Tip: Unsolicited contact, an undue sense of urgency, too-good-to-be-true offers, suspicious requests for payment or personal information, and numbers marked as potential spam are all red flags you can use to potentially identify a scammer.

After falling for a scam, you might feel anxious, embarrassed, and helpless. But acting quickly can help you limit the damage and protect your finances, data, and identity. Follow these steps if you’ve been scammed to start the recovery process.

Stop talking to the scammer

As soon as you realize you’re being scammed, cut contact with the scammer. You may be tempted to try and resolve the issue directly or get more details that you can use to report the incident, but continuing to communicate could give the scammer time to cause more harm, making it harder for you to recover.

If you’re speaking to them on the phone, hang up immediately and block their number. If you’re communicating over email or an instant messaging service, stop replying. Then, note down their contact details and take screenshots of any relevant messages before reporting them on the platform where you’ve been communicating.

Protect your finances

Ultimately, most scams are designed to steal your money, so protecting your finances is crucial when you realize you’ve been scammed.

The steps you should take depend on what type of scam you encountered and what information you gave the scammer. Key actions to safeguard against financial fraud include alerting your bank or credit card company, reversing fraudulent charges, setting up credit protection, and getting an IP PIN from the IRS.

Here’s some more detail on how you can help protect your finances if you’ve been scammed:

Alert your bank and credit card provider

If you gave any financial details away to the scammer, like your bank account number, credit card information, or payment app password, prioritize calling your bank or card issuer to alert them to potential fraud.

They can help you take appropriate steps to protect your finances, including setting up notifications for payments or transfers, canceling a card, or freezing an account altogether. They may also be able to reverse fraudulent transactions that have already been made by the scammer.

Here are the contact details for the fraud departments of some major banks and credit card companies:

Financial institution |

Fraud support number |

|---|---|

JP Morgan Chase |

800-978-8664 |

Bank of America |

800-432-1000 |

Wells Fargo |

800-869-3557 |

Citi Bank |

800-248-4226 |

American Express |

800-528-4800 |

While some banks refund scammed money in certain cases, they’re more likely to reverse transactions that you can verify were unauthorized. Generally, the quicker you contact them, the greater the chance you’ll get your funds back.

