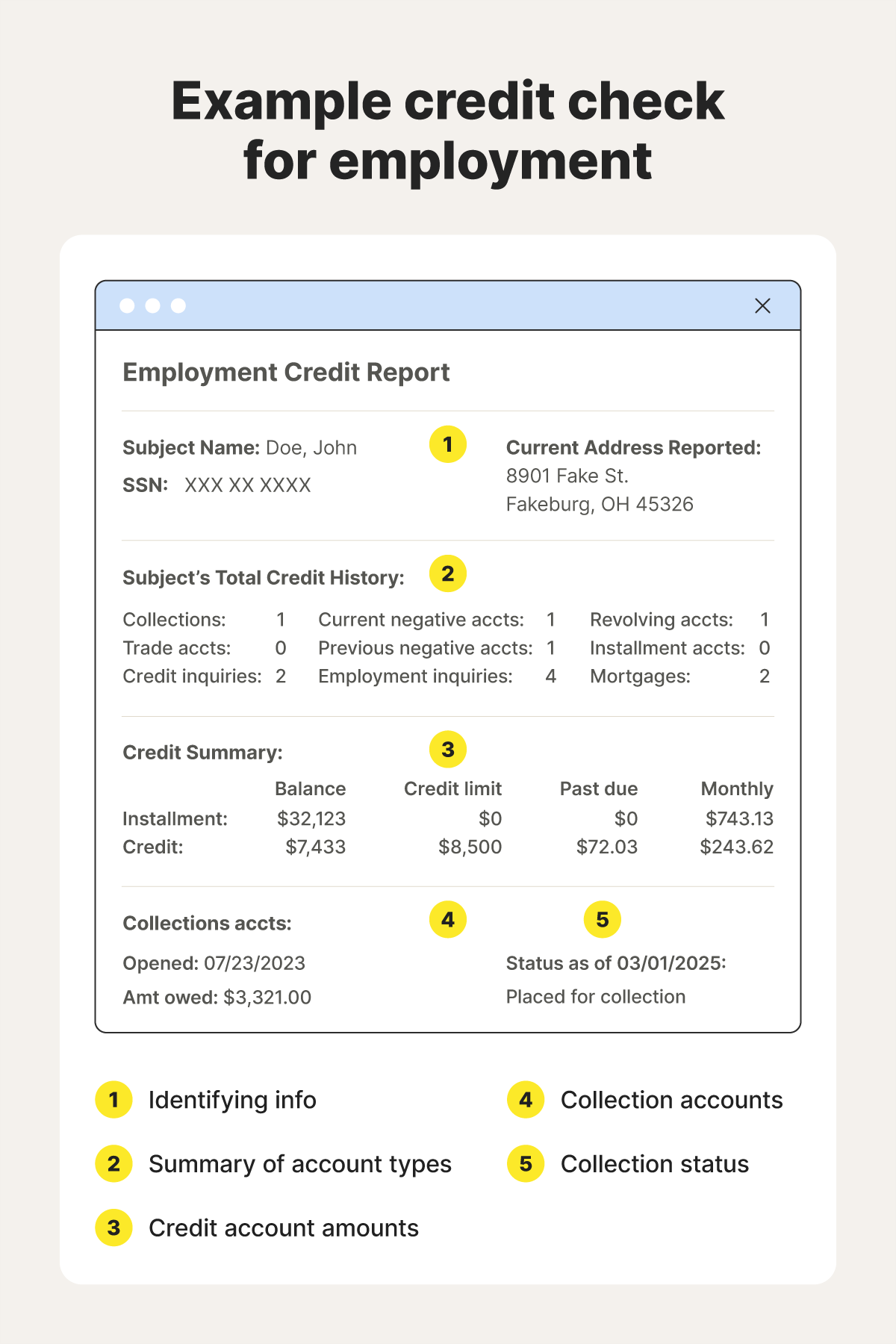

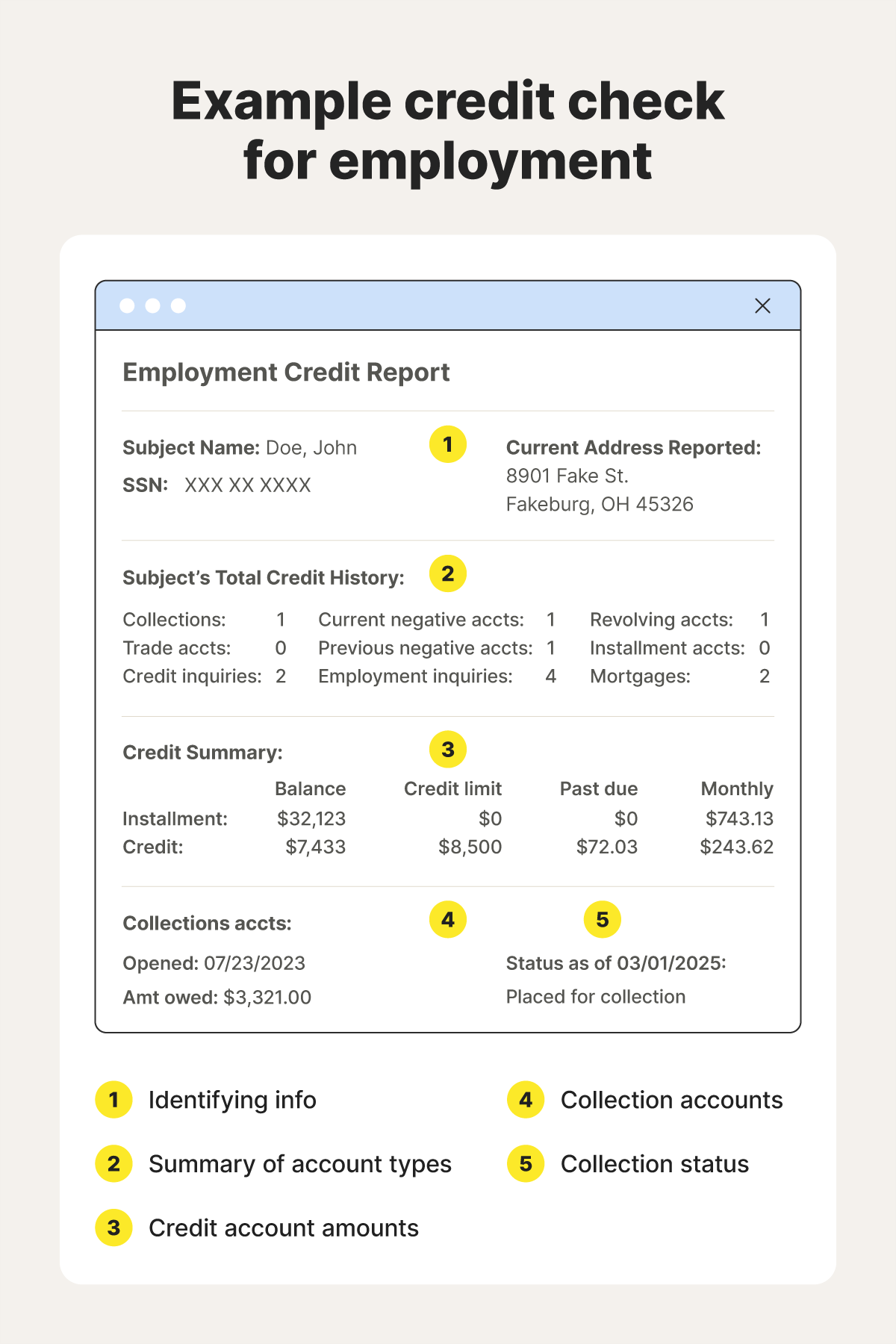

When conducting a credit check for employment, employers review identifying information, active credit accounts, payment history, and accounts in collections. These checks often provide data going as far back as seven years.

Employers will see the following information when making these requests:

Employment credit checks are less detailed than standard credit reports; they often exclude the following information:

Employment credit checks omit this information to prevent discrimination, helping to prevent unfair hiring practices by hiding certain personally identifiable information (PII).

Credit checks for employment do not hurt your credit score because they are soft inquiries, not hard inquiries. That means, even if you apply for multiple jobs in a short timeframe, you won’t suffer credit score damage. Hard inquiries are generally only used when you make new credit applications.

Before conducting a credit check for a job, employers must provide you with written notice and obtain your consent. You also have the right to receive a copy of the screening, challenge any inaccuracies, and request clarification if they reject your application based on credit data.

Here are the rights you need to know during a pre-employment credit screening, mostly based on the Fair Credit Reporting Act (FCRA):

