Quick answer: Credit disputes must be investigated and resolved within 30 to 45 days of submission. After completing the investigation, the credit bureau must share its findings within five business days.

Errors on your credit report can be the result of simple mistakes, like your personal details not being updated after you move house, or closed accounts still being reported as unpaid. But they can also be a sign of identity theft, caused by a fraudster opening new lines of credit in your name.

Whatever errors you spot, disputing your credit report is the best way to go about resolving them. The three credit bureaus — Experian, Equifax, and TransUnion — are required to investigate disputes within 45 days, helping you fix inaccuracies, fight fraud, and boost your credit health.

Read on to learn how to file a credit dispute, what the process entails, and how long it takes to reach a resolution.

How to submit a dispute with the credit bureaus

Disputing an error on your credit report is as simple as contacting the credit bureau whose report is wrong and requesting an investigation. However, before you submit a dispute, follow these steps:

- Check your other credit reports: An error might be limited to your report with one bureau, but check your credit reports from the other two bureaus to check whether it also appears there. If it does, you’ll need to submit disputes to each bureau separately.

- Gather evidence: Providing evidence that what you’re disputing is, in fact, an error, can help make the investigation faster. Depending on what you’re disputing, evidence might include credit card statements, utility bills, or identity theft reports. Make sure to submit evidence with your dispute to avoid delaying the process.

- Notify the furnisher: The credit bureaus contact the “furnisher” (the company that supplied the information you’re disputing) as part of their investigation process. Notifying the furnisher early can lead to a faster resolution.

You can use this FTC-approved template to tell the furnisher about the error you’re disputing:

Subject: Disputing information in credit report

I am writing to dispute the following information that your company supplied to [name of the credit bureau whose report has incorrect information]. I have circled the items I dispute on the attached copy of my credit report(s).

This item [for example: credit card account] is [inaccurate or incomplete] because [describe in detail what is inaccurate or incomplete and why] I am requesting that [furnisher name] have the item [removed or request another specific change to correct the information.]

[Add list and description of other disputed items, if that applies.]

Enclosed are copies of my credit report [and any other documents enclosed], supporting my request. Please investigate this matter and contact the nationwide credit bureaus to have them [delete or correct] the disputed item(s) as soon as possible.

Sincerely,

[Your Name]

Enclosures: [List what you are enclosing]

When you’re ready to file a dispute, you can choose to do it online, by mail, or over the phone. Here’s the contact information you’ll need to get started:

Experian |

Equifax |

TransUnion |

|---|---|---|

855-414-6048 |

888-378-43292 |

800-916-8800 |

Experian |

Equifax Information |

TransUnion Consumer Solutions |

You may be asked to verify your identity, so make sure you have an identifying document like your driver’s license, passport, or Social Security card at hand.

How long does it take for a dispute to be resolved?