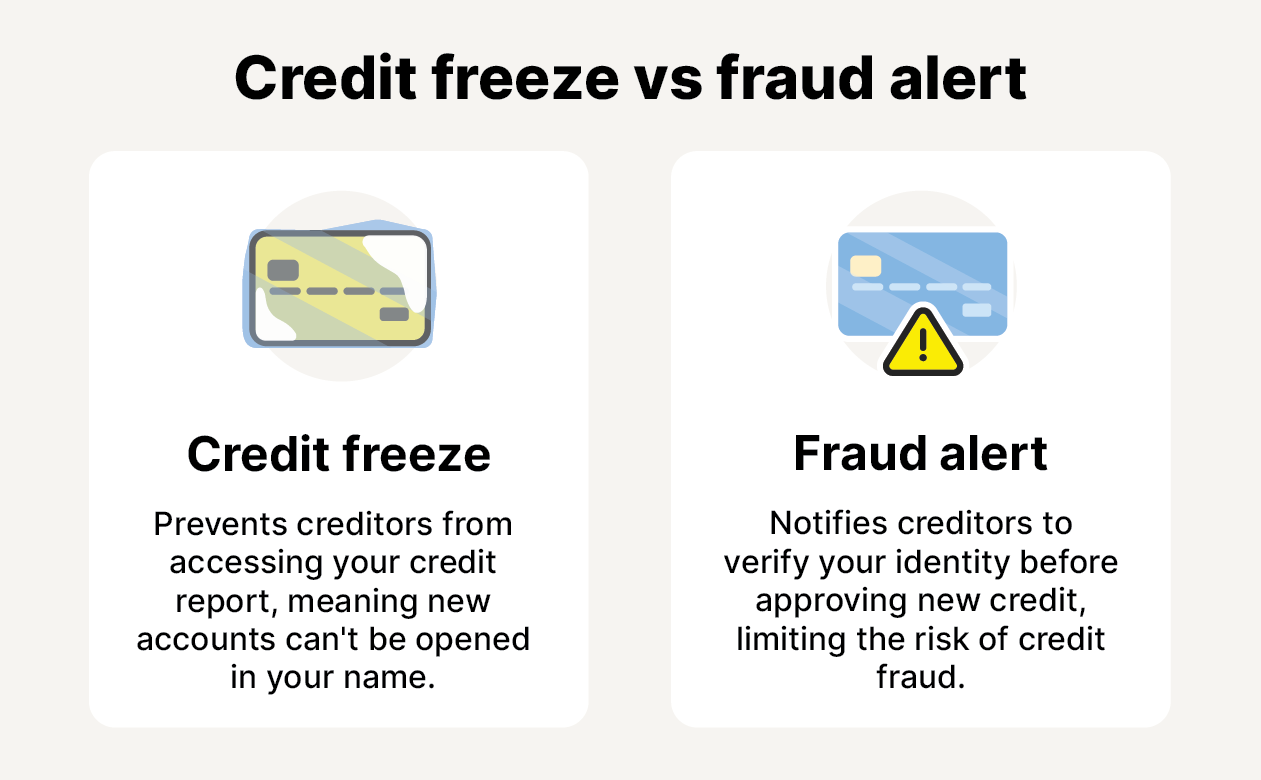

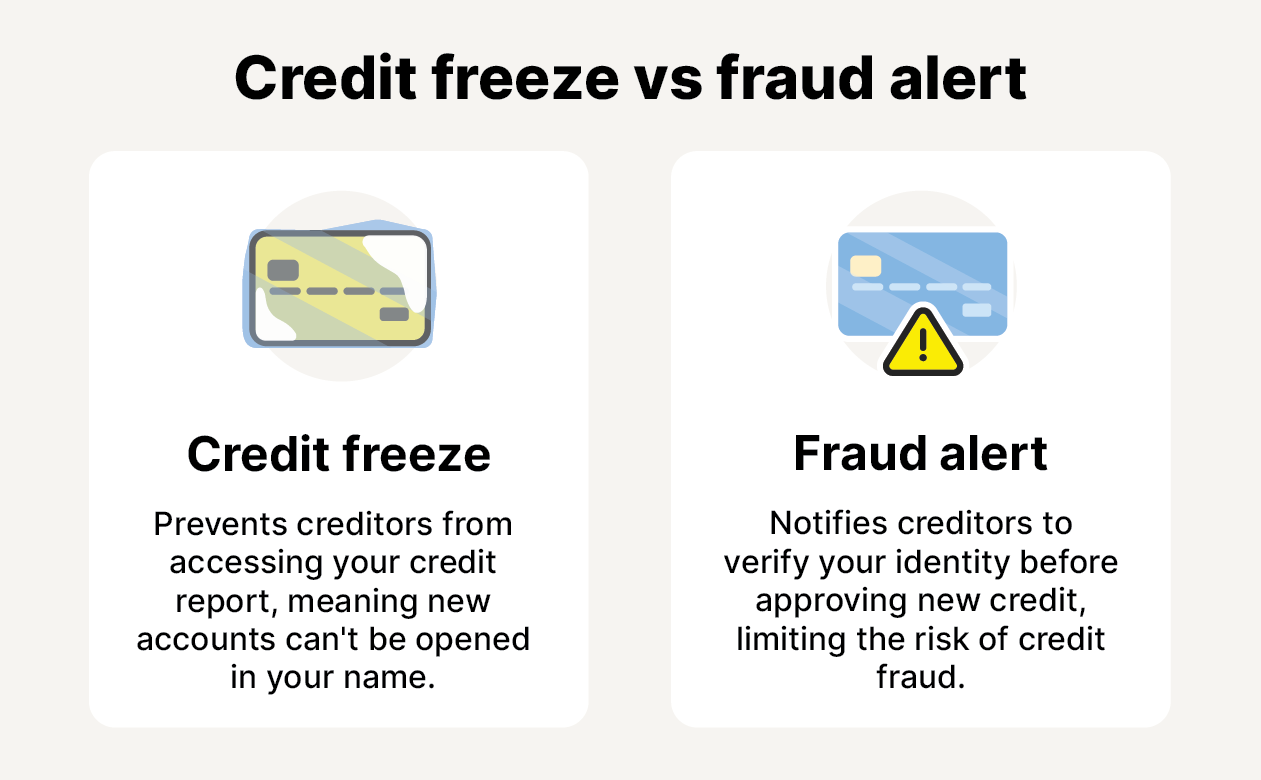

Place a credit freeze or fraud alert

If you gave a scammer sensitive information they could use in credit fraud, setting up credit protection is an essential step to safeguard both your finances and your credit score. You can help protect your credit with a credit freeze or fraud alert — both tools that make it more difficult for fraudsters to access credit in your name.

Information that can leave you vulnerable if compromised includes your:

- Social Security number (SSN).

- Driver’s license or passport number.

- Full name and date of birth.

- Credit card number (including the CVV).

- Bank account number.

Contact the credit bureaus as soon as possible after being scammed to report potential fraud and set up a credit freeze or place a fraud alert.

A credit freeze restricts access to your credit report, preventing creditors and lenders from accessing your file. This helps stop fraudsters from opening new credit accounts in your name, as they won’t be able to trigger a credit check.

You have to contact each of the three credit bureaus to freeze your credit, using the following contact information:

A fraud alert, on the other hand, notifies creditors and lenders that you may be vulnerable to credit fraud, and prompts them to contact you to verify your identity whenever a credit application is made in your name. It’s slightly less secure than a credit freeze, but it means you’ll still be able to make credit applications yourself.

You only have to contact one of the credit bureaus to set up a fraud alert, and they’ll notify the other two. Contact them using the following details:

If you’re worried about the steps involved in freezing your credit and placing a fraud alert, consider LifeLock Advanced: as a member, you’ll get access to a convenient Freeze Center that provides easy instructions for freezing credit, bank, and utility files — all in one place.

