What is a credit lock?

A credit lock, also known as a soft freeze, is a security feature credit bureaus offer when you want to limit access to your credit report but still want to be able to apply for new credit easily. A credit lock prevents unauthorized access to your credit report, making it harder for cybercriminals to open new accounts in your name. You can place or remove a credit lock online or by phone.

While a credit lock is in place, potential lenders won't be able to access your credit report, effectively stopping them from opening new lines of credit in your name. Protecting your credit information is crucial, because identity theft is a serious threat.

This guide will walk you through how to lock credit at Equifax®, Experian®, and TransUnion®—the three major credit bureaus.

How to do a credit lock at each bureau

To lock your credit at each credit bureau, you need to contact each of them directly —unlike a credit freeze, credit locks require separate enrollment at each of the major bureaus. While convenient for quick on-and-off access, lock at all three bureaus for maximum protection.

Each credit bureau offers multiple methods for placing a credit lock:

- Online: This is typically the fastest and most convenient option. You'll need to create an account or log into your existing account with each bureau.

- Phone: You can call their customer service line to request a credit lock. Be prepared to answer some verification questions.

- Mail: While it’s the slowest method, you can also submit a credit lock request by mail. Download and complete the necessary form from each bureau's website.

When contacting each bureau, be prepared to provide the following information:

- Your full name

- Date of birth

- Social Security number (SSN)

- Individual Taxpayer Identification Number (ITIN)

- Current and past addresses

It's important to note that while placing a credit lock is free initially, some bureaus may charge a small fee to remove it in the future.

Experian

You can lock your Experian report through their credit monitoring services by communicating via these channels:

- Online: Visit the Experian website and navigate to the Credit Lock section.

- Phone: Call Experian's customer service line at 1-888-397-3742 (1-888-EXPERIAN) to request a credit lock.

- Mail: Download and complete Experian's credit lock request form from their website and mail it to P.O. Box 4500, Allen, TX 75013.

Experian doesn’t currently offer a free credit lock removal option.

Equifax

To lock your Equifax credit report, visit their website or call their toll-free number for a quick and free process:

- Online: Visit the Equifax website and navigate to the Security Freeze section.

- Phone: Call Equifax's customer service line at 1-888-378-4329 (1-888-EQUIFAX) to request a credit lock.

- Mail: Download and complete Equifax's credit lock request form from their website and mail it to P.O. Box 740256, Atlanta, GA 30374-0256.

Equifax offers a free credit lock removal option.

TransUnion

You can lock your TransUnion credit report via the following methods:

- Online: Visit the TransUnion website and navigate to the Credit Lock section.

- Phone: Call TransUnion's customer service line at 1-800-916-8800 to request a credit lock.

- Mail: Download and complete TransUnion's credit lock request form from their website and mail it to P.O. Box 2000, Chester, PA 19016-2000.

TransUnion offers a free credit lock removal option.