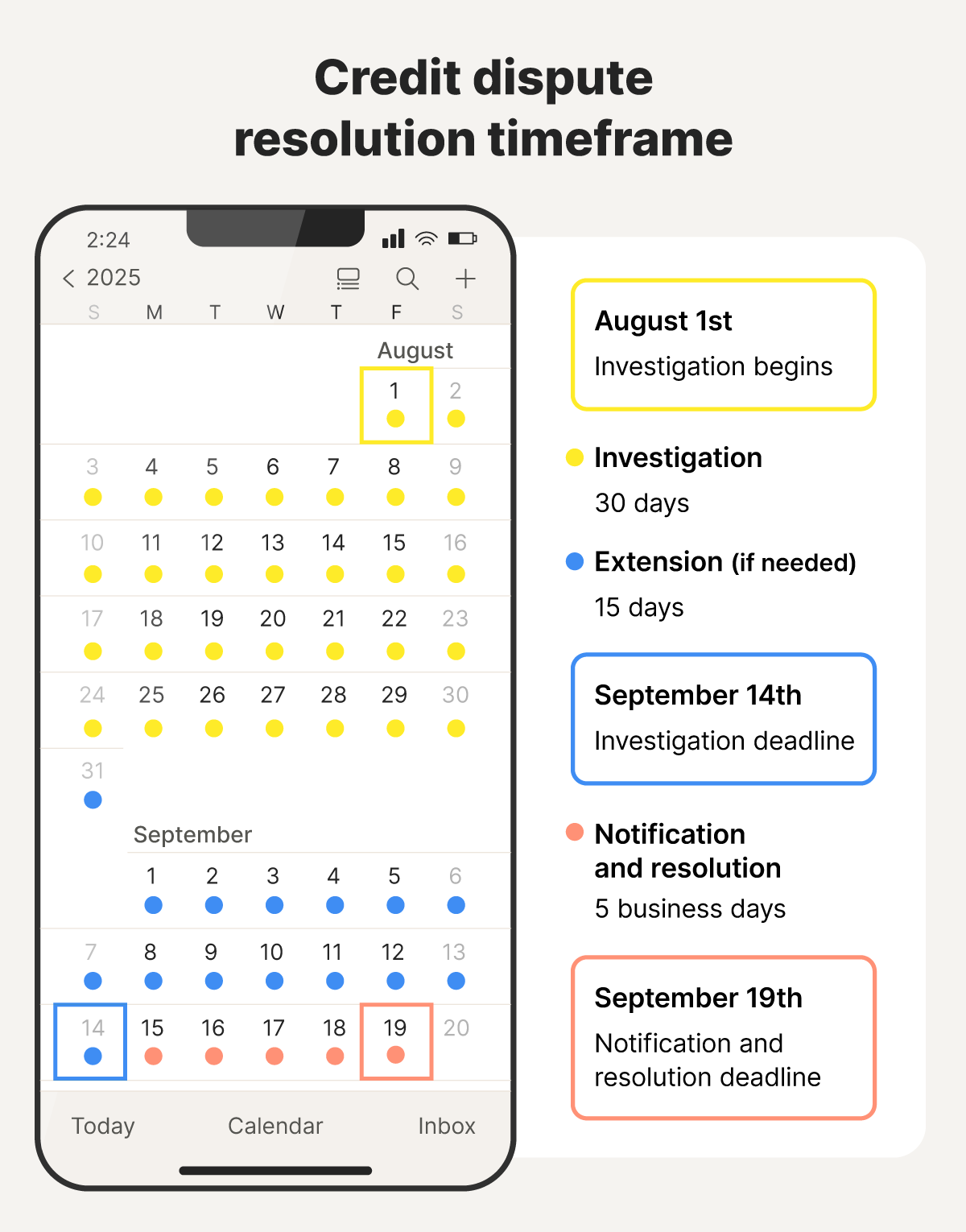

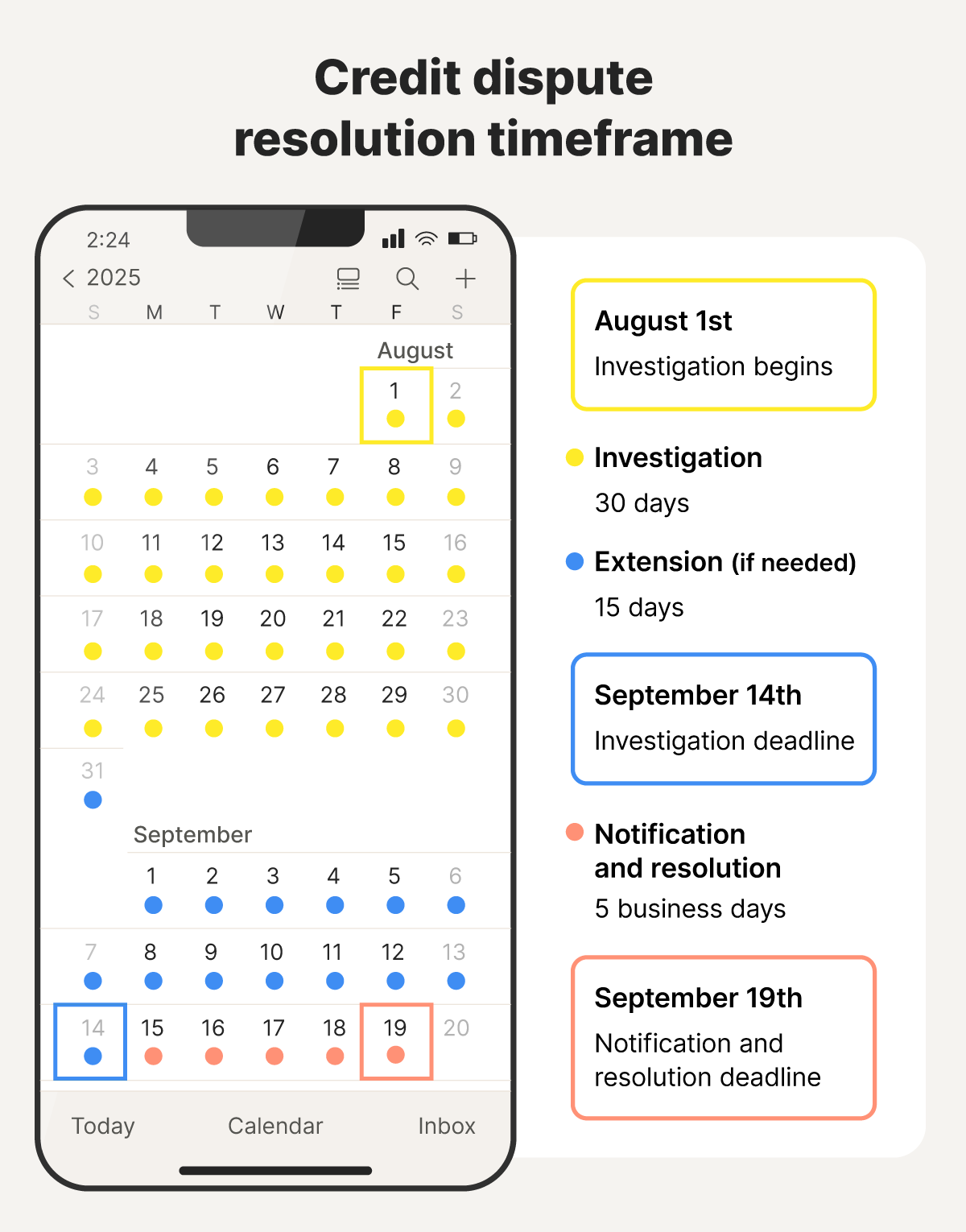

After you’ve submitted a credit dispute, the investigation can take up to 30 days from start to finish. If you submit additional evidence during this period, a 15-day extension may apply, bringing the total time up to 45 days. The credit bureau can then take up to five business days to notify you and apply the resolution to your credit report.

If a credit bureau fails to meet the deadline, it must remove the disputed information from your report until it finishes investigating.

Here’s a more detailed breakdown of how long the credit dispute process takes, stage by stage:

Investigation

Timeframe: 30 to 45 days

During a dispute investigation, the credit bureau contacts the furnisher to check the accuracy of the information you contested. If you provide strong documentation proving that it’s an error, the process may go faster.

But if the bureau thinks your dispute is “frivolous,” they might not investigate at all. This mostly happens if you previously submitted a similar dispute that was rejected, or your claim is too vague.

Notification

Timeframe: 5 business days

Once the investigation wraps up, the bureau will notify you of the results, usually by mail or email. Along with their decision, most also share a short summary detailing what, if anything, changed, along with a revised version of your credit report.

Credit report update

Timeframe: Immediately

Information that the credit bureaus verify and find to be accurate will stay on your credit report. But any errors they find will be removed or corrected immediately.

If your credit score was affected by the error, you might find that it takes a little longer to reflect the resolution. However, you can request a rapid rescore through one of your creditors, like a credit card issuer or loan provider, if you want your score to be updated immediately.

How long does negative information stay on a credit report if a dispute is denied?

If the credit bureaus reject your dispute, negative information can remain on your credit report for up to 10 years. How long it lingers depends on what it reflects:

