Credit card fraud is one of the most common forms of identity theft, and it’s evolving fast. In our Q1/2025 Threat Report, we discovered a 186% surge in breached records, some of which included credit card numbers, putting victims at risk of credit card fraud.

As scammers find new ways to steal card information, staying informed on the latest credit card fraud statistics and trends can help you recognize the risks and protect yourself. Keep reading to learn more about how credit card fraud happens, who’s most at risk, and what’s at stake.

Key credit card fraud statistics

Credit card fraud impacts millions of victims in the U.S. every year. The stats below highlight just how widespread the risk is.

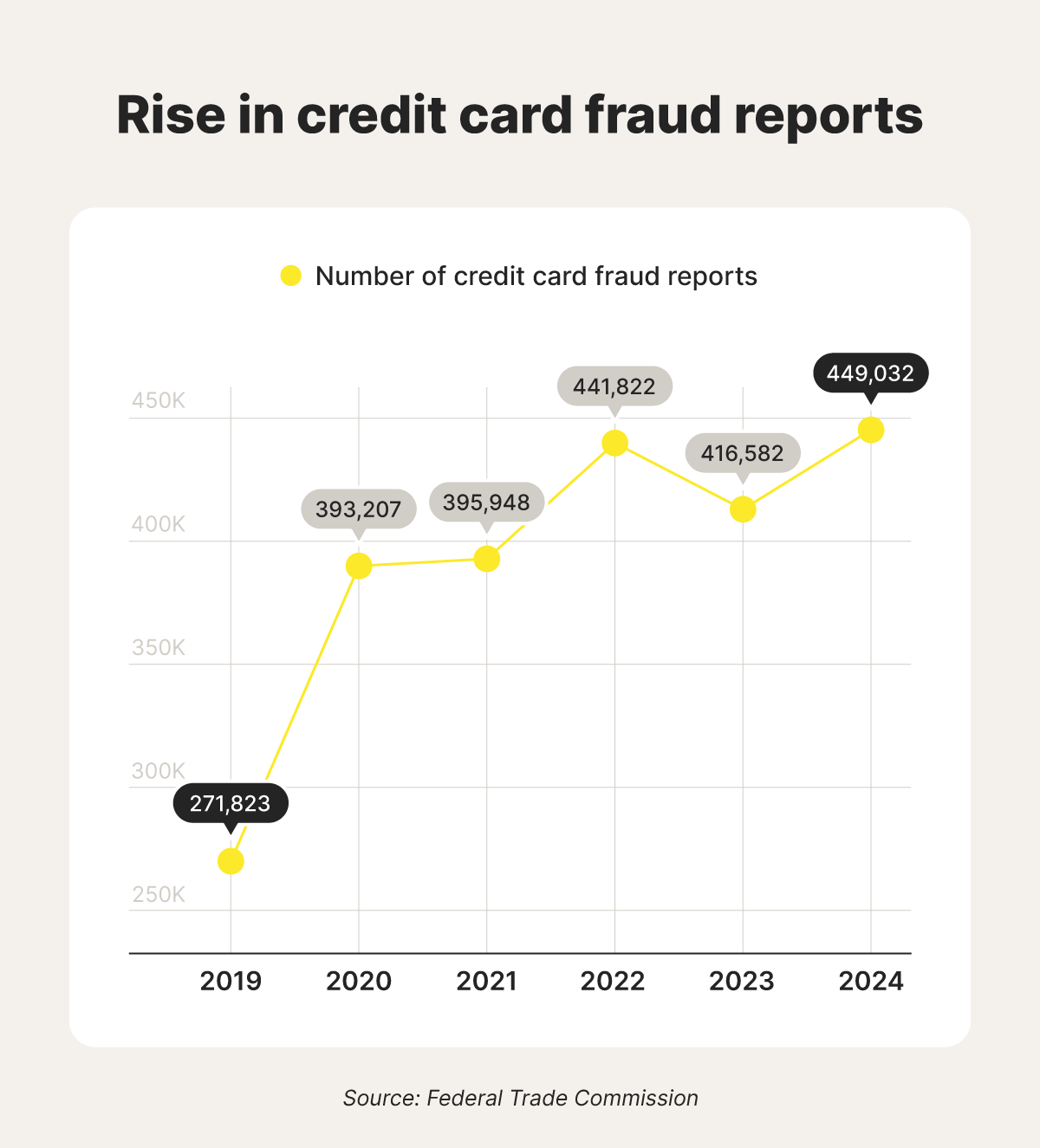

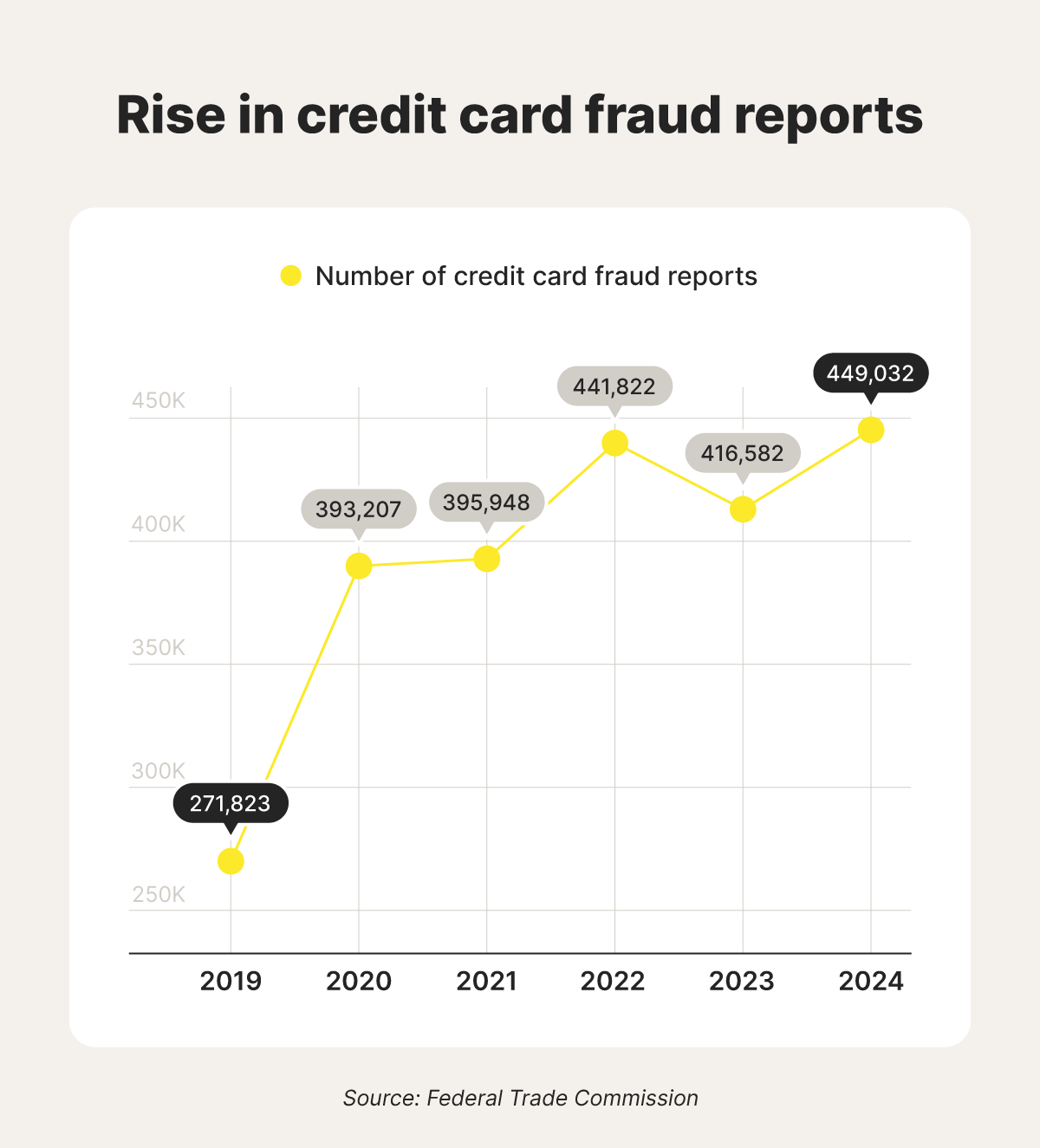

1. Credit card fraud was the most commonly reported type of identity theft in 2024, with the FTC receiving over 449,000 reports. That’s an 8% increase from the 416,000 cases reported in 2023.1

2. Over 151,000 cases of credit card fraud were reported in the first quarter of 2025.2

3. More than a quarter of U.S. consumers experienced credit card fraud in 2023, according to research from PYMNTS.3

4. 62 million Americans had fraudulent charges on their credit or debit cards in 2024, according to Security.org research.4

5. 63% of U.S. credit card holders have been targeted by credit card fraud at some point, with 51% experiencing it multiple times.4

Most common types of credit card fraud

