What to watch for: Someone promising lower interest rates in exchange for upfront fees.

What to do: If you want to ask about lowering your credit card interest rate, contact your issuer directly.

Almost a third of all payments in the U.S. are made with credit cards, with Americans taking advantage of their convenience and better protection against fraud compared to debit cards or cash.

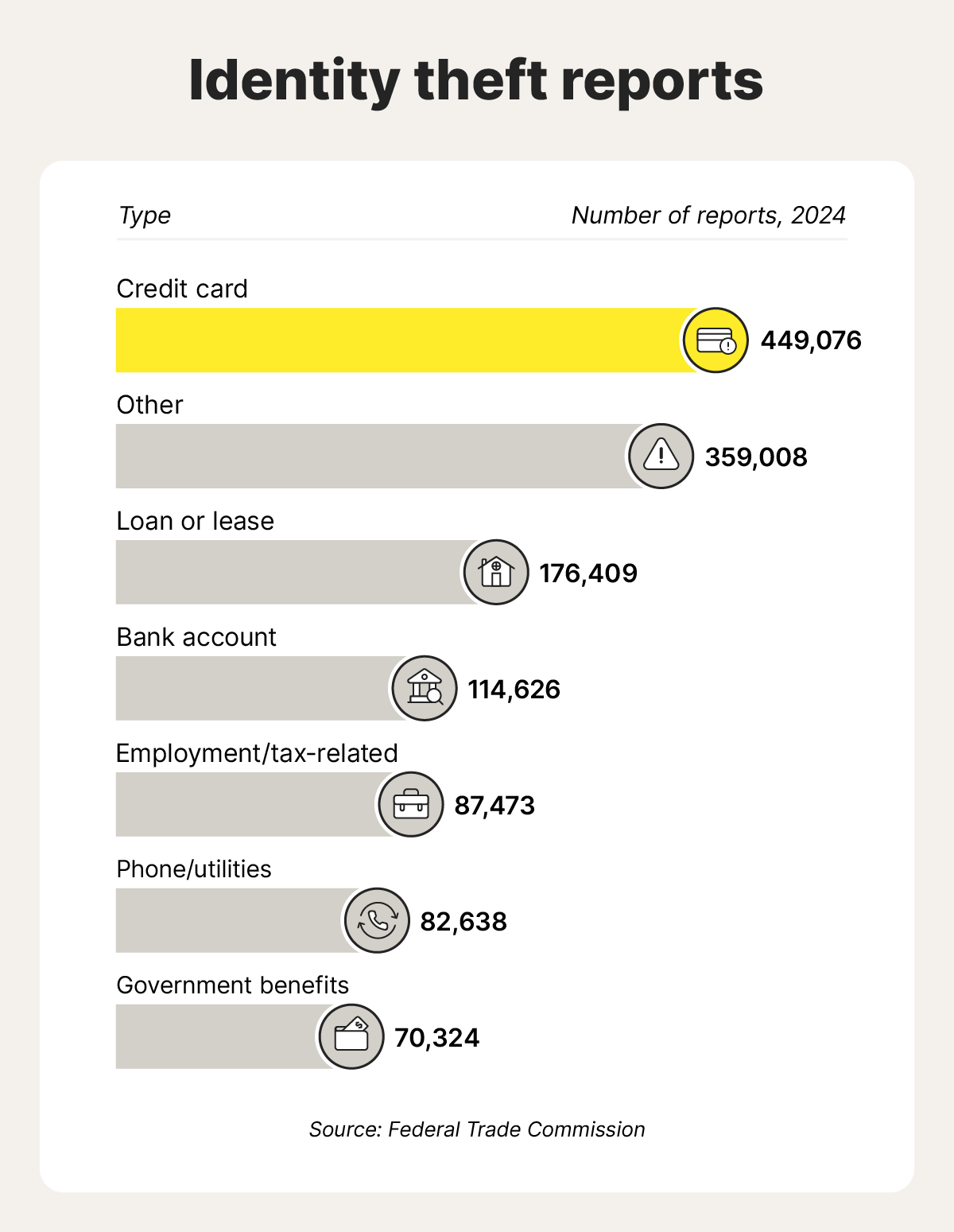

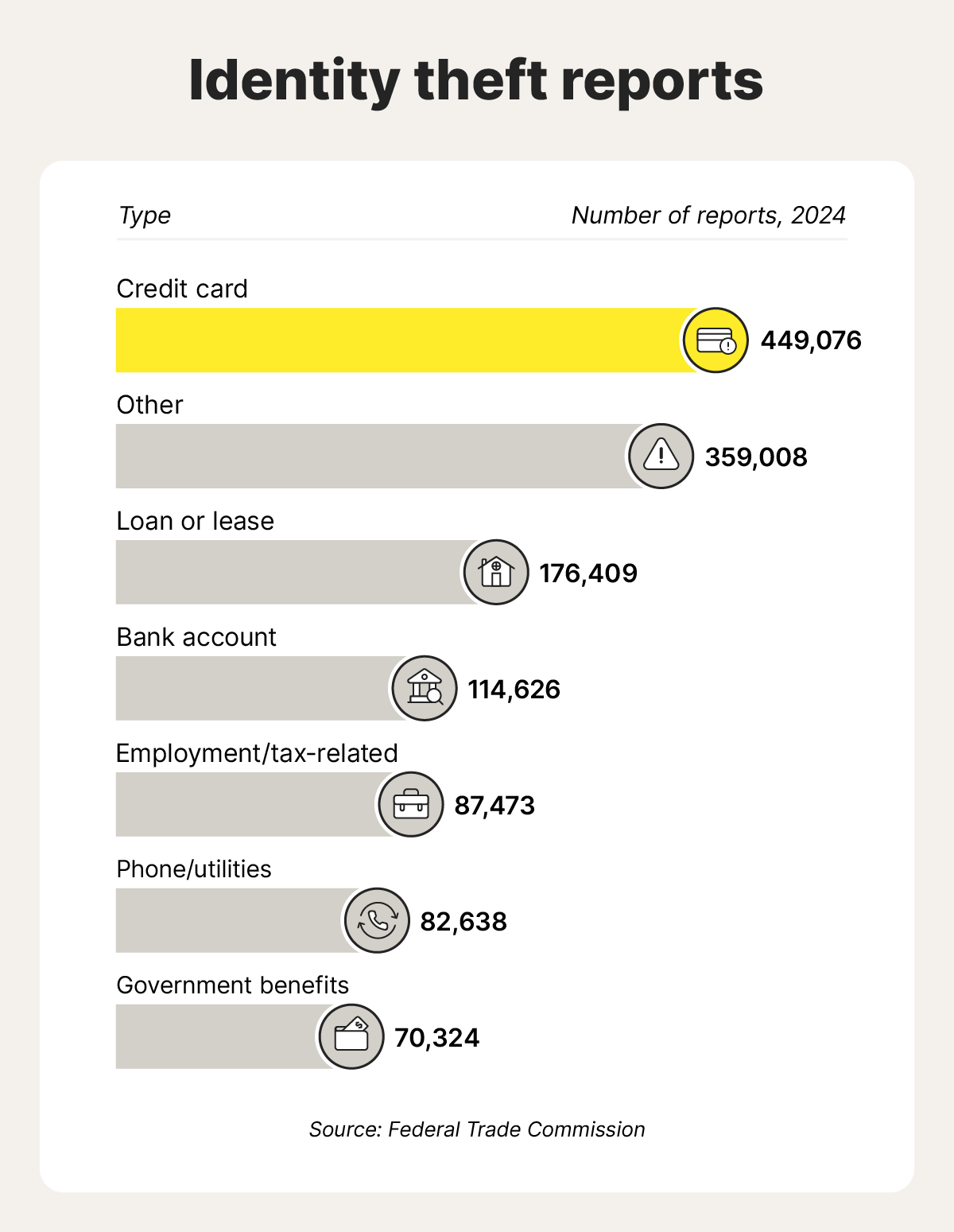

But, despite the protections they offer, credit cards aren’t fraud-proof. On the contrary, they’re consistently the top target for identity thieves, with almost 450,000 credit card identity theft reports filed with the Federal Trade Commission (FTC) in 2024.

Knowing how common credit card scams work can help you avoid falling victim. In this article, we’ll break down the most common tactics scammers use to steal your credit card information, signs to watch for, and what you can do to help protect yourself.

Phishing is a tactic scammers use to trick people into giving up sensitive information or sending money under false pretenses. In a credit card scam, a phishing scammer might impersonate someone you trust, or an organization like your credit card issuer, and claim you need to approve a transaction or provide your credit card details to protect against fraud.