- Hard inquiries stay on your credit report for up to two years.

- Late payments and collections remain for up to seven years.

- Bankruptcies stick around for up to 10 years.

However, this information will generally have less of an impact on your credit score as it ages. It also doesn’t prevent you from working on improving your credit score in other ways, such as by maintaining a good record of on-time payments or reducing your credit utilization.

What can I do if I disagree with the investigation’s findings?

If you disagree with the credit bureau’s decision, add a statement to your credit file telling your side of the story. This statement will be shown whenever someone pulls your report and can help clarify things for future lenders.

Here’s an example of a statement of dissent you can submit to the credit bureaus and have added to your credit report:

I disagree with the results of the investigation regarding [disputed item]. I believe this information is inaccurate for the following reasons: [explain briefly]. I request that this statement be included in my credit file.

Monitor your credit report for errors

While some credit report errors are easily disputed and removed, taking steps to catch them early can help keep your credit health in good condition. Join LifeLock for credit monitoring that alerts you to key changes to your credit file, helping you detect signs of fraud that could signal you’ve fallen victim to identity theft.

FAQs

Will a credit dispute affect my credit score?

No, simply disputing an item won’t hurt your score. On the contrary, filing a dispute that ends up with an error being removed from your report can help improve your credit score.

Should I hire a credit repair company to dispute credit report errors?

You don’t usually need to hire a credit repair company to dispute errors, since it’s both free and easy to do it yourself by submitting a dispute directly with the credit bureaus.

If I submit new information during a credit dispute, how long will it take to get a resolution?

If you send in new information during the bureau’s investigation, they will have an extra 15 days (up to 45 total) to investigate.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.