Credit card fraud can take many forms, including card-not-present fraud, credit card skimming, new account fraud, and existing account fraud. Here's a closer look at the most common types of credit card fraud.

6. Card-not-present fraud, when a criminal uses stolen card information to make purchases online or over the phone without access to a physical card, is one of the most common forms of credit card fraud. It was estimated to represent 73% of credit card fraud losses in 2023.5

7. Credit card skimming costs consumers and financial institutions over $1 billion annually, according to FBI estimates.6

8. New account fraud, when someone opens a credit card using stolen personal information, rose 7% from 2023 to 2024, with over 406,000 reports filed.1

9. Existing account fraud, which involves unauthorized use of a victim’s current credit card, increased by 17% during the same period, with over 52,000 reported cases in 2024.1

Most common causes of credit card fraud

Criminals use numerous tactics, like taking advantage of data breaches or deploying deceptive phishing attacks, to steal credit card numbers. Here's a deeper diver into some of the most common causes of fraud and strategies used by fraudsters.

10. Email was the most common method of contact used by fraudsters in 2024, followed by phone calls and text messages.1

11. Imposter scams, when a fraudster pretends to be someone from a trustworthy organization in their approach, are the most common type of fraud, involved in over 200,000 reports to the FTC in the first quarter of 2025.7

12. 84% of cardholders admitted to practicing unsafe credit card habits, like using the same cards for autopay and everyday spending, sharing passwords across multiple accounts, and storing credit card information in their browser, according to data from Security.org.4

13. Over 1.3 billion individuals were affected by compromises like data breaches and data leaks in 2024. Leaked data often includes financial information, putting affected individuals at risk of credit card fraud.8

Highlighting the potential threat posed by data breaches, the 2024 Slim CD cyberattack endangered the sensitive data of up to 1.7 million people. Hackers had access to the payment processor’s systems for nearly 10 months, potentially compromising credit card numbers, expiration dates, names, and addresses across U.S. and Canadian merchants.

While Slim CD has not confirmed any resulting cases of fraud, security experts caution that stolen credit card data is frequently sold on the dark web and can be exploited months — or even years — after a breach is discovered and contained.

If your information was exposed in a data breach, identity theft protection can help you stay ahead of potential threats by monitoring for signs of misuse, such as your credit card data surfacing on the dark web, and notifying you quickly so you can take action to protect your identity.

Consequences of credit card fraud

Credit card fraud can lead to serious financial and personal consequences, from out-of-pocket losses to long-term damage to your credit profile. Here’s a statistical snapshot look at the potential impacts of credit card fraud.