Plus, the TransUnion Credit File Lock and Payday Loan Lock features will help you block unauthorized account openings, keeping you safer from identity theft.

Get an Identity Protection PIN

Scammers with access to sensitive or personally identifiable information (PII) like your name, SSN, or financial details may try to target you with a tax scam or steal your identity to steal your tax return. Contact the Internal Revenue Service (IRS) to create an Identity Protection PIN (IP PIN) to help protect against this risk.

The PIN is a unique six-digit code that’s required to verify your identity when you file a return. Without it, scammers won’t be able to complete the submission process, meaning your return should stay safe.

To get an IP PIN, visit the IRS website, sign in to your online account, and select the option on the Profile page.

Monitor your credit report

Regardless of the protections you put in place following a scam, it’s important to monitor your credit report in the weeks and months following the incident. Look out for any suspicious activity that could be a sign of fraud.

Potential red flags that might indicate you’re being targeted by a fraudster include:

- New accounts you don’t recognize.

- Hard credit inquiries you didn’t authorize.

- Incorrect personal information (name, SSN, etc.).

- Sudden, unexplained credit score drop.

To monitor for these warning signs, you can request a free copy of your credit report weekly from AnnualCreditReport.com or use the credit reports provided by your bank or credit card issuer, if you qualify for them.

Alternatively, invest in a credit monitoring service for automatic updates of unusual activity that may indicate fraud.

Get identity theft protection with LifeLock that includes credit monitoring features to help watch out for potential signs of fraud. Along with other identity theft protection tools, like SSN notifications and dark web monitoring, it can help you stay more alert for potential fraud following a scam.