Advantages and disadvantages of a credit lock

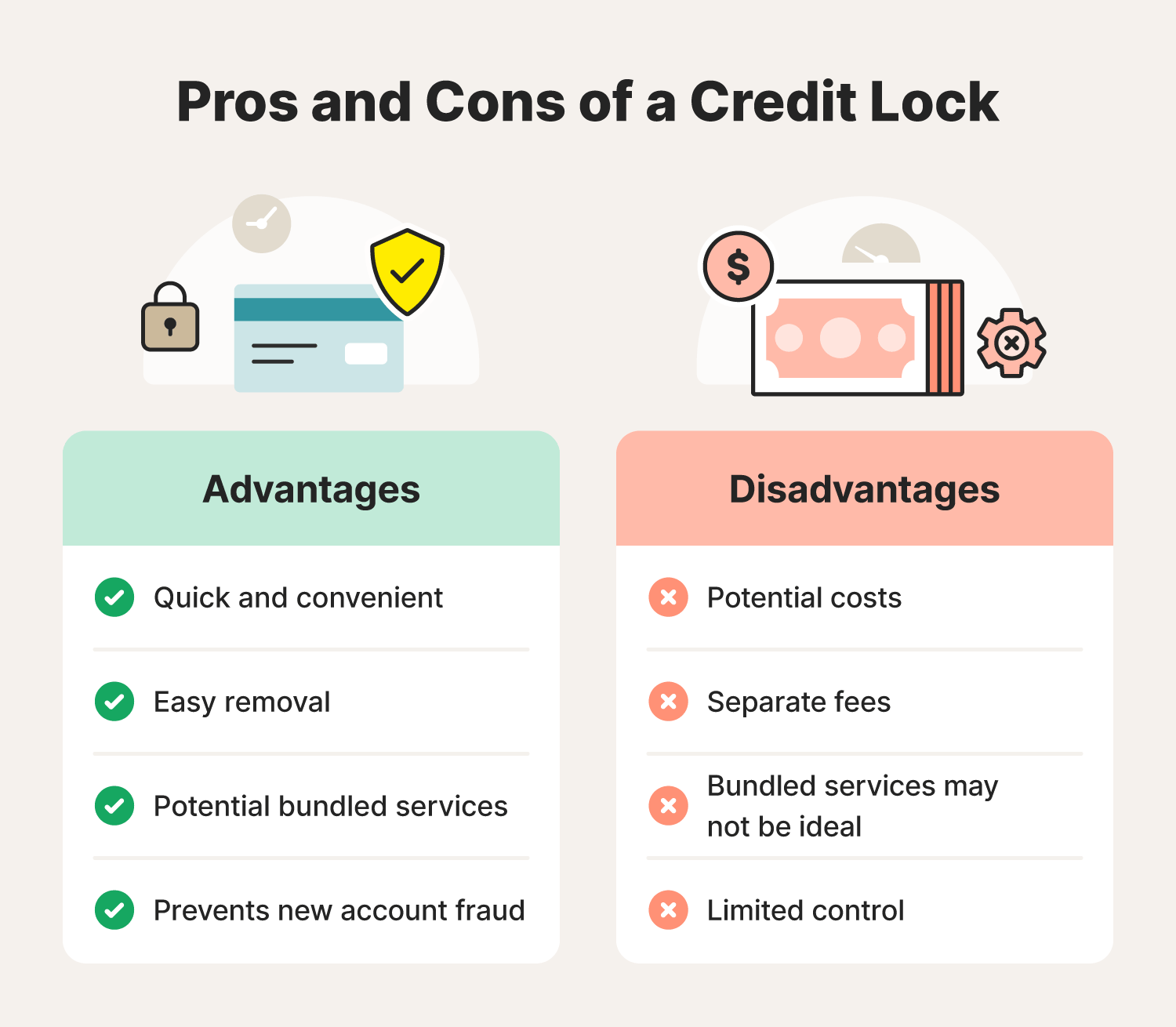

Credit locks provide the advantage of easier access to your credit report for approvals when needed, but they may come with a fee and might not offer the same level of security as a freeze.

Here's a closer look at the pros and cons of using a credit lock to help you decide if it's the right security measure for you.

Pros of a credit lock

When safeguarding your credit information, credit locks offer several advantages, including:

- Speed and convenience: A credit lock can be activated and deactivated more quickly than a credit freeze. This allows for greater flexibility, especially if you anticipate applying for new credit soon, such as a mortgage or car loan.

- Easy removal: Unlike a freeze, which can take days to remove, a credit lock can typically be lifted almost instantly online or by phone.

- Potential bundled services: Some credit card companies or identity theft protection services may offer credit lock features as part of their package. This can be a convenient way to access a credit lock without additional fees.

- New account fraud protection: The primary benefit of a credit lock is that it restricts access to your credit report.

A credit lock acts as a security gatekeeper, helping to stop unauthorized access and keep your financial information safe.

Cons of a credit lock

While credit locks offer convenience and flexibility, they have some drawbacks, including:

- Potential costs: While placing a credit lock may be free initially, some bureaus charge a fee to remove it.

- Separate fees: Unlike a credit freeze, credit lock services might not be included with your account and could incur separate charges.

- Unnecessary bundled services: Credit lock features offered through credit cards may come with additional services you don't necessarily need.