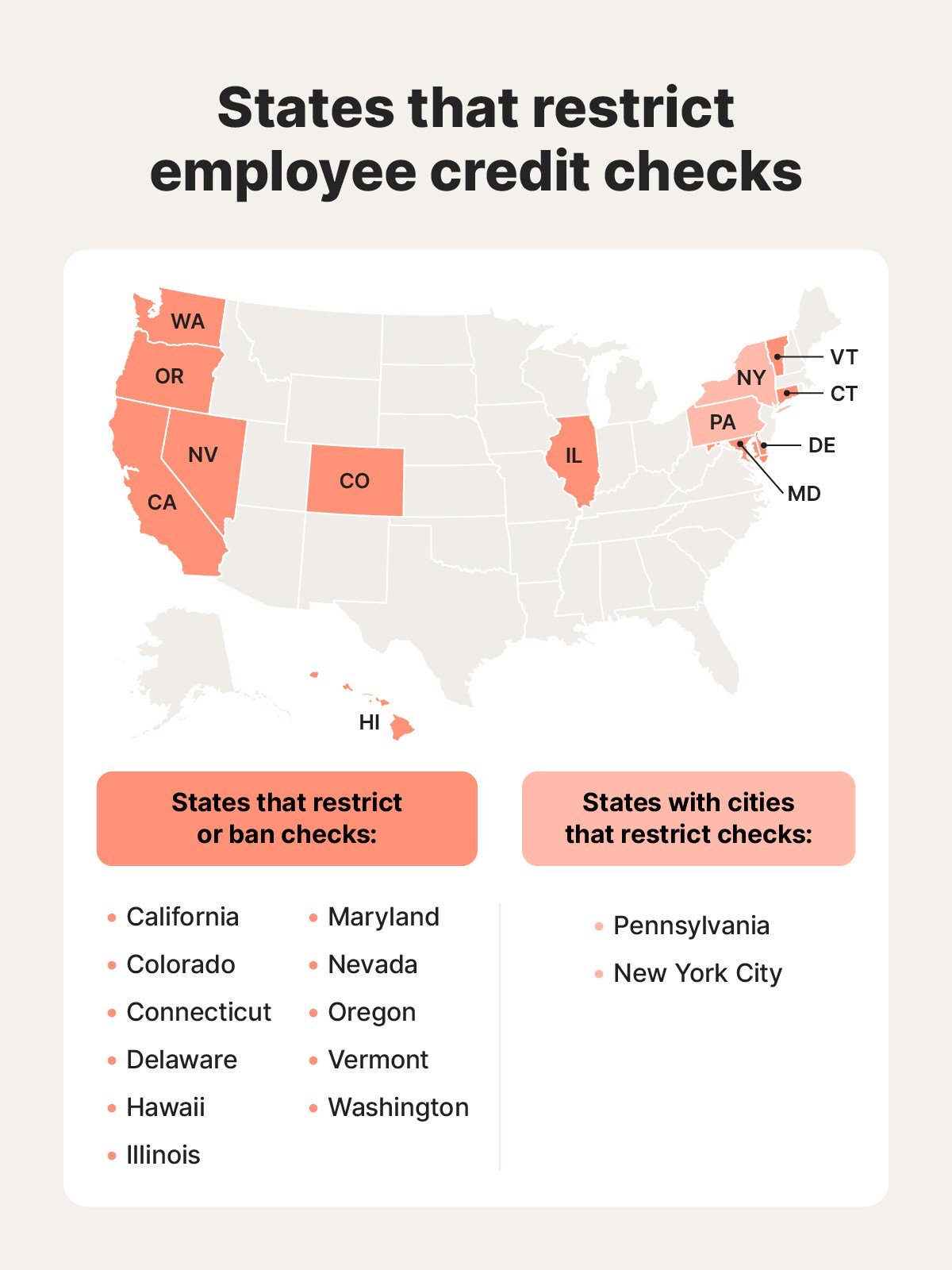

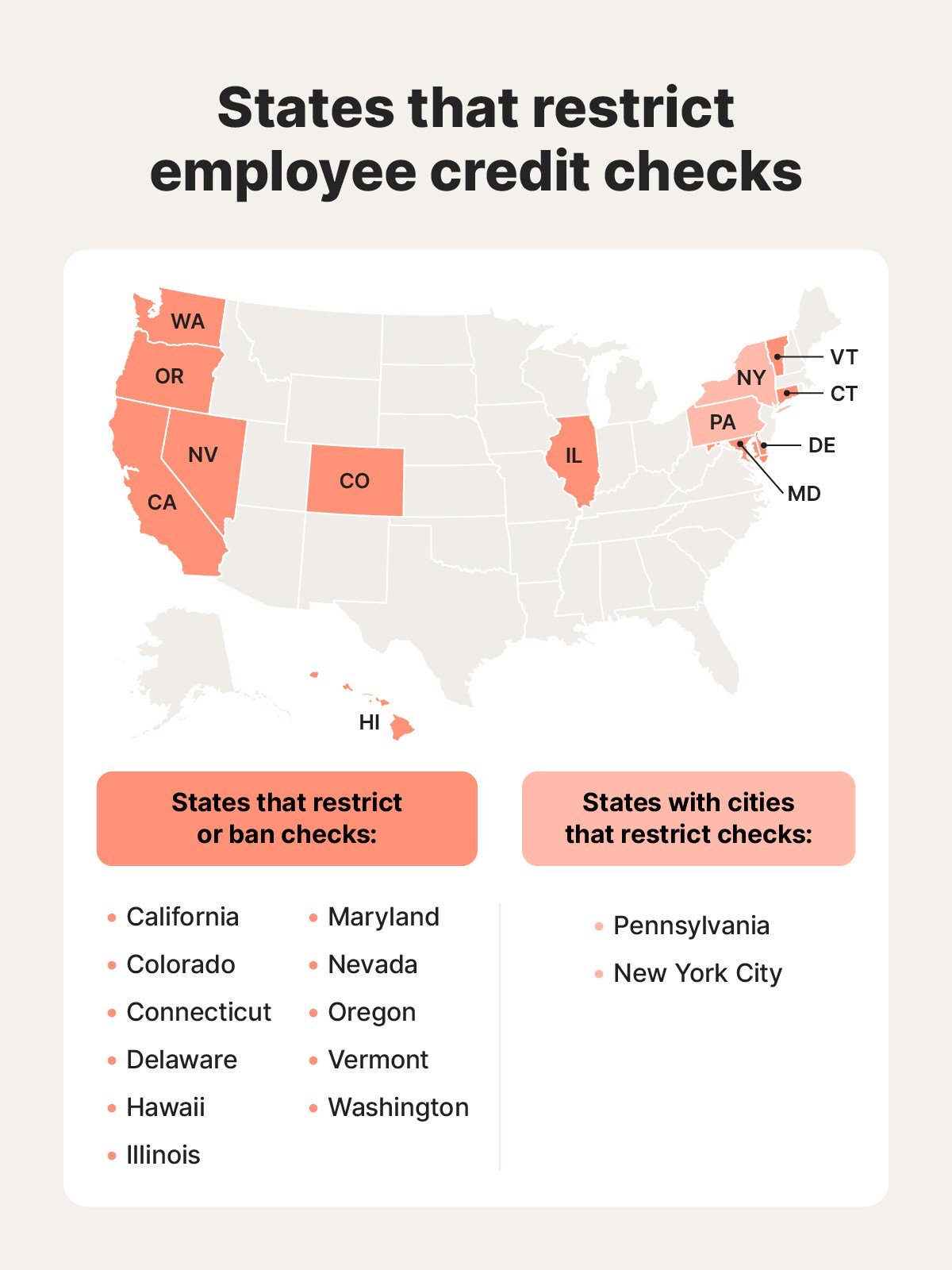

Several states have enacted legislation limiting the use of employment credit checks in the hiring process. States that ban or restrict credit checks for employment include California, Colorado, Illinois, Connecticut, Delaware, Maryland, Nevada, Oregon, Vermont, Washington, and Hawaii.

These are rarely outright prohibitions, but instead bans on employment credit checks before a conditional offer is made. Many of these states also have restrictions that prevent employers from running a credit check unless the information is materially relevant to the role.

In these states, credit checks for positions involving significant financial responsibilities, such as accounting or financial management, are generally still permitted.

Here are some links to each state’s unique labor laws:

If you’re confused about whether employment credit checks are allowed in your state or city, contact your local Department of Labor for details.

Before applying for jobs, get a copy of your credit report. Having this information on hand will help you understand the factors impacting your credit history, so you can take action to fix them or consider the best way to explain any issues employers might see on your report.

Once you get your credit report, follow these steps to make your employment credit check go smoothly:

For credit monitoring across all three of the major bureaus, join LifeLock Total. It’ll help you monitor your credit file for signs of fraud, track your progress with daily credit reports, and get alerts if you’re at risk of identity theft. Protecting your credit can help you improve your job prospects.

Pre-employment credit checks are a subject of some controversy, with critics claiming that they’re an extra barrier to employment for low-income job seekers. A Demos study revealed that 1 in 10 unemployed respondents were denied employment because of their credit.

Here are some other criticisms of the practice:

If it goes unchecked, credit-damaging fraud can harm your employability and your ability to get new credit. Monitor your credit for signs of unauthorized activity with LifeLock Total, and get daily credit reports that also help you track your credit-building progress.

No, pre-employment credit checks are a specific kind of background check focused on your credit history. Both credit and background checks could be part of the employment qualification process. Other types of background checks may include checks for criminal history, drug screenings, or employment and education verification.

Employers use pre-employment credit checks to assess employability, while creditors use regular credit checks to see if you qualify for a loan or credit card. Employment credit checks are less comprehensive and don’t impact your credit score.

Employers cannot see your credit score through an employment credit check. Some cities, such as New York City, have specific restrictions on what employers can ask about your credit history.

You may be able to check your credit score with tools offered by your credit card company or bank. Alternatively, you can keep up with your credit score through the daily updates that come with LifeLock Total.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.