Secure your accounts

Not all scammers aim to steal your money directly — some try to trick you into sharing personal information that will enable them to access your online accounts. With access, they can extract more sensitive details to use in fraud or identity theft. If you gave any information away to a scammer, securing your accounts is critical to minimize the risk of harm.

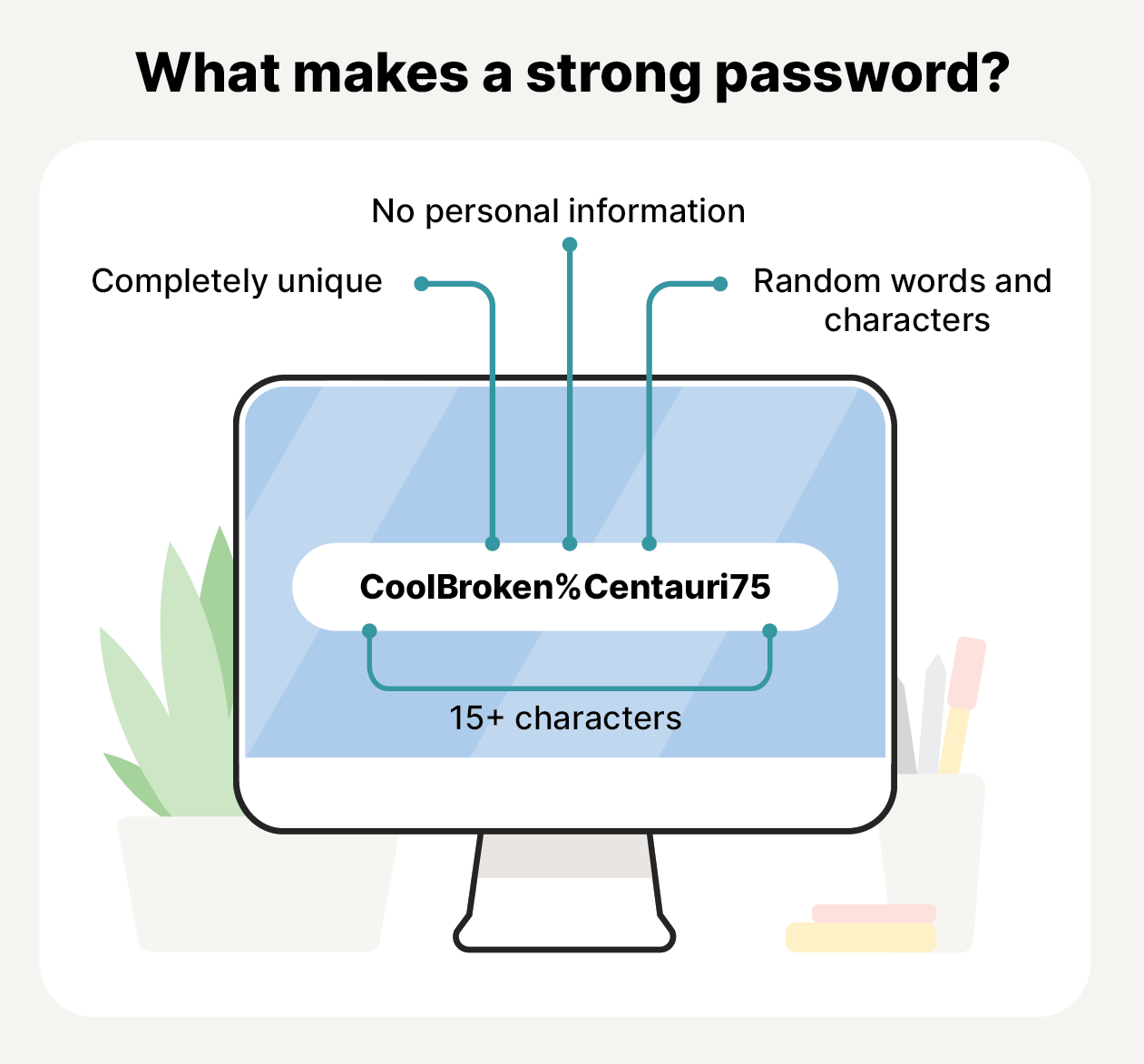

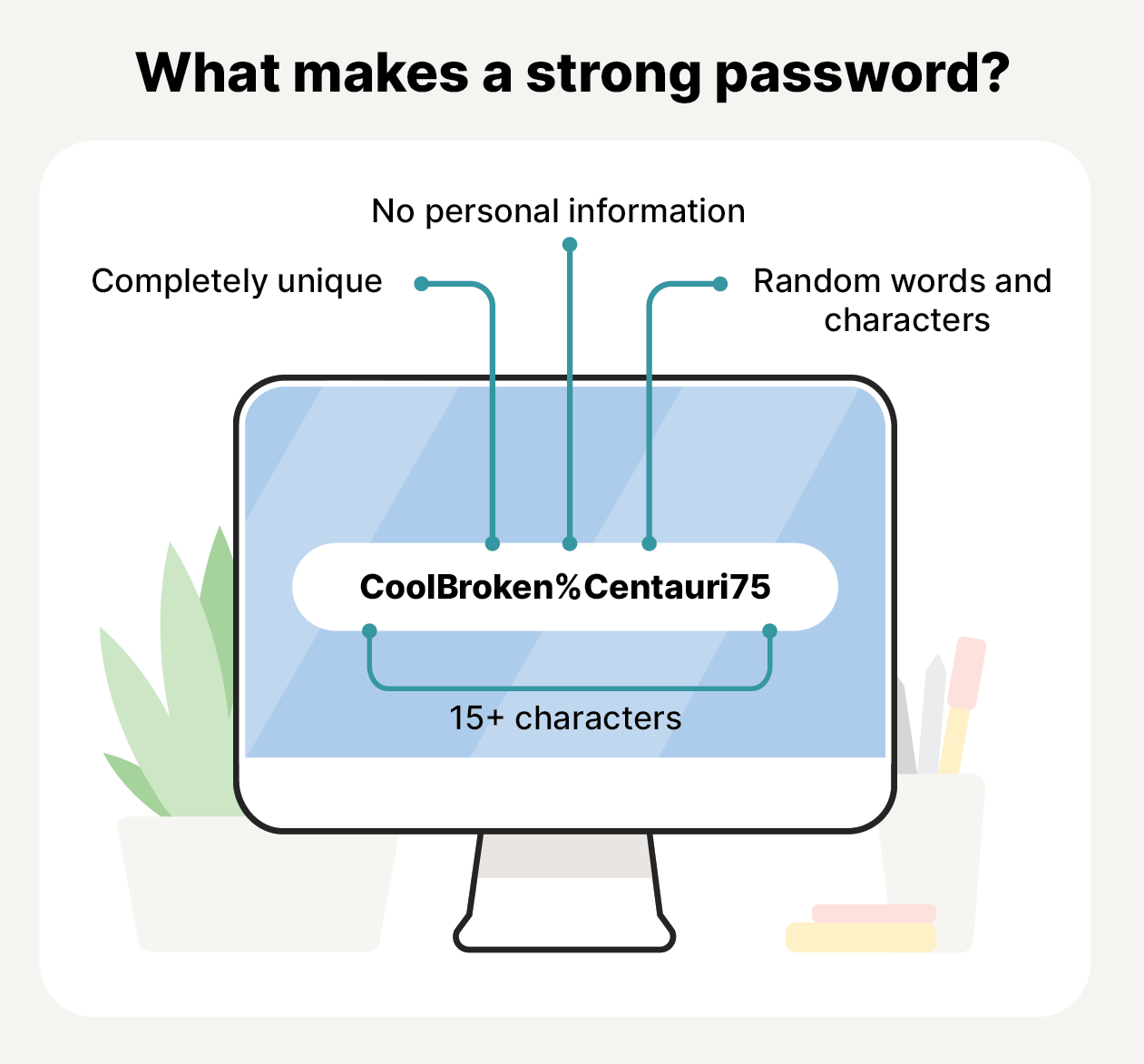

As soon as possible after realizing you’ve been scammed, update your passwords for any potentially compromised accounts, prioritizing those that contain particularly sensitive information like your SSN or banking details.