Smishing and vishing are both variants of phishing attacks, the main difference between them being how the scammer contacts you:

LSS Financial Counseling warns of a vishing scam where fraudsters impersonate the victims’ credit card company. They cite a real-life example where someone received a call from a scammer posing as a representative from their card issuer’s fraud department and claiming they needed her CVV number to investigate “suspicious activity.” In reality, the scammer used her credit card details to make purchases totaling nearly $500.

What to watch for: Any unsolicited emails, calls, or texts asking for your credit card information or requesting that you click a link.

What to do: If you suspect someone is targeting you with a phishing attack, stop communicating and contact the company they claim to be from directly through a verified channel.

In a credit card interest rate reduction scam, a scammer claims to represent a company that can negotiate much lower interest rates on your behalf in exchange for a fee. They often promise you’ll save thousands of dollars, and say the offer is only available for a limited time.

You can contact your credit card issuer for free to see if they’ll give you a lower interest rate. Anybody claiming to be able to do this is likely to be a scammer as third-party companies don’t have any special influence. And according to the FTC’s Telemarketing Sales Rule, it’s illegal for a company to charge a fee before successfully reducing your interest rate.

What to watch for: Someone promising lower interest rates in exchange for upfront fees.

What to do: If you want to ask about lowering your credit card interest rate, contact your issuer directly.

Donation or charity scams often use social engineering techniques to trick you into giving money to a scammer under the impression that it’s going to a good cause. Scammers may pose as known charity organizations or invent tragic scenarios to garner your sympathy.

However, once you agree to donate, the scammer may try to alter the amount of money without you noticing or outright steal your card details. If it’s not already obvious, none of the money you send will go to a charity.

Local news reported that a man in Kansas who was targeted by a donation scam thought he was donating $5 to a charity, but later discovered his credit card had been charged $6,000.

What to watch for: Be wary of strangers asking for money, especially if they use high-pressure tactics.

What to do: Stick to donating to reputable charities through verified, trustworthy channels.

In an overcharge scam, a fraudster contacts you, often pretending to be from a well-known company like Amazon or Netflix, claiming there was an overcharge on your credit card and that they need to issue a refund. The catch? You have to “verify” your credit card details and other sensitive data to receive it.

By handing over your information, you unknowingly give the scammer access to your account, leading to fraudulent purchases. According to the Oregon Department of Justice, these scams can also lead to your identity being stolen or malware being installed on your device.

What to watch for: Unsolicited texts or emails about supposed overcharges are a red flag.

What to do: Always check your credit card statement and contact your credit card company directly to verify any questionable or inaccurate charges.

If you get a message saying a recent transaction was declined, it could be a scam. In transaction declined scams, you might buy something from a seemingly legitimate online store, often with bargain prices, only to later receive a message claiming your payment didn’t go through.

In reality, the store is likely to be a fake designed to steal credit card information submitted during the checkout process, and you’ll never receive the product you ordered. Bold scammers might even ask you to try a different card, hoping to be able to steal two sets of your credit card details before you realize the store is a front for their scheme.

One victim reported to the Better Business Bureau’s Scam Tracker that a fake BÉIS website scammed them. After being told their payment was declined, they lost $4,500 to the fraud.

What to watch for: Fake online stores with tempting prices. You might receive a message saying your payment was declined, prompting you to re-enter your card details or try a different card.

What to do: Before entering payment information, double-check the website URL for subtle misspellings, extra characters, or anything that seems off. If you’re suspicious, don’t proceed with the purchase.

QR code scams, sometimes called quishing (short for QR phishing), involve scammers placing fake QR codes in public spaces like cafes, parking meters, or on restaurant tables. When victims scan them, these codes direct them to malicious websites designed to look like legitimate payment portals.

From there, the site may prompt you to enter your credit card information to “pay” for a service, like parking or food, but instead, the financial or personal information you entered goes straight to the scammer. In some cases, scanning the code may even trigger a malware download that can allow the scammer to steal saved card details from your device.

What to watch for: Be cautious of random QR codes in public places or on unexpected items. Scammers may use them to direct you to malicious websites.

What to do: Don’t scan unfamiliar QR codes, especially if they’re out of place. If a QR code leads to a site asking for personal or financial information, don’t enter anything and close the page immediately.