14. In 2024, total reported losses due to credit card fraud reached $275 million.1

15. 7% of respondents to a Security.org survey said fraudulent charges were never refunded, or their case was still pending.4

16. Victims of credit or debit card fraud in 2025 experienced a median loss of $100 in fraudulent charges.4

The consequences of credit card fraud often extend well beyond the initial shock or inconvenience — it can have lasting effects on your financial well-being.

One Reddit user shared a cautionary tale about how a family member secretly opened a credit card in their name and accumulated charges without their knowledge. After reporting the fraud and closing the account, the bank assured them there was nothing to worry about. But months later, the unpaid balance was sent to collections, seriously damaging their credit score.

Credit card fraud demographics

Certain age groups and communities are more frequently targeted by credit card fraud than others. Here’s a breakdown of which demographics reported the highest numbers in 2024.

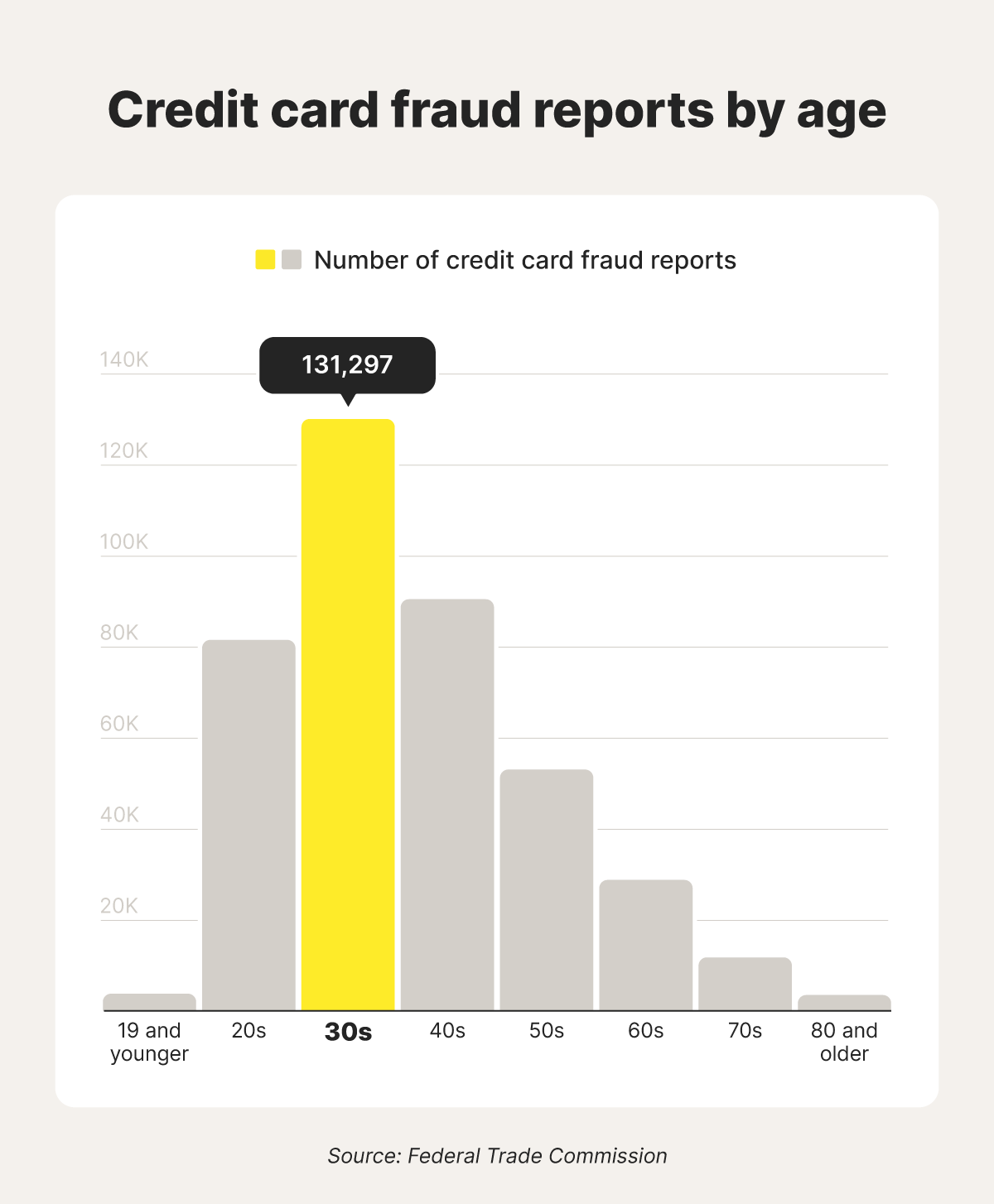

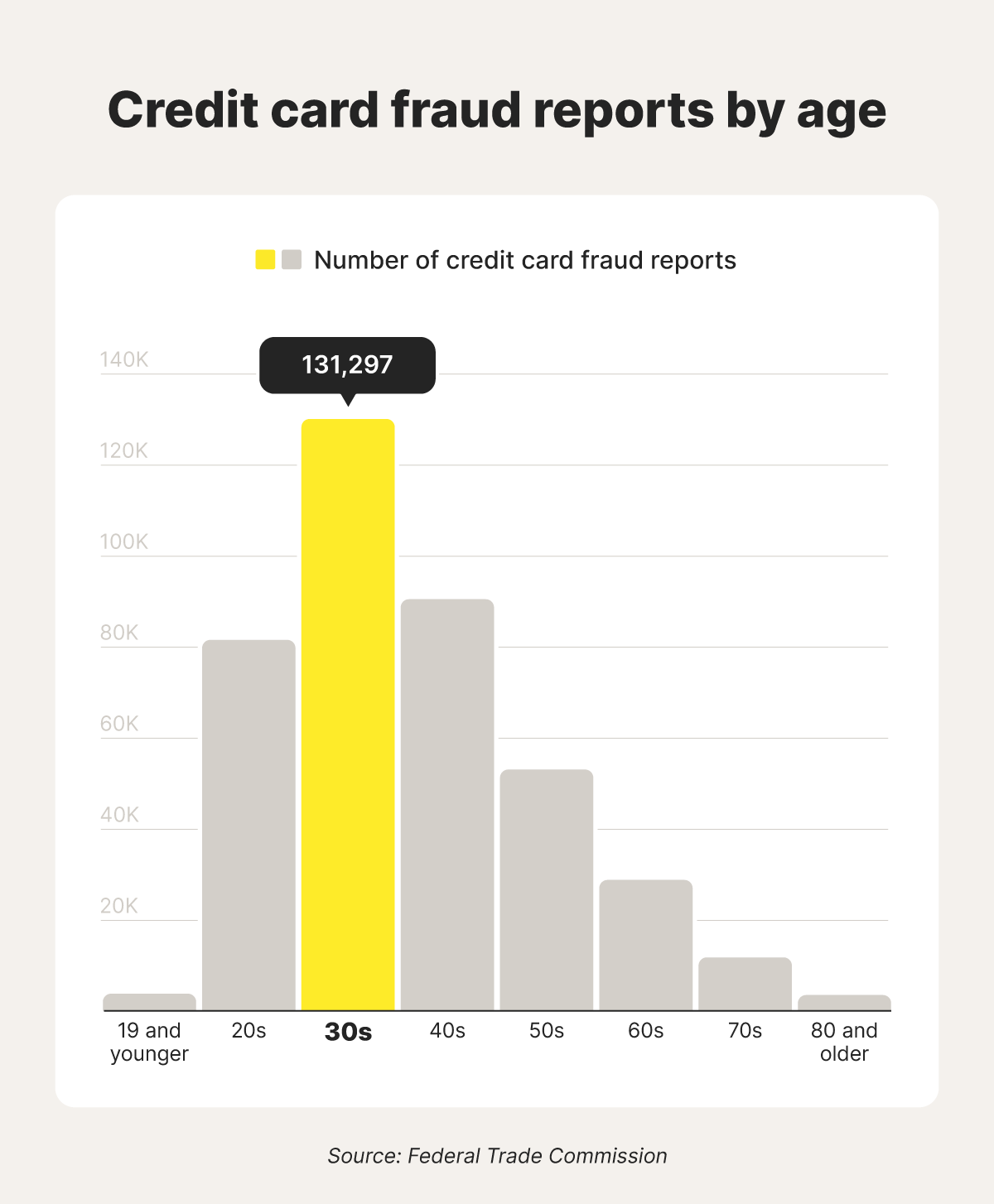

17. Individuals aged 30-39 reported the most cases of credit card fraud, with over 131,000 reports.1

18. Individuals aged 40-49 were the second most targeted group in 2024, reporting nearly 90,000 cases of credit card fraud.1

19. Individuals 19 and under were the least affected but still filed more than 2,000 reports.1

20. Among military service members, credit card fraud was the most common type of identity theft, with over 14,000 cases reported in 2024.1

Credit card fraud emerging trends