For the best protection, create strong passwords that are 15+ characters long, completely unique, and contain random characters.

Also consider enabling multi- or two-factor authentication (MFA or 2FA) for added layers of security. This will help prevent scammers from accessing your accounts without a verification code, even if they have your password.

Run a security scan

Some scams, particularly those involving phishing, may put your devices at risk of malware infections. If you clicked a link or opened an attachment sent by a scammer, scan your phone or computer to detect and remove any potentially harmful software.

Different types of malware can put your data, finances, and identity at risk in different ways. Spyware, for example, might be able to record your keystrokes, giving the scammer access to your passwords.

To identify and tackle any threats, download reputable antivirus or anti-malware software and run a full scan. Any malware found during the scan will be flagged for removal, helping secure your device and protect your privacy.

Report the scam

Reporting a scam you’ve fallen for to authorities like the Federal Trade Commission (FTC), IRS, or Internet Crime Complaint Center (IC3) can help you get tailored advice for further protection or recovery steps. It will also contribute to a bank of evidence these authorities maintain, potentially helping catch that scammer in the future.

These are the main organizations to report a scam to, with details of how to get in touch:

- FTC: Report any scams or fraud you’ve experienced to the FTC by visiting reportfraud.ftc.gov, providing as much detail as possible.

- IRS: If you were targeted by a tax scam or gave up information that may have compromised your tax account, report it to the IRS online or by forwarding the scam email to phishing@irs.gov.

- IC3: Report any scams you encounter online at ic3.gov, the FBI’s central hub for investigating cybercrime.

- Local law enforcement: If the scam you were targeted by affected your finances or personal safety, report it to your local police department.

You should also report any scams you experience online to the platform you were targeted on. This can help them address the issue and remove the scammer from their platform.

Take care of your mental health

Besides putting your personal data and finances in jeopardy, falling victim to a scam can also have a lasting emotional impact: you may feel shame, anger, embarrassment, or anxiety for a long time after the incident. To support your emotional recovery, talk about it with family, friends, or a therapist. And remember, scams can happen to anyone.

There’s also a wealth of resources online that provide advice on how to recover emotionally from being scammed, so search for the support you need.

Protect against future scams

Scammers thrive on catching you off guard, often creating a sense of urgency to make you act without thinking. Invest in proactive protection to help reduce the risk of fraud in the future by joining LifeLock.

You’ll benefit from features that can help protect your personal details and catch signs of potential fraud. And if you fall victim to identity theft, LifeLock gives you the time you need to take restorative action, with our dedicated U.S.-based Identity Restoration Team ready to assist you.

FAQs

Who should I contact after being scammed?

The most important organizations to contact after being scammed include your banking institution, credit card company, the credit bureaus, the FTC, and the IRS. Who you should contact depends on the type of scam you were targeted by and what harm you suffered.

Can I get my money back if I was scammed?

While it’s not always guaranteed, you may be able to get scammed money back by contacting your bank or credit card issuer as soon as possible after the scam. They might be able to reverse fraudulent transactions or transfers, and they can assist you in setting up further fraud protection measures.

Is it worth reporting a scammer?

Yes, it’s almost always worth reporting a scammer, even if you didn’t lose money or personal data. Filing detailed reports can help the authorities track fraud patterns, warn others, and potentially help future victims.

What to do if a scammer has my phone number and address?

If a scammer has your phone number, you should block their number immediately, consider locking your SIM card, and contact your cell phone carrier for further advice. If a scammer has your address, be on the lookout for mail scams or mail theft.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.