Skimming and shimming are two techniques scammers use to steal credit card information during transactions. Both involve small, hard-to-detect devices placed on or inside payment terminals, often found at gas stations or ATMs.

Skimming has been around for decades and targets the magnetic stripe on the back of your card. As chip cards have made skimming easier to avoid, one of the newest credit card scams — shimming — has emerged to steal data from the EMV chip on the front of your card. Also referred to as “super skimmers,” shimming devices are much harder to detect, according to Boston 25 News.

What to watch for: Look for signs of tampering, such as mismatched colors or unusual bulkiness, when using a card reader. Skimmers are usually placed over readers, but shimmers may be hidden inside, making them harder to spot.

What to do: Check card readers before using them, looking out for any components that feel loose. When in doubt, pay inside or opt for a contactless option.

Keyloggers are malicious programs that secretly record everything you type, including your credit card number. Once installed on a computer or mobile phone, they can transmit your keystrokes directly to a scammer, potentially giving them full access to your credit card account password, card details, or other sensitive data.

Scammers often plant keyloggers on devices through malicious links or app downloads. Your computer could get infected if you click a link included in a phishing email, for example.

What to watch for: If your device suddenly slows down, starts crashing, or behaves strangely, it could be a sign of a keylogger or other malware.

What to do: Run a security scan using reputable antivirus software to help detect and remove keyloggers or other malware.

Scammers may try to intercept your credit card or other related documents before they reach your mailbox. Mail theft can lead to unauthorized purchases, account takeovers, and fraudulent account openings.

In one case, a woman stole hundreds of pieces of mail, including credit cards, then used that data to commit credit card fraud and identity theft.

What to watch for: If you’re expecting a new credit card or other important mail and it doesn’t arrive on time, it may have been intercepted or stolen.

What to do: Contact your card issuer immediately to report the issue. Consider opting for paperless statements to help reduce the risk of mail theft.

If somebody scammed you and may have access to your credit card details or other sensitive related information, acting fast can help limit the damage, protect your credit, and increase your chance of preventing identity theft.

Here’s what to do:

If you suspect you’ve been the target of a credit card scam, notify your card issuer right away. Call the number on the back of your card or find the official phone number online. You should dispute fraudulent charges and ask to have your card canceled or replaced with a new number. Be sure to submit your dispute within 60 days of the date your statement was issued.

After falling for a credit card scam or learning about a data breach that involved your information, update your passwords and security questions for your online financial accounts to help block unauthorized access. If you reuse login credentials across accounts, create new, unique passwords for each one.

If you've been targeted by a credit card scam, place a fraud alert on your credit report to help stop scammers from opening new credit accounts in your name. Contact one of the three major credit bureaus — Equifax®, Experian®, or TransUnion® — and they’ll notify the other two on your behalf.

Reporting credit card fraud and scams can support investigations and help prevent others from falling victim. Consider filing a report with the following organizations:

Scammers may try to target you again using the information they’ve already collected. Stay vigilant and watch for suspicious emails, texts, phone calls, or unexpected account activity.

Consider investing in identity theft protection, like LifeLock. It will monitor key changes to your credit and alert you to help detect fraud. It also scans the dark web for your personal information, notifying you whenever it’s found, so you can take action to protect vulnerable accounts.

To protect against credit card scams, take proactive measures to lock down your credit card number and secure your accounts. Here are some tips to help stay ahead of scammers:

Staying up-to-date with the latest credit scams is your first line of defense. But you should consider adding an extra layer of security by getting identity theft protection.

LifeLock can help alert you to potential threats that could lead to credit card identity theft and fraud. If you do fall victim to identity theft, our US-based identity restoration team will help you recover.

Credit card scams typically involve scammers using deceptive schemes to get access to a person’s card information so they can make unauthorized purchases or access their accounts.

Scammers may try to obtain your credit card details by using skimming devices, phishing attacks, or intercepting mail that contains your card or account information.

Someone may be able to spend on your credit card without physically having it by stealing your card details and using them to make purchases online or over the phone. This type of fraud is known as card-not-present (CNP) fraud, and often involves the fraudster stealing your details through methods like skimming, phishing, or keyloggers.

Yes, chip cards and contactless payments are generally more secure than magnetic stripe cards. They use encryption and dynamic transaction codes, which makes it harder for scammers to clone.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.