As AI technology advances, criminals are using it to craft more convincing AI scams that end with credit card fraud. At the same time, companies are leveraging AI to help detect and prevent fraud more effectively. Here’s a closer look at how AI is shaping both sides of the credit card fraud landscape.

21. An estimated 42.5% of detected fraud attempts use AI, including 29% of fraud attempts considered successful.9

22. The good news? More brands like Norton and Mastercard are using AI to help detect fraud. Research shows that AI-powered fraud detection tools achieve detection rates of 87-94%.10

Don’t become a statistic, defend against credit card fraud

Credit card fraud continues to evolve, but staying informed is your first line of defense. Understanding the risks, how scams work, and who’s most affected can help you spot warning signs before damage is done.

For additional protection, join LifeLock to help reduce online exposure of your sensitive information and get alerts about data breaches that may have left you exposed. You’ll also benefit from credit monitoring that can help you detect the signs of fraud if you’re targeted, so you can take action to minimize the consequences.

FAQs

What is the punishment for credit card fraud?

The punishment for credit card fraud depends on the jurisdiction, the amount of money involved, and whether it’s charged as a misdemeanor or felony. It can include fines, restitution, and jail time, ranging from a few months to over 20 years for serious offenses.

How will I know if my credit card information has been stolen?

If your credit card information has been stolen, you may notice unfamiliar charges, declined transactions, or alerts from your bank. Regularly check your statements and credit report for suspicious activity.

What should I do if someone uses my credit card or opens an account in my name?

Report the fraud to your credit card issuer immediately, file a report with the FTC, and place a fraud alert on your credit reports. You may also want to report the incident to your local police department.

What is the connection between credit card fraud and identity theft?

Credit card fraud is a form of identity theft. It occurs when someone uses your personal information, such as your credit card number, name, or Social Security number, without your consent to make unauthorized purchases or open new accounts in your name.

Resources:

- Consumer Sentinel Network Data Book 2024 - Federal Trade Commission, March 2025

- Identity Theft Reports - Federal Trade Commission, April 2025

- Credit Card Fraud Fears Can Drive Consumers to Switch Banks - PYMNTS, September 2024

- 62 Million Americans Experienced Credit Card Fraud Last Year - Security.org, January 2025

- Card-not-present fraud to make up 73% of card payment fraud - EMARKETER, January 2023

- Skimming - FBI, May 2025

- The Big View: All Sentinel Report by Federal Trade Commission - Tableau Public, 2025

- Annual number of data compromises and individuals impacted in the United States from 2005 to 2024 - Statista, February 2025

- The Battle Against AI-driven Identity Fraud - Signicat, 2025

- AI-driven fraud detection in banking: A systematic review - GSC Advanced Research and Reviews, November 2024

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.