- Limited control: Credit locks typically have a set expiration date or are tied to the service you obtain them through. This means you may need to renew or re-lock your credit periodically, depending on the provider.

Weigh these drawbacks against the benefits to determine if a credit lock is the right choice for your financial security needs.

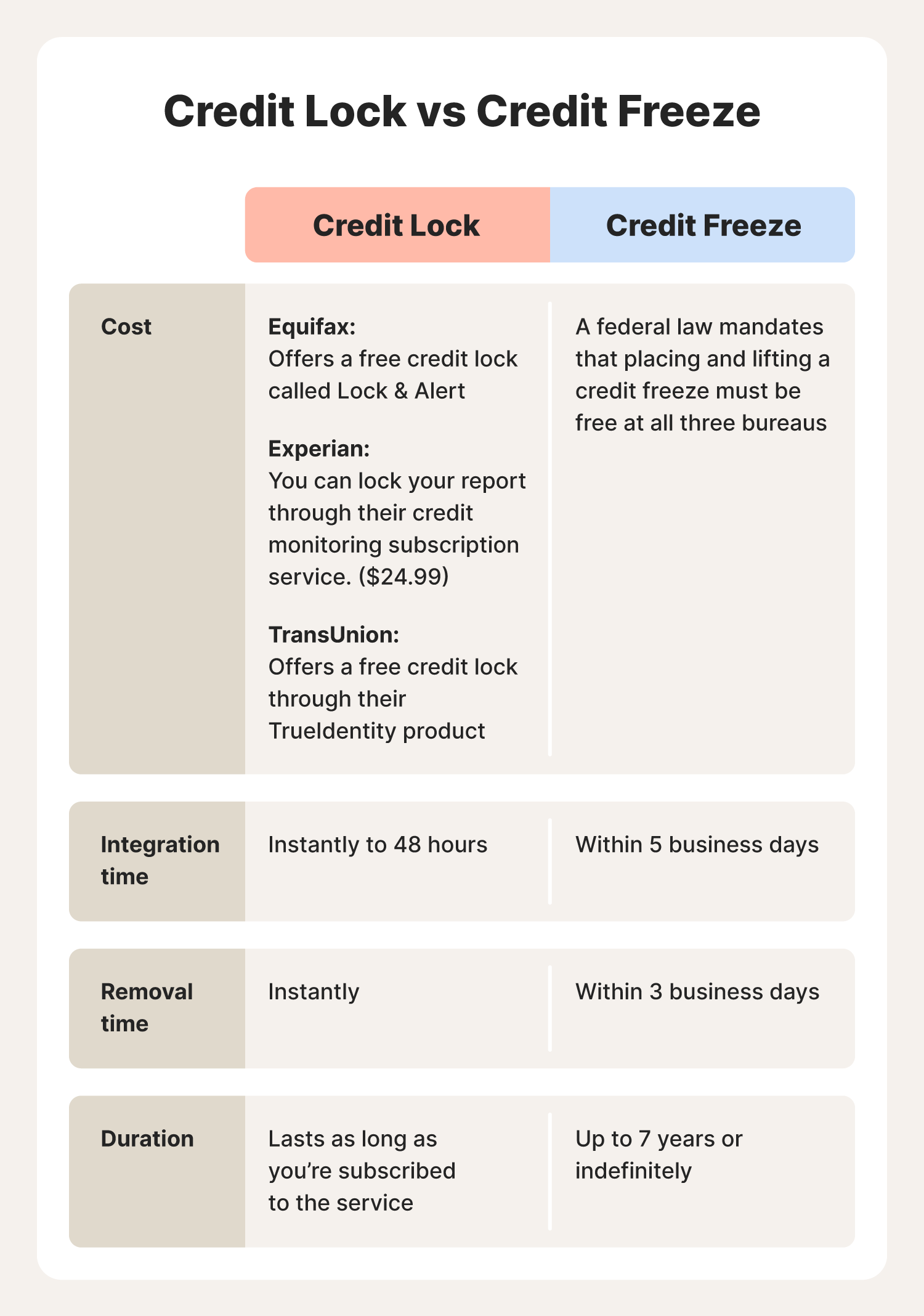

Credit lock vs. credit freeze

Both credit locks and credit freezes help protect against identity theft, but they have some key differences. A credit lock might be suitable if you value convenience and flexibility, whereas a credit freeze may be the better option if you prioritize cost-effectiveness and long-term protection.

Here's a quick breakdown to help you decide which option is best for you:

Activation and deactivation

- Credit lock: Generally faster and easier to activate and deactivate, often possible online or by phone

- Credit freeze: Typically requires contacting each bureau by mail or phone and can take several days to activate or deactivate

Fees

- Credit lock: Depending on the bureau or service used, there may be fees associated with placing or removing the lock

- Credit freeze: Federally mandated to be free to place and remove at all three bureaus

Control

- Credit lock: This may have expiration dates or be tied to a service, requiring renewal or re-locking

- Credit freeze: Generally remains in place indefinitely until you remove it

Reasons to lock your credit

Locking your credit offers a powerful layer of security for your financial well-being. Here are some compelling reasons to consider placing a credit lock on your reports at all three major bureaus:

- Prevent unauthorized access: A credit lock acts as a gatekeeper, restricting access to your credit report. This makes it significantly harder for criminals to view your sensitive financial information.

- Minimize identity theft risk: By locking your credit, you significantly reduce the risk of identity thieves using your personal information to open new accounts in your name.

- Protect your information: A credit lock helps safeguard your Social Security number, addresses, and other sensitive personally identifiable information within your credit report from falling into the wrong hands.

- Maintain credit score: Unauthorized access to your credit report can lead to fraudulent activity that could negatively impact your credit score. A credit lock helps prevent this from happening.

- Control who sees your credit: With a credit lock, you choose who can access your credit report. This empowers you to only manage and share your financial information with authorized lenders.

- Be proactive: Taking a proactive approach to securing your credit is crucial in today's digital world. A credit lock adds an extra layer of defense against potential threats.

- Reclaim peace of mind: Knowing your credit is locked down can significantly reduce stress and anxiety. You'll gain peace of mind knowing your financial information is protected.

Tips for protecting your credit report

Your credit report is vital to your financial well-being, so safeguarding it is crucial. Here are some key tips to help you keep your credit report safe and protect against identity theft.

- Regularly monitor your credit report for any suspicious activity or inaccuracies.

- Use strong, unique passwords for your financial accounts and change them periodically.

- Be cautious when sharing personal information online or over the phone, especially with unfamiliar entities.

- Enable two-factor authentication for added security on your financial accounts.

- Shred or securely dispose of sensitive documents, such as bank statements and credit card offers.

- Avoid clicking on suspicious links or downloading attachments from unknown sources in emails or text messages.

- Review your financial statements regularly for any unauthorized transactions.

- Be aware of phishing scams and never provide personal information in response to unsolicited requests.

Learn how to lock your credit with confidence

Learning how to confidently lock your credit is an important element in protecting your personal information—but it’s just one small part of a much larger process.

With LifeLock, safeguarding your identity can be a whole lot easier thanks to a range of identity theft protection features, including credit monitoring that alerts you to potentially unauthorized updates to your credit file.

FAQs about how to lock credit

Still have questions about how to lock credit? We’ve got you covered.

Does a credit lock prevent soft inquiries?

No, a credit lock does not block soft inquiries into your credit for things like pre-approved credit offers or checking your credit score.

What happens when you lock your credit?

A credit lock restricts access to your credit report, making it harder for lenders to approve new credit applications in your name. By preventing unauthorized access to your credit report, a credit lock also helps block fraudsters from accessing your credit details and other personal information.

What is a fraud alert?

A fraud alert adds a note to your credit report warning creditors of potential fraud, making them take extra steps to verify your identity before approving new credit.

How long does a credit lock last?

Credit lock durations vary depending on the bureau, but they typically expire after one year and must be renewed.

Will a credit lock affect your credit score?

No, placing a credit lock or a freeze on your credit report will not affect your credit score.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.